Swiss Franc As usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. Click to enlarge. Federal Reserve Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve Fischer seemed to echo Dudley’s sentiment, and this has underpinned the dollar and is the major spur of today’s price action. Although Fischer’s speech was focused on the slowdown in productivity, he reaffirmed that the Federal Reserve was close to meeting its objectives. He expected growth to strengthen in the coming quarters. He pointed to the “remarkable” resilience of the labor market and anticipates stronger investment going forward. Our approach to the Federal Reserve has been to consistently put more weight in the signals from the Fed’s leadership than the regional presidents. We quickly recognized Dudley’s comments to reflect the Fed’s leadership, and anticipated that Fed Chair Yellen would offer a broadly similar assessment at Jackson Hole later this week. Although some observers do not accept our heuristic approach, Fischer’s comments are harder to shrug off.

Topics:

Marc Chandler considers the following as important: CAD, EUR, Featured, FX Daily, FX Trends, GBP, Jackson Hole, Japanese Yen, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

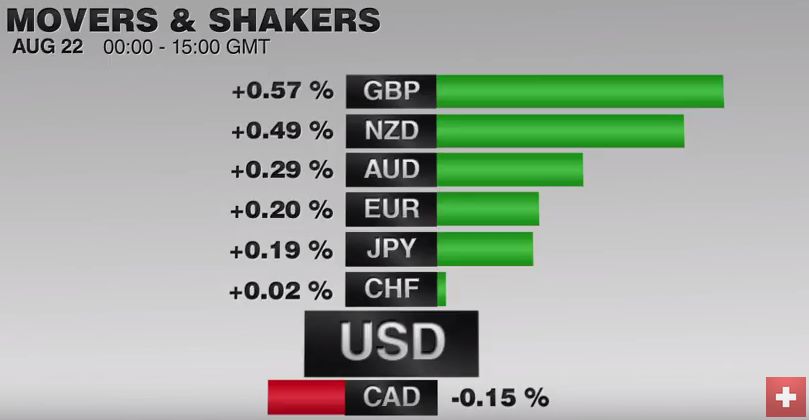

Swiss FrancAs usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. |

Federal Reserve

Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve Fischer seemed to echo Dudley’s sentiment, and this has underpinned the dollar and is the major spur of today’s price action.

Although Fischer’s speech was focused on the slowdown in productivity, he reaffirmed that the Federal Reserve was close to meeting its objectives. He expected growth to strengthen in the coming quarters. He pointed to the “remarkable” resilience of the labor market and anticipates stronger investment going forward.

Our approach to the Federal Reserve has been to consistently put more weight in the signals from the Fed’s leadership than the regional presidents. We quickly recognized Dudley’s comments to reflect the Fed’s leadership, and anticipated that Fed Chair Yellen would offer a broadly similar assessment at Jackson Hole later this week. Although some observers do not accept our heuristic approach, Fischer’s comments are harder to shrug off.

Dudley and Fischer’s comments underscore one side of the divergence, while developments in Europe and Japan play up the other side of the divergence. Reports suggest that the ECB’s negative interest rates are finally being passed on the some (mostly large) depositors. There are press reports that Irish and German banks may have begun to charge large depositors, while a UK-based bank will also reported pass through negative rates.

