Overview In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high. In the financial account, reported transactions in the third quarter of 2022 showed a net reduction in both assets (down by CHF 26 billion) and liabilities (down by CHF 41 billion). On both sides, ‘other investment’ in particular played a key role in this reduction. On the assets side, the SNB reduced its claims on non-residents

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview

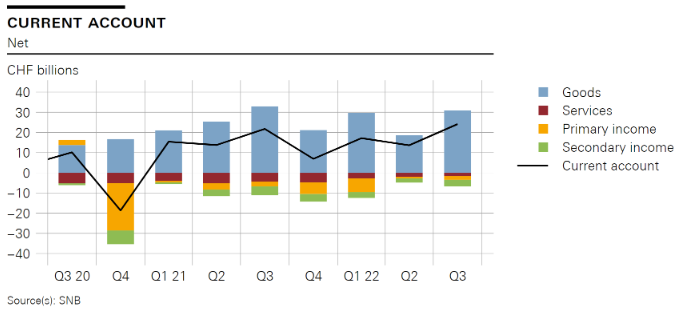

In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high.

| In the financial account, reported transactions in the third quarter of 2022 showed a net reduction in both assets (down by CHF 26 billion) and liabilities (down by CHF 41 billion). On both sides, ‘other investment’ in particular played a key role in this reduction. On the assets side, the SNB reduced its claims on non-residents in connection with repo transactions (reverse repos), and on the liabilities side, the liabilities of resident commercial banks towards non-resident customers declined. Including derivatives, the financial account balance totalled CHF 13 billion. | |

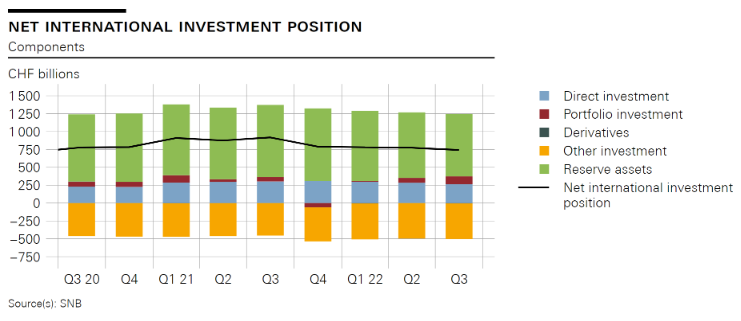

| In the third quarter of 2022, the net international investment position declined by CHF 31 billion quarter-on-quarter to CHF 742 billion. Stocks of assets were down by CHF 106 billion to CHF 5,328 billion, and stocks of liabilities decreased by CHF 74 billion to CHF 4,586 billion. The decline in stocks on both the assets and the liabilities side was due in particular to valuation losses on equities and bonds. The decline in stocks was compounded by the transactions reported in the financial account. Furthermore, exchange rate-related valuation losses were recorded on the assets side. |

Data revisions

The data on the balance of payments and international investment position take into account revisions that have arisen as a result of newly available information from reporting institutions. Some of these revisions date back to 2015. Among other things, the revisions affected the net international investment position, which increased by an average of 15% per quarter between Q2 2021 and Q2 2022. More detailed information regarding these revisions is available under Changes and revisions on the SNB’s data portal.

Tags: Featured,newsletter