You have probably heard of the 4% rule if you are interested in early retirement. This rule states that if you withdraw 4% of your portfolio every year, you can sustain your withdrawals for 30 years. But do you know where it comes from? If you have read a lot about it, you probably heard about the Trinity Study. This study is where it all started. But do you know what the Trinity Study is? Probably not. A lot of things people are saying about the Trinity Study are not correct. A lot of people talking about this study have not even read the original paper. There is nothing mystical about this study. It is merely a research paper by three professors of The Trinity University. Hence the name. And do you know that it has nothing to do with early retirement? So, why is

Topics:

Mr. The Poor Swiss considers the following as important: 9) Personal Investment, 9) The Poor Swiss, Featured, Financial Independence, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

You have probably heard of the 4% rule if you are interested in early retirement. This rule states that if you withdraw 4% of your portfolio every year, you can sustain your withdrawals for 30 years. But do you know where it comes from? If you have read a lot about it, you probably heard about the Trinity Study. This study is where it all started.

But do you know what the Trinity Study is? Probably not. A lot of things people are saying about the Trinity Study are not correct. A lot of people talking about this study have not even read the original paper.

There is nothing mystical about this study. It is merely a research paper by three professors of The Trinity University. Hence the name.

And do you know that it has nothing to do with early retirement? So, why is it the cornerstone of most Early Retirement articles?

In this article, I want to go into details about this paper and what it exactly is! First, we are going to see what is inside the Trinity Study. And also what this data is showing us. And finally, we are going to see what people get wrong when they talk about the study.

The Trinity Study

As I said, the Trinity Study is a research paper from 1998. Three professors of the Trinity University wrote it, Philip L. Cooley, Carl M. Hubbard, and Daniel T. Walz. The real name of the article is “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable”.

It was only nicknamed The Trinity Study based on the university it came from. And also probably because the name of the paper is too long!

This research studies the success rates of different investment portfolios for various periods with varying rates of withdrawal.

They have researched five different portfolios:

- 100% Stocks

- 75% Stocks and 25% Bonds

- 50% Stocks and 50% Bonds

- 25% Stocks and 75% Bonds

- 100% Bonds

They have researched four different periods:

- 15 years

- 20 years

- 25 years

- 30 years

They have tested withdrawal rates from 3% to 12%. The withdrawal rate is how much of your portfolio you withdraw every year.

It is essential to base the withdrawals on the initial value of your portfolio. If your portfolio grows 10% in the first year, you still withdraw the same amount as the first year. You do not increase your withdrawal amount with your portfolio. The only thing you adapt is that you index your expenses on inflation. Inflation is the only increase accounted for in the study!

Not accounting for inflation would completely change the results of the study!

The Results – Success Rates

There are several interesting results in the research paper. They first researched the success rates over 50 years and over 70 years. We have to remember that it is an old paper, from 1998. Indeed, the period that they studied was 1926 to 1995. It has not been updated in more than 25 years.

The most exciting result for me is the inflation-adjusted success rates over the entire period. They computed the success rate for each possible period in the 70 years. Success is defined as still having money after the duration. So, for instance, if you still have 10% of your portfolio in the end, it is considered a success.

Portfolio of 100% StocksThe study has simulated several different withdrawal rates. A withdrawal rate is how much (in percent) of your initial portfolio you are withdrawing every year. For reference, here are the original results for a portfolio of 100% stocks