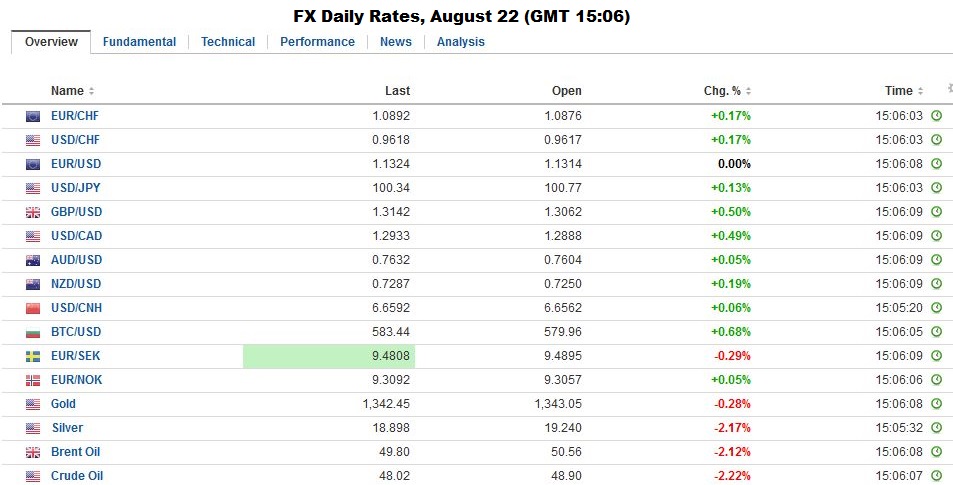

FX RatesSterling is the sole exception today among the major currencies, as it is up about 0.2% against the greenback. These upticks should not be exaggerated. Sterling is well within the pre-weekend range, and its gains appear to be a results of some unwinding of cross positions against the euro and yen. Last week’s high was set near $1.3185. Today’s high is about $1.3120. Sterling has not fully recovered from the drop before the weekend that was sparked by a press report quoting two unnamed UK officials suggesting that Prime Minister May was inclined to trigger Article 50 to formally begin the negotiations for the separation with the EU by April next year, ahead of the French and German elections. |

|

| While there has not been official confirmation, our understanding is that this is the most likely scenario at this juncture. May reportedly has indicated to other EU leaders that her intent is to begin the negotiations next year. When she first assumed office, she is believed to have explained that her new government would need a few months to sort things out, but that she was committed to do so in a reasonable time. And this seemed acceptable to Merkel. Others who wanted an immediate trigger, as Cameron had initially indicated, moved into line with Merkel. Some observers think the UK and EU are so entwined that the separation is too difficult and will be put off indefinitely. | |

| Renzi appears to be walking it back in the sense that he reaffirmed that the next election will be held as scheduled in 2018, even if the referendum fails. That suggests 2017 could be “caretaker” year without fresh reforms or legislation. Renzi needs to get ahead of the curve. One way this may be done is by picking a fight with the EU over the 2017 budget, due a few weeks before the referendum. Italy’s Minister of Industry suggested that the EU could grant Italy further fiscal leeway. With the economy apparently not yet on a self-sustaining path, Renzi may look to provide more stimulus. |

Japan

Separately, BOJ’s Kuroda acknowledged that there was technically room to lower rates further. The coverage of his remarks seemed to emphasize what was translated a “sufficient chance” to ease next month. It is not clear that Kuroda is tipping his hand, but that is the way the market responded. The yen was sold. Government bonds and stocks were bought.

Japanese stocks bucked the regional trend, and the Nikkei gained 0.3%, after posting a similar gain before the weekend. The MSCI Asia-Pacific Index fell 0.2%, for its third consecutive decline. The dollar rose to almost JPY101 before easing in the European morning, but intraday technicals suggest the North American session may push it higher. Initial resistance is seen near JPY101.10, but the JPY101.50 is a more important test. Note the dollar has not closed above its five-day moving average against the yen since August 9. That moving average is found near JPY100.30 today.

