The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates. 10-year Gilt yield, Close on 06/12 Whether it is due to rising, or receding, fears of Brexit, earlier today UK Gilts joined the global club of record low government bond yields. As the FT noted earlier, Gilt yields have followed where JGBs and German Bunds led, hitting a new record low of 1.222% today on the back of the relentless rush for fixed income and central bank frontrunning. the 10-year Gilt yield dropped 3 bps today to a new record low, surpassing the previous low of 1.225 per cent seen in February. 10-year Gilt yield, Close on 06/12 According to the WSJ, “England has been issuing debt for centuries: The Bank of England was founded in 1694 to finance King William III’s wars with France. The 10-year bond is a relatively recent phenomenon—much early government debt had no fixed repayment date—but today’s yields appear unprecedented.” According to Bank of England data, “medium-dated” government yields—a rough proxy for the 10-year bond—fell below 2% in 1946.

Topics:

Tyler Durden considers the following as important: Bank of England, CHF, Featured, German Bund, German government bonds, Gilt yield, Gilts, Global Economy, King William III, Monetary Policy, newsletter, Sovereign Debt, Switzerland, yield

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

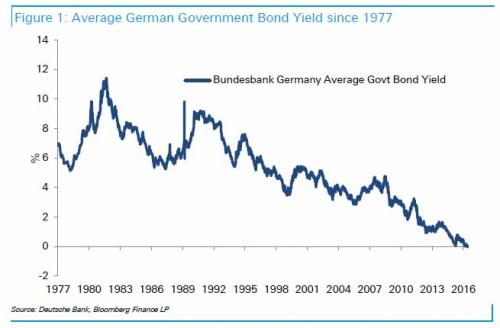

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates.

10-year Gilt yield, Close on 06/12Whether it is due to rising, or receding, fears of Brexit, earlier today UK Gilts joined the global club of record low government bond yields. As the FT noted earlier, Gilt yields have followed where JGBs and German Bunds led, hitting a new record low of 1.222% today on the back of the relentless rush for fixed income and central bank frontrunning. the 10-year Gilt yield dropped 3 bps today to a new record low, surpassing the previous low of 1.225 per cent seen in February. |

According to the WSJ, “England has been issuing debt for centuries: The Bank of England was founded in 1694 to finance King William III’s wars with France. The 10-year bond is a relatively recent phenomenon—much early government debt had no fixed repayment date—but today’s yields appear unprecedented.”

According to Bank of England data, “medium-dated” government yields—a rough proxy for the 10-year bond—fell below 2% in 1946. They then rose in the postwar years, and the 10-year bond crested above 16% in the 1970s and again in the early 1980s. In the 1990s, they returned permanently—so far—to single digits.

On Tuesday, the U.K. sold a 30-year bond with a yield of 2.095%, the lowest average auction yield ever for that maturity. A similar bond auctioned in April yielded 2.345%. And Switzerland announced it will be issuing 13-year bonds with a 0% coupon, the lowest on record. It is difficult to assess how the pending British referendum on its membership in the European Union is affecting bond yields. On the one hand, a vote to leave may cause economic disruption; on the other, investors appear to be betting that the central bank will cut rates if there is one.

It wasn’t just the UK. As the WSJ adds, yields on the 10-year government debt of Germany and the U.K. fell to all-time lows, a stark demonstration of the modern era of scant inflation, weak growth and outsize monetary policy. Government-bond yields have been slumping for a year across the developed world. Tuesday’s decline came after tepid U.S. jobs data on Friday spurred concerns that the global economy would remain weaker for longer. Which apparently was also enough to send the S&P just shy of new all time highs.

But the start attraction remain German Bunds where the yield on 10-year German bunds closed at 0.049% on Tuesday and continued to fall on Wednesday, hitting 0.036% in early European trade, according to data from Tradeweb. The 10-year U.K. gilt yield slipped to 1.263% at Tuesday’s close and traded down to 1.256% early Wednesday. Both yields are lower than previous troughs in the first half of last year. A different measure of the U.K. yield from data provider FactSet stood at 1.267% Tuesday. Yields fall as prices rise.

And two stunning statistics: according to Commerzbank almost two-thirds of all German sovereign debt outstanding now yields below minus-0.4%, which makes it ineligible for central-bank purchases. Additionally, as DB adds, Bund yield across the whole curve has gone negative for the first time.

“A bund yielding zero or slightly below zero is a credible scenario in the coming weeks with almost no inflation in Europe and [strong] appetite from the ECB,” said Vincent Juvyns, global market strategist at J.P. Morgan Asset Management. “The bulk of the negative-yielding supply of eurozone bonds will be in the second half of the year,” said Eric Oynoyan, analyst at French bank BNP Paribas. “There’s the potential for a further rally.”

Average German Government Bond Yield since 1977Putting it all together, here is a chart of German bunds since 1977. It needs no commentary. |