Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again. About the only exception on the equity side was China, which outperformed for much the same reason as US growth – technology stocks. Generally, we expect foreign stocks to outperform in a weak dollar environment but so far any outperformance has been underwhelming. Just one more oddity in this oddest of stock markets. In January of this year, when stocks were surging to new highs, I wrote that stocks had entered the “silly season”. Oh, if only I had known how wrong that was. I am always loath to use the term bubble because we can’t know the

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Research, bonds, commodities, currencies, Featured, Markets, newsletter, Real estate, stocks

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

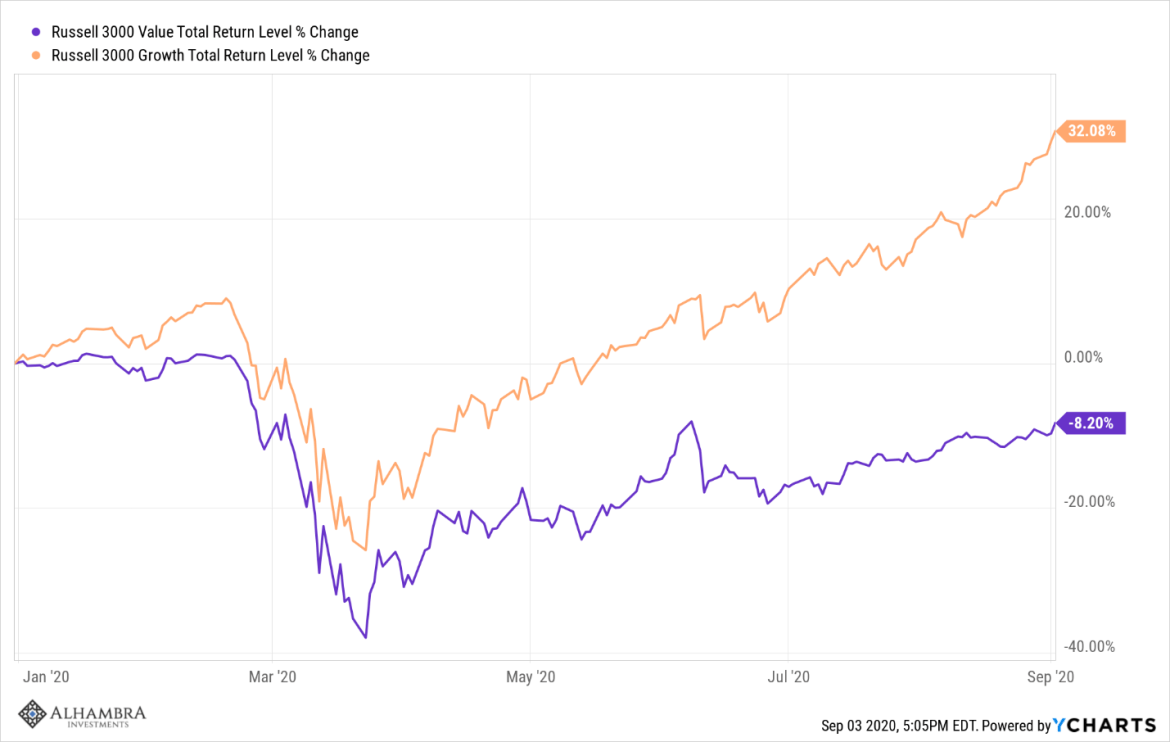

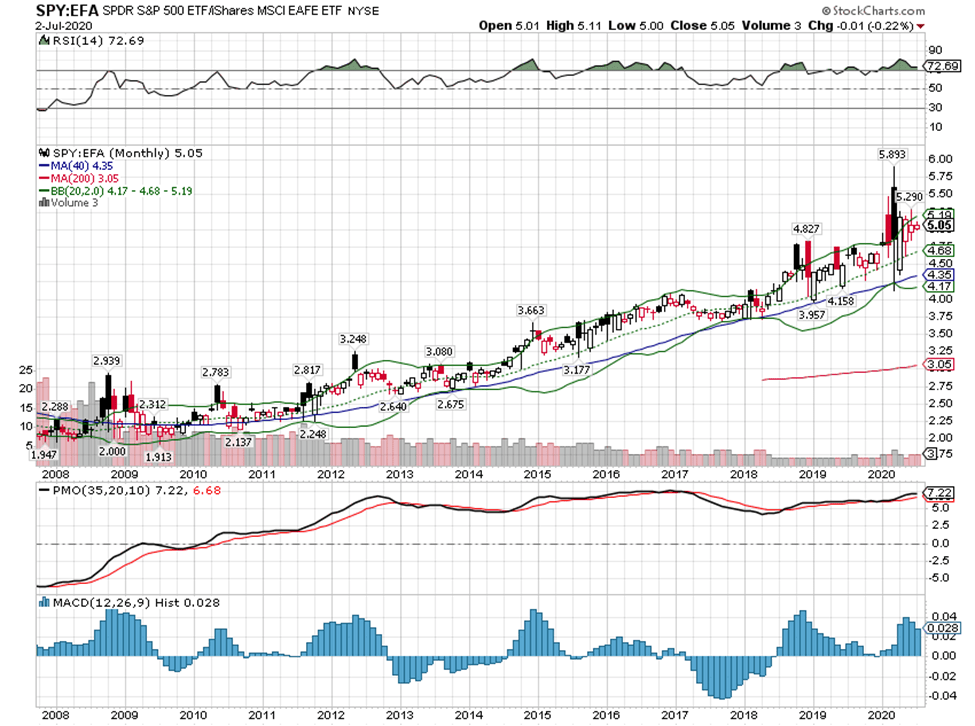

| Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again. About the only exception on the equity side was China, which outperformed for much the same reason as US growth – technology stocks. Generally, we expect foreign stocks to outperform in a weak dollar environment but so far any outperformance has been underwhelming. Just one more oddity in this oddest of stock markets.

In January of this year, when stocks were surging to new highs, I wrote that stocks had entered the “silly season”. Oh, if only I had known how wrong that was. I am always loath to use the term bubble because we can’t know the future and today’s asset prices could look perfectly