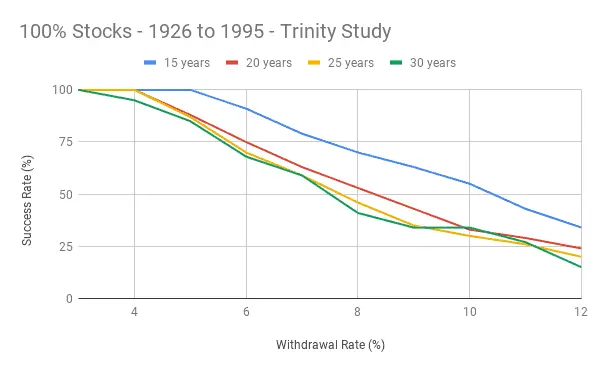

Or if you prefer something more visual: As we can expect, a higher withdrawal rate has a lower success rate. Indeed, a higher withdrawal rate means you are withdrawing more money every year. The 4% rule comes from the fact that even after 30 years of withdrawing 4% of your initial portfolio, the success rate is still 95%. So with that, the 4% rule was born! We can also see that after 6%, the success rates are going down quite quickly. An 8% withdrawal rate has less than a 50% chance of success. Nobody should gamble its retirement on such a high withdrawal rate. On the other hand, in a short-term case of 15 years, 8% still has a 70% chance of success. It is more than I thought. |

100 Percent Stocks Trinity Study - 1926 to 1995 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Portfolio of 100% BondsLet’s also see what happens when we only have bonds:

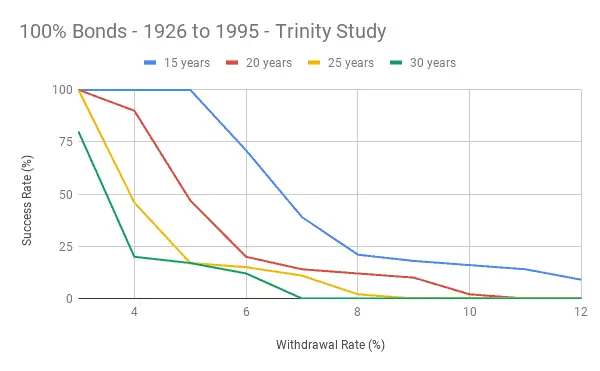

And once again, in a nice graph: As we can see, it is much worse than a 100% stock portfolio. Even if with a 4% withdrawal rate, your chance of success is less than 25%. It is because the returns on bonds are meager. So you are going to withdraw more money than you are getting every year. Moreover, while many people think that bonds are much safer than stocks, it is not always the case. Bonds can be quite volatile in some situations. The reason is that bonds are more complicated than stocks. And a lot of people overlook this complexity. I am not going to show all the results. But they are all available in the paper. Feel free to read the paper to get the details. |

100 percent Bonds Trinity Study 1926 - 1995 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Comparing portfoliosI thought it would also be interesting to compare all the different portfolios directly. The study does not directly do that, but the data is directly available, so I did it for you! What we are interested in is the 30 years success rate. It is the minimum duration we should be planning for. I wish the study did the test for at least 40 years. Here are the results for each portfolio:

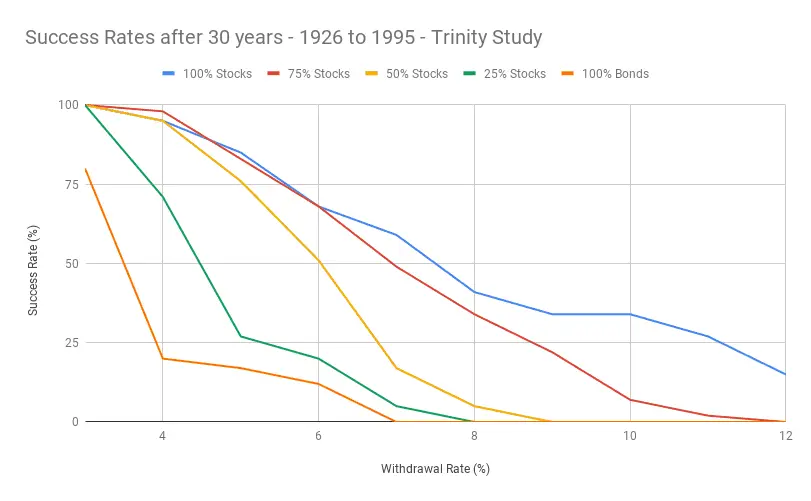

And here are the results in a graph: |

Success Rates Trinity Study 1926 - 1995 |

This graph is fascinating! We can see several important points.

First of all, you need stocks! You need a significant allocation to stocks if you want to sustain your lifestyle. Unless you plan a withdrawal rate of less than 3%, you will need at least 50% stocks in your portfolio.

