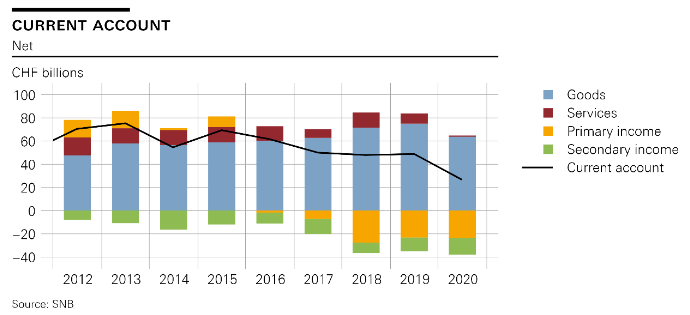

Key developments in 2020 The current account surplus in 2020 was CHF 27 billion, down CHF 22 billion on the previous year. This decline was particularly due to the lower receipts surpluses in trade in goods and services. In the case of goods, the decline in receipts – with expenses remaining unchanged – caused the balance to decrease by CHF 11 billion to CHF 64 billion. While both receipts and expenses were substantially lower in the cyclically sensitive goods trade (special trade, total 1), this decline was offset on the expenses side by higher expenses for gold imports. In trade in services, receipts decreased more strongly than expenses, causing the balance to decline by CHF 8 billion to CHF 1 billion. Current Account 2012-2020 - Click to enlarge In the

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Key developments in 2020The current account surplus in 2020 was CHF 27 billion, down CHF 22 billion on the previous year. This decline was particularly due to the lower receipts surpluses in trade in goods and services. In the case of goods, the decline in receipts – with expenses remaining unchanged – caused the balance to decrease by CHF 11 billion to CHF 64 billion. While both receipts and expenses were substantially lower in the cyclically sensitive goods trade (special trade, total 1), this decline was offset on the expenses side by higher expenses for gold imports. In trade in services, receipts decreased more strongly than expenses, causing the balance to decline by CHF 8 billion to CHF 1 billion. |

Current Account 2012-2020 |

| In the financial account, reported transactions for 2020 showed a net acquisition of financial assets (CHF 17 billion) and a net incurrence of liabilities (CHF 5 billion). In addition to the SNB’s foreign currency purchases (reserve assets), portfolio investment contributed to the net acquisition on the assets side. This was counteracted by the fact that companies reduced intragroup lending (assets) to non-residents, which led to a net reduction in direct investment as well as in other investment (finance companies). On the liabilities side, other investment saw a high net incurrence, with resident commercial banks increasing their liabilities towards non-resident banks (interbank market) as well as towards non-resident customers. Direct investment, on the other hand, saw a net reduction, with non-resident parent companies scaling back their equity capital in their resident subsidiaries.

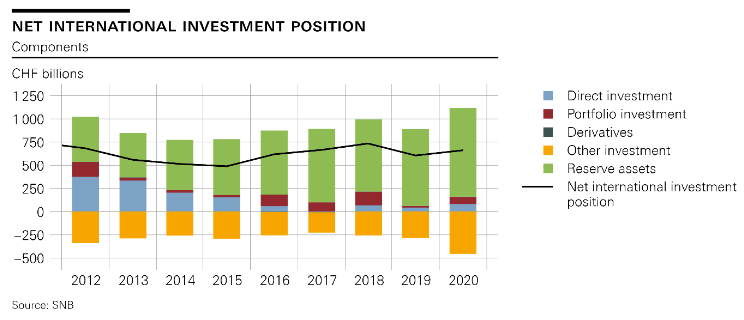

The net international investment position rose by CHF 56 billion to CHF 662 billion in 2020. Stocks of assets were up by CHF 47 billion to CHF 5,323 billion, while stocks of liabilities were down by CHF 10 billion to CHF 4,661 billion. The change in stocks was influenced by two opposing effects: on the one hand, valuation gains due to higher prices on stock exchanges in Switzerland and abroad; and on the other, exchange rate-related valuation losses resulting from the weakness of the US dollar against the Swiss franc. |

