In spite of the various pressures facing banks, the ECB's latest Bank Lending Survey points to continued improvement in loan conditions. The hope must be that ECB policies will continue to facilitate bank lending in the months ahead Read the full report here The ECB’s April Bank Lending Survey (BLS), conducted among 141 banks between 11 and 30 March 2016 and released today, revealed a net easing of credit conditions for companies for the eighth consecutive quarter. The demand for loans from non-financial corporations actually moderated somewhat in comparison to Q4, but levels are still supportive of improving credit flows (see chart). There was some disappointment on the household front. The number of banks reporting tightening credit standards for loans to buy houses outweighed the number of banks reporting an easing of credit standards in Q1. The net tightening of credit standards on housing loans was mainly related to new credit directives, which require stricter in-depth creditworthiness assessments of borrowers. By contrast, conditions for consumer credit and other loans to households eased again. Looking ahead, euro area banks expect a further net easing of credit standards for corporate lending and for consumer credit in Q2. But banks expect credit standards on loans for house purchases to tighten further.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Bank Lending Survey, credit standards, ECB, euro area lending, Macroview, policy transmission

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

In spite of the various pressures facing banks, the ECB's latest Bank Lending Survey points to continued improvement in loan conditions. The hope must be that ECB policies will continue to facilitate bank lending in the months ahead

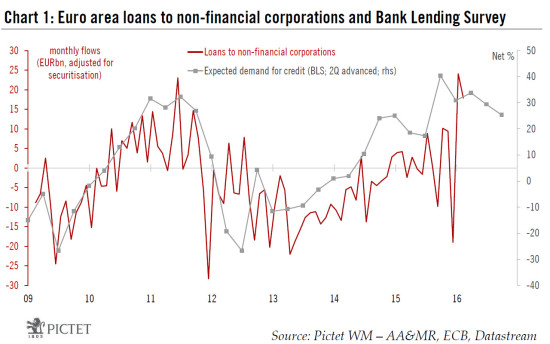

The ECB’s April Bank Lending Survey (BLS), conducted among 141 banks between 11 and 30 March 2016 and released today, revealed a net easing of credit conditions for companies for the eighth consecutive quarter. The demand for loans from non-financial corporations actually moderated somewhat in comparison to Q4, but levels are still supportive of improving credit flows (see chart).

There was some disappointment on the household front. The number of banks reporting tightening credit standards for loans to buy houses outweighed the number of banks reporting an easing of credit standards in Q1. The net tightening of credit standards on housing loans was mainly related to new credit directives, which require stricter in-depth creditworthiness assessments of borrowers. By contrast, conditions for consumer credit and other loans to households eased again.

Looking ahead, euro area banks expect a further net easing of credit standards for corporate lending and for consumer credit in Q2. But banks expect credit standards on loans for house purchases to tighten further.

Risks remain to the near-term outlook, keeping the ECB on alert

While today’s encouraging BLS remains consistent with improving credit growth, recent developments call for caution. Analysis of the BLS suggests that both the ECB’s Quantitative Easing (QE) programme and its Negative Interest Rate Policy (NIRP) are having mixed effects on the banking sector. Although low market rates and yield-curve flattening are hurting bank profitability, the ECB still estimates that its unconventional policies have had a clear net positive impact on credit standards, supply and demand. The ECB also judges that the transmission of its monetary policy to the ‘weakest links’ is improving, as evinced in lower bank lending rates to SMEs in the periphery.

The hope must be that the pressure on European banks—at least as seen in their equity and profitability this year—will not translate into weaker credit flows. Obviously, the by creating stronger incentives to lend—via the new TLTRO II programme in particular—the ECB’s support will be key. More generally, the ECB notes that better policy transmission has allowed “low interest rates to encourage demand for all types of loans”.

While we share the ECB’s positive assessment, another risk to the near-term outlook for bank credit could come from an inadequate response to the structural issues facing banks in Italy.