Macroview As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes. April insights from Pictet Wealth Management's Asset Allocation & Macro Research team The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern, and suggests limited upside for equities. But if the resources sector is stripped out, the trend is much less worrying. Moreover, fears of a recession are not supported by macro data. US data has been poor recently, notably household consumption. However, we are not unduly concerned, as underlying conditions still appear sound. We continue to forecast real GDP growth in the US of around 2% this year and we still expect global growth to remain reasonably healthy, at around 3%. Our forecast for a small acceleration in real GDP growth–to 1.8% in 2016–in the euro area remains intact. The ECB’s March package of monetary measures should help to limit the impact on banks of negative interest rates and thus support lending growth, while our baseline scenario for political risk is benign. However, we remain conscious of the political risk stemming from the UK’s ‘Brexit’ vote on June 23.

Topics:

Perspectives Pictet considers the following as important: Central Banks, China, Global Growth, growth forecasts, Macroview, oil prices

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes.

April insights from Pictet Wealth Management's Asset Allocation & Macro Research team

- The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern, and suggests limited upside for equities. But if the resources sector is stripped out, the trend is much less worrying. Moreover, fears of a recession are not supported by macro data. US data has been poor recently, notably household consumption. However, we are not unduly concerned, as underlying conditions still appear sound. We continue to forecast real GDP growth in the US of around 2% this year and we still expect global growth to remain reasonably healthy, at around 3%.

- Our forecast for a small acceleration in real GDP growth–to 1.8% in 2016–in the euro area remains intact. The ECB’s March package of monetary measures should help to limit the impact on banks of negative interest rates and thus support lending growth, while our baseline scenario for political risk is benign. However, we remain conscious of the political risk stemming from the UK’s ‘Brexit’ vote on June 23.

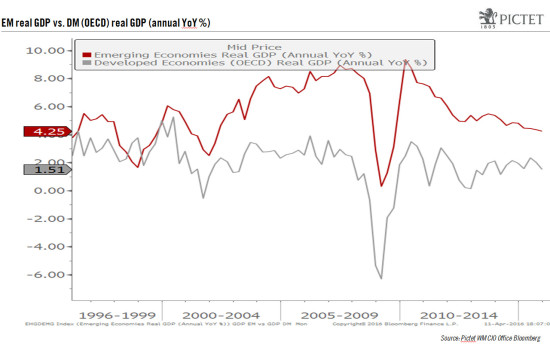

- We maintain our forecast of real GDP growth of 6.5% in China this year. The authorities have helped to stabilise economic growth within their target range. But after botched attempts to liberalise the currency, China needs to keep the renminbi broadly stable in the near term for markets to consolidate and capital flows to level off. Chinese companies are using surplus dollars to buy a range of assets overseas. Capital outflows from China therefore have a positive effect on global investment growth. We do not believe the broader slowdown in emerging markets will derail the recovery in developed economies, which continue to reap the benefits of low oil prices. Moreover, we are starting to see improvements in emerging markets. Most notably, there are signs that currency reserves are stabilizing in Asian countries.

- Oil prices have rebound to over USD 40 per barrel, but it will be hard for oil prices to rally much further in the short term in the absence of production cuts. However, a renewed fall to below USD 30 per barrel looks unlikely, since the depth of the earlier decline partly reflected a welter of short positions that need to be covered. Our forecast is that following a correction of the current supply/demand imbalance, oil will average USD 50 per barrel by early 2017.

- We expect developed-market equities to remain highly volatile. Although central banks are broadly supportive of asset prices, this volatility is being fed by desynchronised central bank policy. Moreover, forecasts for poor 2016 earnings growth caps valuation ratios, which are already stretched at around 3 basis points over long-term averages in Europe and the US.

- Although inflation may rise in the short term, a sustained upturn in prices is unlikely until banks start lending more and economic growth strengthens. Yields on core sovereign bonds will therefore likely remain subdued. Depletion of emerging markets’ foreign reserves has been reflected in reducing buying of US Treasuries. But these are being compensated for by European private investor purchases, reducing the upward pressure on US Treasury yields.