We can see that the two best portfolios are the 100% stock portfolio and the 75% stock portfolio. With a low withdrawal rate, there is an advantage to having 25% bonds. But if you want a higher withdrawal rate (starting from 6%), you will need to opt for the 100% stocks.

If your goal is a success rate of at least 75%, you can afford a 5% withdrawal rate. However, if you are more conservative and aim for a 90% success rate, you will go with a 4% withdrawal rate. Hence the 4% rule!

The Results – Terminal Values

There is another interesting thing in the research. Indeed, the authors checked how much was the value of the portfolio after each period. These are called terminal values. This gives an excellent idea of how safe a withdrawal rate is.

The terminal value is how much money remains on the portfolio after the entire period. All portfolios start with 1000 USD. And they tried different withdrawal rates.

Unfortunately, the study only shares the terminal values of three portfolios:

- 75% of Stocks

- 50% of Stocks

- 25% of Stocks

I would have liked the results with the 100% Stocks Portfolio. But it is already interesting.

Portfolio of 75% StocksLet’s see the terminal values for a portfolio of 75% Stocks. I think this is the most interesting of the portfolio.

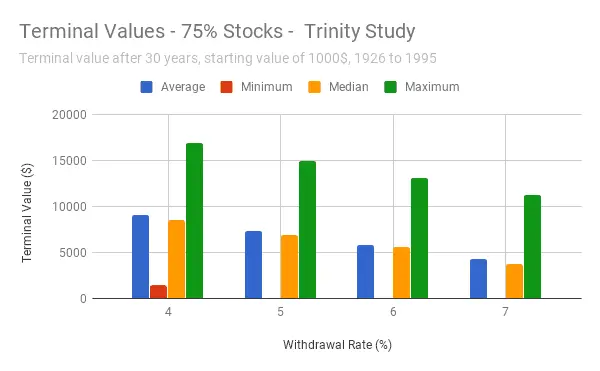

And the same data in a graphic form: |

75 Stocks Terminal Values Trinity Study |

As expected, as your withdrawal rate increases, your terminal values are decreasing. This fact makes a lot of sense since you are withdrawing more money.

Interestingly, with this portfolio and the 4% withdrawal rate, the minimum terminal value is still higher than the initial value. That means that you will have made 40% over 30 years in the worst case while not investing anything! I think this is already pretty nice.

And the maximum terminal values are really impressive. In the best case, with a 4% withdrawal, you will end with almost 19’000 USD. This terminal value is incredible, considering that you are living out of your portfolio.

And even with a high withdrawal rate of 7%, the average is still about 4000$. This average is still four times the initial value. A great result already. On the other hand, the minimum can be zero! In the case of zero, you end up in a bad situation where you cannot sustain your lifestyle anymore.

On average, even after 30 years, you still end up with a lot of money. It means you can probably sustain this forever in the right conditions.

The Conclusions of the study

The paper finishes with several interesting conclusions, as every good article ought to finish!

First, and it should be evident if your portfolio needs to sustain your lifestyle for a long time, you need a lower withdrawal rate. Reducing your withdrawal rate will increase your success rate. You will not be able to sustain a 10% withdrawal rate for more than 20 years.

Second, bonds help increase the certainty of success for low to average withdrawal rates. But they are significantly reducing the returns of your portfolio. So, bonds are not helping when you use higher withdrawal rates. But, they will likely decrease the volatility of your portfolio. Thus, bonds could help against sequences of returns risk.

Then, inflation makes it much more challenging to sustain your spending. If you know your lifestyle is not subject to inflation, you can use a much higher withdrawal rate. The problem with inflation is that your real withdrawal rate will increase every year since your expenses will increase.

Finally, if you have a significant allocation to stocks in your portfolio, you can afford higher withdrawal rates. Indeed, you are even likely to end up with much more money than what you started with. This is interesting if you plan on giving away a lot of money to your heirs (or to charity) at your passing.

Once you know your target withdrawal rate, you can compute your Financial Independence (FI) Ratio.

Misconceptions about the Trinity Study

Several things I have read about the Trinity Study are wrong. I want to dispel some of these misconceptions.

