When I took my high school’s twentieth-century world history class, both the teacher and workbooks claimed repeatedly that World War II took us out of the Great Depression. Why would anyone question this? After all, unemployment went down. The US Bureau of Labor Statistics measured the unemployment rate from 1929 onward. In 1939 the unemployment rate stood at 17.2 percent. By 1942 it was at 4.7 percent, and by 1944 it was at 1.2 percent. Professor Friedrich Hayek wrote in his essay “Full Employment, Planning, and Inflation” about the phenomenon of full employment and the reason behind it. Professor Hayek stated: Full employment has come to mean that maximum of employment that can be brought about in the short run by monetary pressure. This may not be the original

Topics:

John Kennedy considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

When I took my high school’s twentieth-century world history class, both the teacher and workbooks claimed repeatedly that World War II took us out of the Great Depression. Why would anyone question this? After all, unemployment went down. The US Bureau of Labor Statistics measured the unemployment rate from 1929 onward. In 1939 the unemployment rate stood at 17.2 percent. By 1942 it was at 4.7 percent, and by 1944 it was at 1.2 percent.

Professor Friedrich Hayek wrote in his essay “Full Employment, Planning, and Inflation” about the phenomenon of full employment and the reason behind it. Professor Hayek stated:

Full employment has come to mean that maximum of employment that can be brought about in the short run by monetary pressure. This may not be the original meaning of the theoretical concept, but it was inevitable that it should have come to mean this in practice. Once it was admitted that the momentary state of employment should form the main guide to monetary policy, it was inevitable that any degree of unemployment which might be removed by monetary pressure should be regarded as sufficient justification for applying such pressure. That in most situations employment can be temporarily increased by monetary expansion has long been known.

In 1942, the time where unemployment finally made it below 5 percent, the United States government tripled defense spending to $17.5 billion, or about $531.7 billion in today’s currency. The military needed to staff its new army and fleet. The size of the military swelled from 3.9 million men and women in 1942 to 12.2 million by the war’s end in 1945. Hayek was doubtful that employment would follow the peace, especially without the monetary expansion found during times of war, but eventually the war ended as did the spending, and 1946 would expose the smoke and mirrors of the spending economy.

The World War Boom and the ’46 Bust

Productive economic activity heightens the living standards of the average person. Producers throughout the world create goods and services through a price system that puts food in the markets, cars in the driveway, and refrigerators in the kitchens. When the government, however, mandates the mass production of a certain product, it may lower the living standards of the country. During World War II, there was a mass production of war supplies like tanks, planes, ships, etc. A large portion of the munitions workforce during this time were women and teens, seeing that much of the men and skilled labor were sent off to war. Keynesians claim it was because of this massive increase of spending and production of these munitions that dragged America out of the Great Depression, but this is untrue. The arms production was short term as the war was not going to last forever, and tanks, war planes, and battleships aren’t exactly in high demand in the civilian market. Just because the government employed whoever didn’t go to war to build tanks that would be scrapped after the war doesn’t mean living standards improved. Thomas Sowell explains, “The federal government could make a Rolls Royce affordable for every American, but we would not be a richer country as a result. We would in fact be a much poorer country, because of all the vast resources transferred from other economic activities to subsidize an extravagant luxury.”

Everything from sugar, meat, rubber, and gasoline was extremely scarce, and Americans took every bit of scrap they had to fuel the building of arms and fighting vehicles. The mainstream idea is that the war and blockades caused these massive shortages, but this was also a time of regulations like price and wage controls, which were managed by the Office of Price Administration during the war.

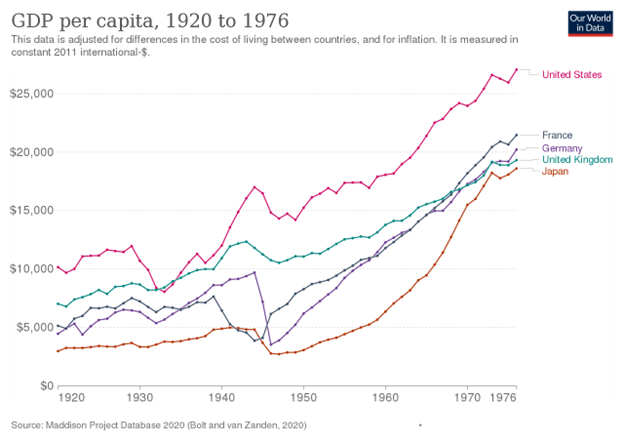

Keynesian economists claim the war dragged us out of the depression,and, after all, the graph above shows a massive rise in GDP during the war, and a dip in 1946. These economists may claim that once the spending stopped, the economy tanked, but the reality is that arms and munitions stopped being produced, permitting a productive domestic market for civilian goods to absorb the unemployed in the properous post war economy. World War Two did not end the depression; the end of World War Two ended the depression.

Conclusion

Why does this matter? Who cares what ended the depression, given it was long ago. It matters because the false belief that war can end our economic problems will create a society where war is not only seen as normal, but as necessary for a market economy to thrive, something that is taught to every new generation.

Young adults today were born either right before or after 9/11, and they grew up with war continually in the background. They entered adulthood during the collapse of Kabul, and beginning of a new forever war in Ukraine. The United States has moved from the Global War on Terror phase and has entered a new phase of maintaining global hegemony by political means and by printing dollars. We see the consequences of the latter with inflation and the recent collapse of the SVB bank. It is time to change course.

Tags: Featured,newsletter