reasonable with the benefit of hindsight. Okay, it might take some theoretical, many worlds alternate reality for that to be true of today’s market, but still, it could be true. You just have to have an imagination more imaginative than mine, I guess. Tesla, the poster child for overvalued stocks, has fallen 17% over the first three trading days of September and it is still the most valuable car manufacturer on the planet, by far. Its market cap exceeds its next four largest competitors (Toyota, VW, Daimler & Honda) combined. It’s revenue, on the other hand, is a mere 3% of those big four. It trades for over 1000 times trailing earnings and at least 100 times forward earnings. I could go on but it’ll just rile up the Elon Musk fanboys so suffice it to say that justifying Tesla’s valuation is difficult. Could Tesla grow into its valuation? I hesitate to say no, which probably says more about today’s market than any metric I might cite. |

Russell 3000 Value/Growth |

| I’ve heard a lot of comparisons to the dot-com mania that gripped America in the late 90s and there are some similarities in behavior. But at least today’s absurdly valued tech stocks largely have earnings and some real growth. And while they are expensive, the spread to the rest of the market isn’t nearly as extreme as it was back then. Of the 11 economic sectors of the S&P 500, only three have P/Es less than 20. The technology sector is 25% of the S&P 500, but that is still well below late 1999 when it was about 35%. Which means that yes, it can get crazier.

