Ladies and gentlemen I am very pleased to welcome you to the eighth Karl Brunner Distinguished Lecture. We are delighted and honoured that Professor Kristin Forbes accepted our invitation. I would like to thank the ETH Zurich and its President, Joël Mesot, for their hospitality. When we began our search for tonight’s speaker, we had specific qualities in mind. We were looking for an exceptional economist who is at home both in academia and policy, and who can...

Read More »Thomas Jordan: Policy-making under uncertainty: The importance of maintaining a medium-term orientation

Ladies and gentlemen I am very pleased to welcome you to the Third High-Level Conference on Global Risk, Uncertainty, and Volatility. Thank you all for taking the time to join us today. I would especially like to thank our colleagues at the Bank for International Settlements and the Federal Reserve Board for working together with us in organising this event. The topic of this year’s conference – policy-making under uncertainty – is highly relevant. There is, for...

Read More »2023-11-09 – Thomas Moser: Implementing monetary policy with positive interest rates and a large balance sheet: First experiences

In September 2022, the Swiss National Bank (SNB) raised its policy rate back into positive territory. At the same time, it adopted a new approach to implementing monetary policy in the money market. This approach employs two levers: the tiered remuneration of reserves, also referred to as reserve tiering, and reserve absorption. The speech explains why, with a large central bank balance sheet, remunerating the reserve holdings of commercial banks is the only...

Read More »2023-11-09 – Martin Schlegel: A pillar of financial stability – The SNB’s role as lender of last resort

As part of its contribution to the stability of the financial system, the Swiss National Bank acts as lender of last resort. In this role, it makes emergency liquidity assistance available to banks when, in crisis situations, they need substantial liquid funds which they are no longer able to obtain on the market. The SNB provides this liquidity assistance in the form of secured loans. It accepts a broad range of collateral for this – in particular also illiquid...

Read More »2023-03-23 – Monetary policy assessment of 23 March 2023

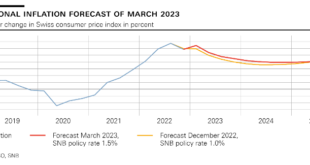

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.5% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB...

Read More »Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank. With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation. Both banks have unrestricted access to the SNB’s existing facilities, through which they can...

Read More »2023-02-16 – Markus K. Brunnermeier to hold the 2023 Karl Brunner Distinguished Lecture

The Swiss National Bank has named Markus K. Brunnermeier as the next speaker for its Karl Brunner Distinguished Lecture Series. Markus K. Brunnermeier is Professor of Economics at Princeton University and also Director of the Bendheim Center for Finance. His research focuses on the interaction between financial markets and the macroeconomy. His work on price bubbles in stock and real estate markets, systemic risks, liquidity crises and digital currencies is of great...

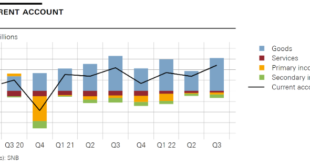

Read More »Swiss balance of payments and international investment position: Q3 2022

Overview In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high. In the financial account,...

Read More »Thomas Jordan: Introductory remarks, news conference

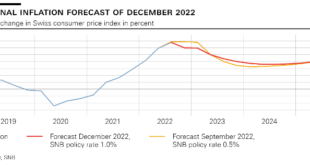

Ladies and gentlemen It is my pleasure to welcome you to the news conference of the Swiss National Bank. I would also like to welcome all those who are joining us today online. After our introductory remarks, the members of the Governing Board will take questions from journalists as usual. Monetary policy decision I will begin with our monetary policy decision. We have decided to tighten our monetary policy further and to raise the SNB policy rate by 0.5 percentage...

Read More »Martin Schlegel: Introductory remarks, news conference

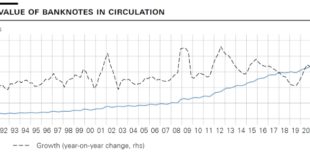

I am pleased to give you an assessment of current developments with regard to cash. Since June, after many years of strong growth, we have seen a significant decline in banknote circulation. To contextualise this decline of approximately 10%, let me first say a few words about the above-average growth in recent years. In the period since the 2008 financial crisis, the value of banknotes in circulation grew, on average, more than twice as fast as in the two...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org