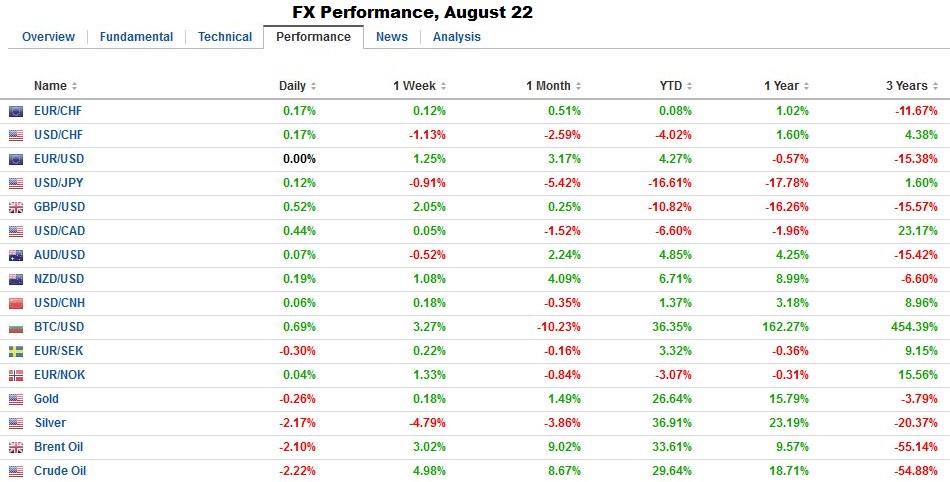

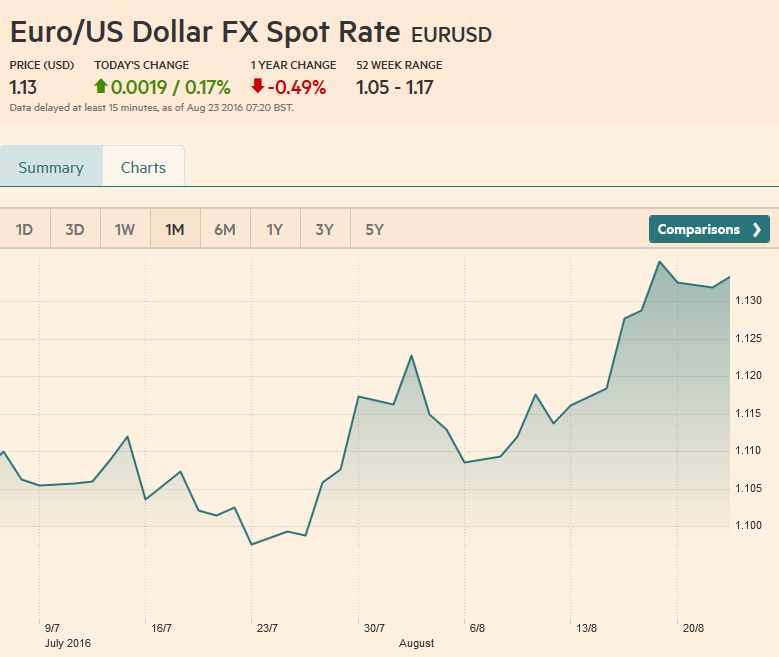

EurozoneThe divergence between the US and European rates has weighed on the euro. The US-German 2-year interest rate differential has jumped six basis points today to 138 bp. It is the highest since early-June. Last week, the euro met the 61.8% retracement objective of its decline since early May. That retracement objective was found near $1.1350. Recall the euro closed above there on August 18 and then consolidated before the weekend. Today, the euro has been pushed down to return toward the 50% retracement that is found near $1.1265. A break of it could spur a move toward $1.1180. European stocks are higher today. The Dow Jones Stoxx 600 fell four of five sessions last week, but is 0.4% higher today, led by telecoms and financials. Of note, Italian bank shares that were hit hard last week (~-8%) have begun the new week with a 2.25% advance, it strongest since August 5. The Italian economy stagnated in Q2, and surveys show that the constitutional referendum to be held later this year is likely to lose. Both the Five-Star Movement and the center-right are opposed, and Renzi acknowledged his error of linking the referendum to the future of the government. |

United States

Lastly, we note that the dollar-bloc currencies are lower, led by the Canadian dollar. Canada reported soft inflation data, but especially disappointing retail sales before the weekend. The disappointing economic news snapped the Canadian dollar’s nine-day advancing streak. The US dollar traded down to CAD1.2765 last week and now is testing resistance near CAD1.2935. Above there, near-term potential extends toward CAD1.3000-CAD1.3030.

There are no important economic reports or FOMC speeches in North America today.

Graphs and additional information on Swiss Franc by the snbchf team.