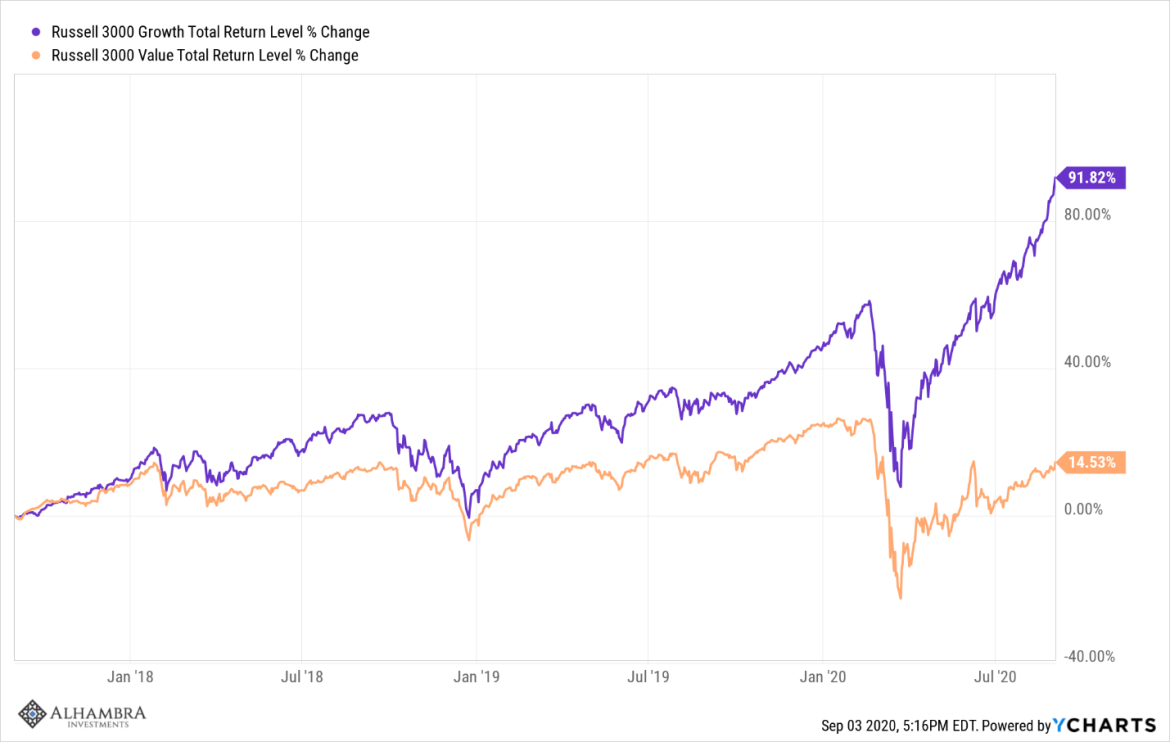

Yes, there are a few stocks, like Tesla, that just defy fundamental logic. But the more important observation is that almost all stocks are expensive today, not just technology. Procter & Gamble, just to cite one example, is a fine company, but 28x earnings is hard to justify for a company growing at less than 5% annually. Walmart is also a great company, but 30x earnings for single-digit growth? These are not cheap stocks. The only sector exceptions are financial services and energy, at 12 and 10 times earnings respectively. If you want a bargain today, you have to buy the villain sectors, one seen as the poster child for crony capitalism and inequality and the other so evil it threatens all mankind. I don’t know when the fever will break. Maybe today as the NASDAQ is down 5% on the third day of the new month. We have reached such extremes between growth and value, international and domestic, that merely pulling back to the long-established trend lines would involve a rather violent move. The Russell 3000 growth index has outperformed the Russell 3000 value index by 40% just this year. Over the last three years the difference is even greater, 77% in favor of growth. |

