Jeff Deist and Ben Nadelstein discuss narratives surrounding the merits of gold ownership. Is gold an inflation hedge, store of value, or a safe haven asset? The episode ends with questions regarding gold’s monetary premium and the different types of inflation. Connect with Jeff and Monetary Metals on X: @JeffDeist @Monetary_Metals [embedded content] Additional Resources Start Earning Interest on Gold The Case for Gold Yield in an Investment Portfolio How NOT to...

Read More »Keith Weiner on the VoiceAmerica Business Channel

CEO Keith Weiner returns to popular radio show Turning Hard Times into Good Times hosted by Jay Taylor. Jay argues that the U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. Keith and Jay discuss why...

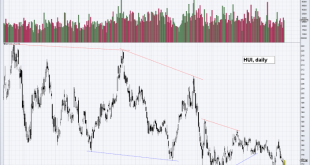

Read More »Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data. So we won’t say anything more about it today. On 17 Feb, we wrote about the widening bid-ask spread...

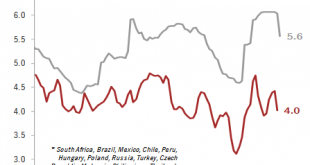

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less...

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a...

Read More »The Ultimate Stablecoin, Report 18 Nov 2018

A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year. Back in those halcyon days, volatility was deemed to be a feature. That is, volatility in the upward direction was loved by everyone who said that bitcoin is money, in their desire to make money. In...

Read More »Useless But Not Worthless, Report 21 Oct 2018

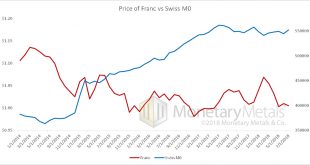

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal. They will never reach their...

Read More »Why Am I Fighting for the Gold Standard?

Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects. Prepping makes no sense to me. I don’t know if I would choose...

Read More »Getting Their Pound of Flesh – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Regulated to Death The price of gold fell $13, and that of silver $0.23. Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why? Obviously, last week the sellers were more...

Read More »Black Holes for Capital – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Race to the Bottom Last week the price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org