Net international investment position, 2012-2020 |

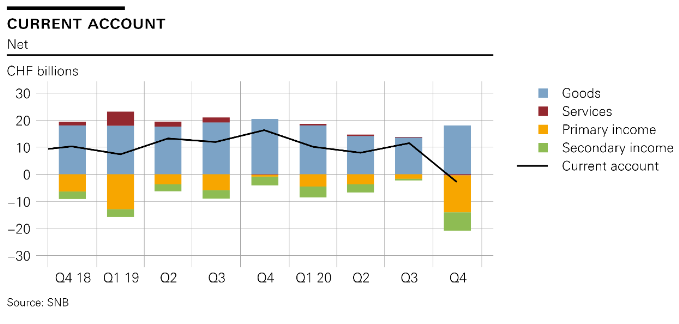

Key developments in Q4 2020The current account recorded a deficit of CHF 3 billion in Q4 2020, having recorded a surplus of CHF 16 billion in Q4 2019. The decline in the current account balance was principally due to the increased expenses surpluses in primary and secondary income. Under primary income, direct investment played a decisive role, with receipts here declining more strongly than expenses. Under secondary income, higher claims payments by private insurers were the main driver of the increased expenses surplus. |

Current Account Q4 2018- Q4 2020 |

| In the financial account, reported transactions for Q4 2020 showed a net acquisition of financial assets (CHF 9 billion) and a net incurrence of liabilities (CHF 6 billion). On the assets side, a net acquisition was recorded under reserve assets, portfolio investment and other investment. The net acquisition under other investment was caused by the SNB and the commercial banks, which increased their claims on non-residents. On the liabilities side, the net incurrence was mainly attributable to other investment. The transactions under direct investment counteracted the net acquisition of financial assets and the net incurrence of liabilities – foreign-controlled finance and holding companies reduced their balance sheets by decreasing equity capital on the assets side and the liabilities side.

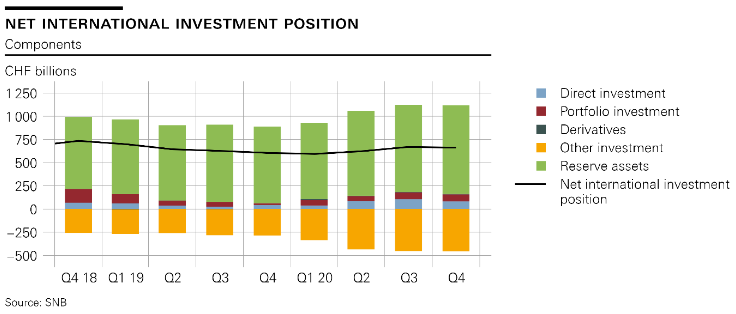

The net international investment position fell by CHF 8 billion to CHF 662 billion quarter-on-quarter, because the stocks of liabilities increased more strongly than the stocks of assets. In Q4 2020, assets rose by CHF 51 billion to CHF 5,323 billion and liabilities rose by CHF 59 billion to CHF 4,661 billion. The increase in stocks on both sides was a result of the same factors: exchange rate-related valuation losses resulting from the weakness of the US dollar against the Swiss franc and valuation gains due to higher prices on stock exchanges in Switzerland and abroad. |

Net international investment position, Q4 2018- Q4 2020 |

Data revisions

The data on the balance of payments and international investment position take into account revisions going back to Q1 2020. These revisions were primarily due to an adjustment in the method used to estimate companies’ investment income (direct investment). The new estimation method factors in additional information at both company and industry level, which makes it more robust in the face of external shocks (e.g. the coronavirus crisis). The revisions led in particular to higher expenses under primary income, which in turn resulted in a lower current account surplus. As usual, the estimates will be replaced by surveyed data with the publication of the Q3 2021 data (21 December 2021).

Further information

Comprehensive charts and tables covering Switzerland’s Balance of Payments andInternational Invest ment Position can be found on the SNB’s data portal.

Tags: Featured,newsletter