Russell 3000 Growth/Value |

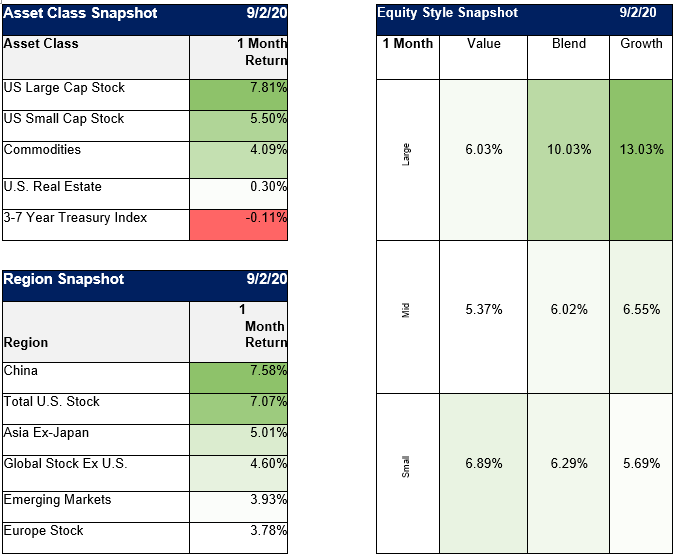

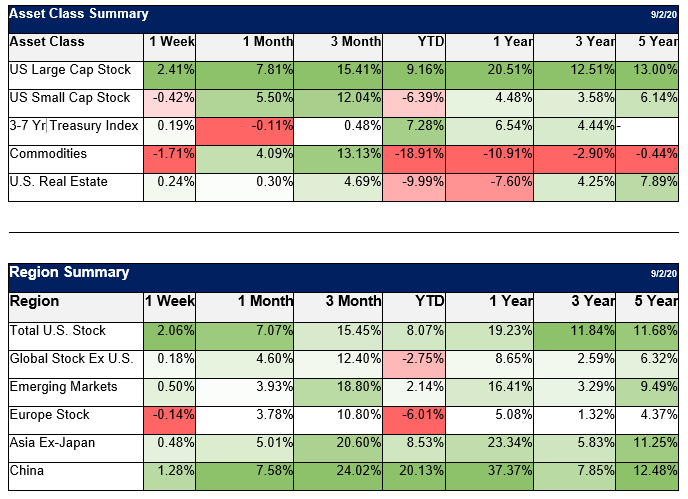

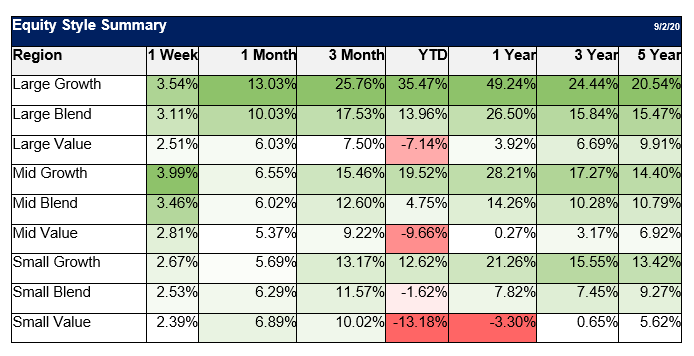

| Over the last month, almost every type of risk asset rose, even the things that have lagged all year. But YTD, the only place to be has been large-cap growth and bonds, specifically Treasuries. That is a strange combination but it is a strange market for a strange time. |