First of all, The Trinity Study has nothing to do with early retirement! The authors made it with standard retirement in mind. It is why they have not studied any success rates after more than 30 years. So, if you plan to retire in your 30s, you need to plan for much more than 30 years!

More important, the trinity study does not say that your money will last forever! Many people believe that the 4% rule from the study means that they can sustain their net worth forever. But this is not what the study is about.

The Trinity Study did not study the success rate of sustaining your lifestyle forever. They only tested if there was something left after some duration of time. If you have 1000 USD out of one million after 30 years, it still counts as a success from the study point of view. Moreover, it is just a success rate.

Also, many people seem to ignore the fact that the Trinity study is already more than 20 years old! This age does not mean it is wrong, of course. But this needs to be taken into account.

One thing we also need to consider is that the Trinity is only using the S&P 500 index. It does not apply to any stock market index. It will work very well in a broad U.S. index. But this also means we cannot extrapolate the results for any country. For other stock market indexes, we need to rerun the experiments.

Nobody is talking about the terminal values of the portfolios. People say they can sustain it for 30 years. But after 30 years, you are likely to have much more money than when you started. This result is significant. Because this goes to show that you could sustain it longer, and this also goes to show that you could have used a higher withdrawal rate than you thought.

Finally, many people cite the 4% rule regardless of the portfolio they are planning to use. Indeed, the study only shows success rates higher than 90% for a portfolio with at least 50% stocks. For instance, a portfolio with 100% bonds has a 20% chance of success only!

If you have another portfolio, you will have to run the simulations yourself. If you are interested in that, I have done many more simulations and provided a calculator. See next section.

Updated Results

The most significant issue with the Trinity Study is that it is quite dated.

Fortunately, we now have more recent data from the stock market. So, we can rerun the simulations. And since I like to code, I decided to do it myself.

I have collected stock market data from 1871 to 2021 and reran the experiments. You can read the updated results of the Trinity Study for 2020. We will see if the Trinity Study holds for more extended periods of simulation.

And if you want to do some simulations yourself, I have made a Trinity Study calculator for you.

More Simulations

I have also done some other simulations with this wealth of data:

- Rebalancing in retirement

- The Trinity Study in recent years

- Retirement with Swiss Stocks

- The Trinity Study and Low-Yields

If you have an idea for other simulations, let me know!

FAQ

What is the Trinity Study?

The Trinity Study is a 1998 research paper by three professors of the Trinity University. Its original name is Retirement Savings: Choosing a sustainable withdrawal rate. It shows that with a withdrawal rate of 4%, one could sustain its lifestyle for 30 years. It is the origin of the 4% Rule.

What is the 4% Rule?

The 4% states that if you withdraw 4% of your initial portfolio every year, you could sustain for more than 30 years. It is a rule of thumb since it depends on the portfolio and how long you need to sustain your lifestyle.

What are the shortcomings of the Trinity Study?

This study only covers up to 30 years of retirement. Thirty years is not enough for early retirees to base their plans on. Also, it is already twenty years old and its results should be updated.

Conclusion

The Trinity Study is an excellent research work with a lot of great results. But a lot of people take it out of context. And a lot of people consider this study as the holy grail or the bible. But it is just a research paper!

As we saw, there are many things that people get wrong about this paper. And I think it is essential to put everything back in perspective.

Most important of all, the study was never about early retirement. It was about standard retirement with up to 30 years to sustain your expenses.

Also, it is not about sustaining money forever. It is about the success rates (probabilities only!) of sustaining during a set amount of time.

Now, this does not mean it is not a great study! On the contrary, the Trinity Study is fascinating. And the 4% rule can indeed be derived as an excellent withdrawal rate that can sustain your portfolio for at least 30 years and probably longer. And we can get inspiration from this study for early retirement!

If you want to learn more about this study, I invite you to read the paper. It is really interesting. And to learn more, you should read about my updated trinity study results.

I have already talked a lot about Financial Independence on this blog. If you want to learn more, you can read about compelling reasons to become Financially Independent.

Did you know about the Trinity Study? What do you think about this study?

Tags: Featured,Financial Independence,Investing,newsletter