Asset Class Snapshot/Region Snapshot |

Asset Class Summary/Region Summary |

|

Equity Style Summary |

|

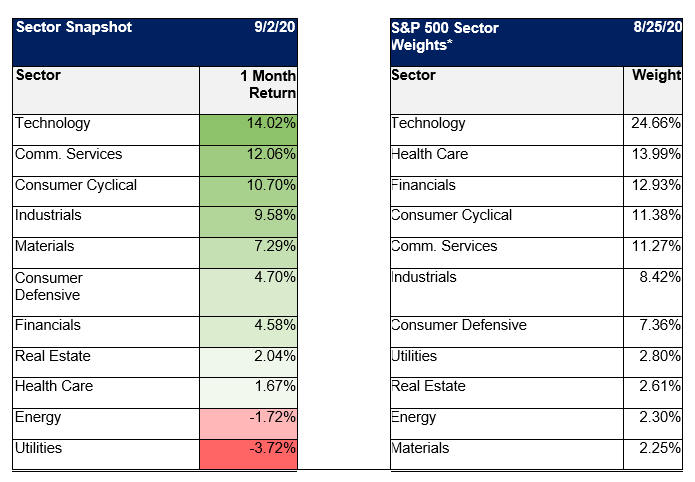

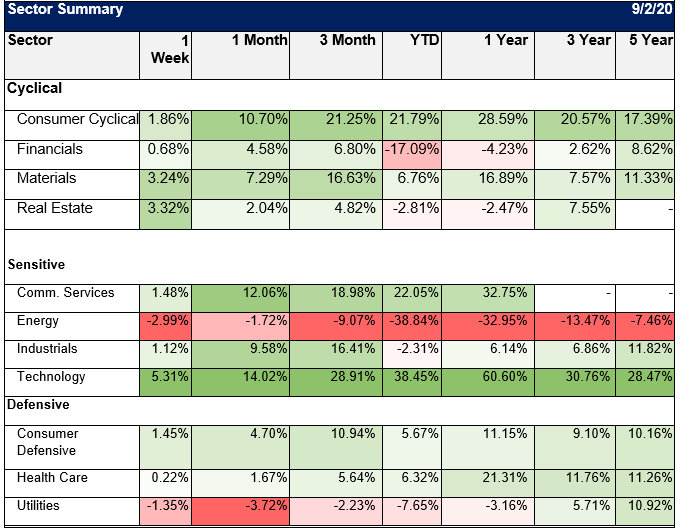

Sector Snapshot/S&P500 Sector Weights |

|

Sector Summary |

|

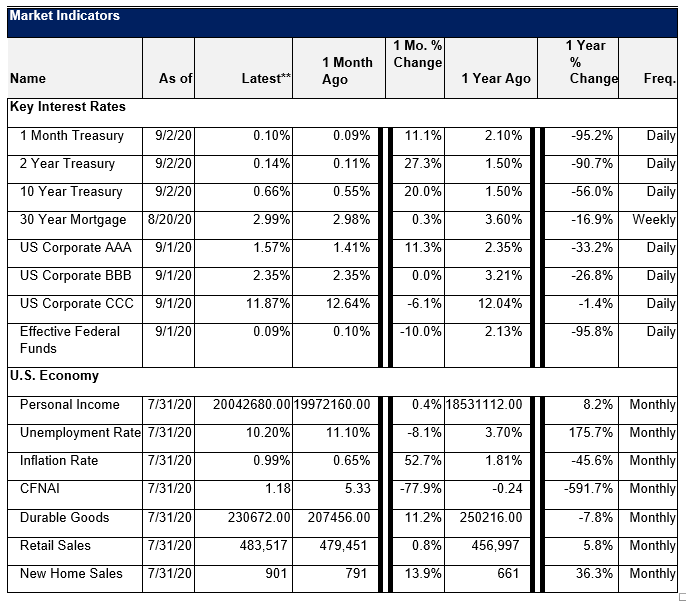

Market Indicators |

|

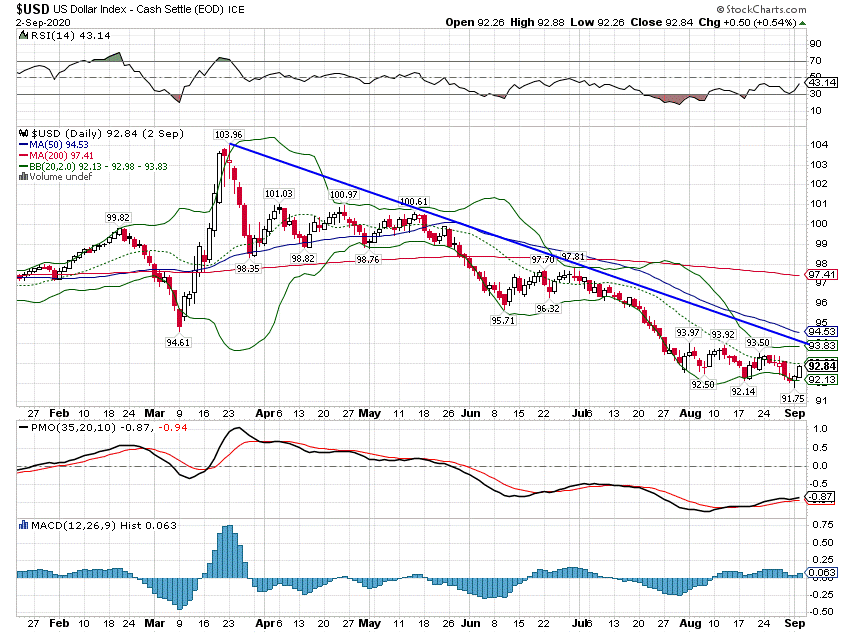

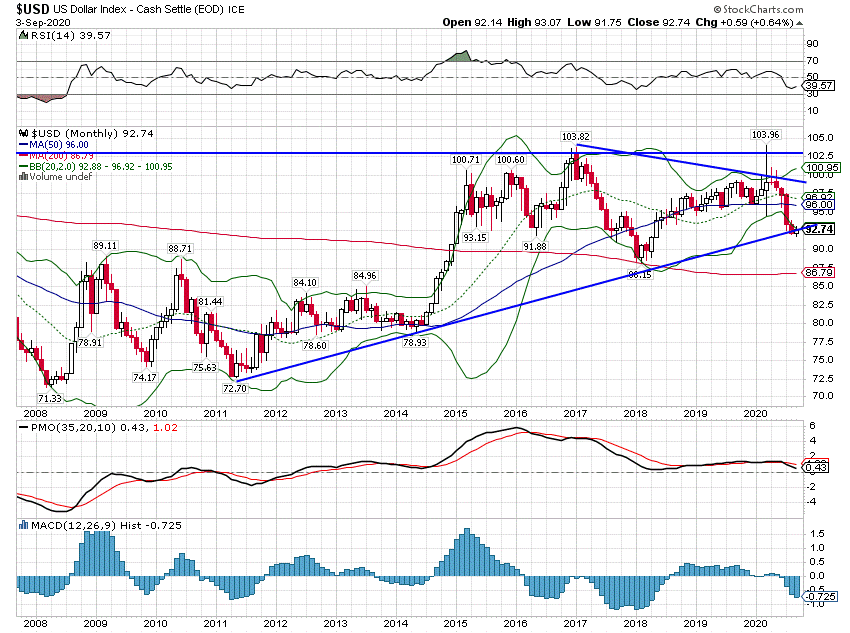

Selected ChartsThe dollar continued to fall in July and August. |

US Dollar Index |

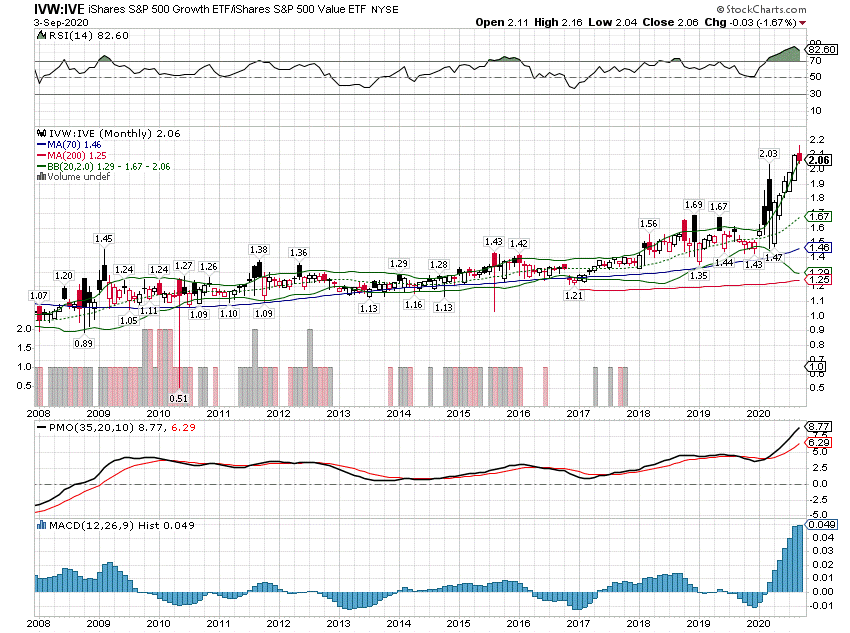

| Closing the spread between S&P 500 growth and value would require a roughly 25% outperformance by value in a short period of time. That is hard to imagine, but then so was this degree of outperformance by growth in such a short period of time. If we have learned nothing else in this long bull market (was March a bear market or just a correction of this bull?), it is that markets can and will do things you think are impossible. |

iShares S&O 599 Growth / iShares S&P 500 Value |

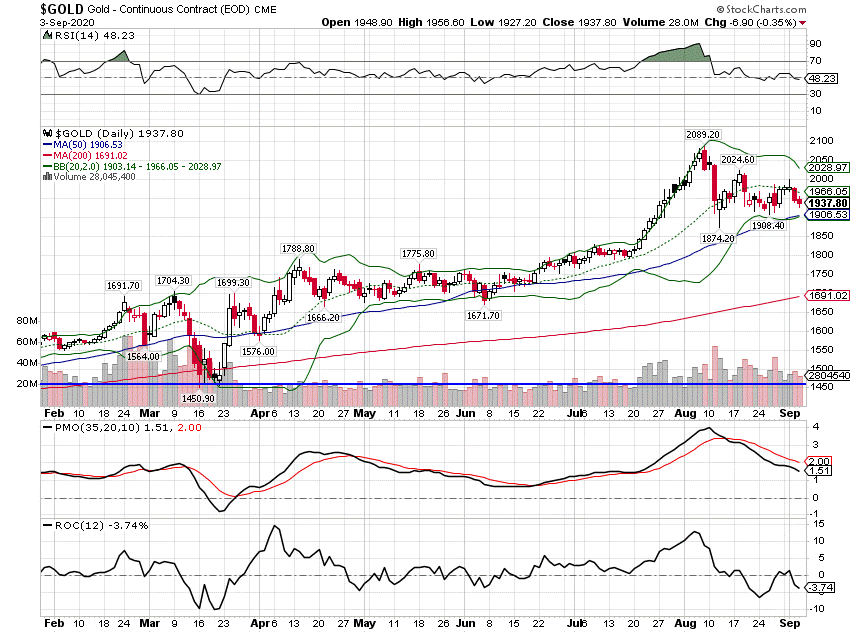

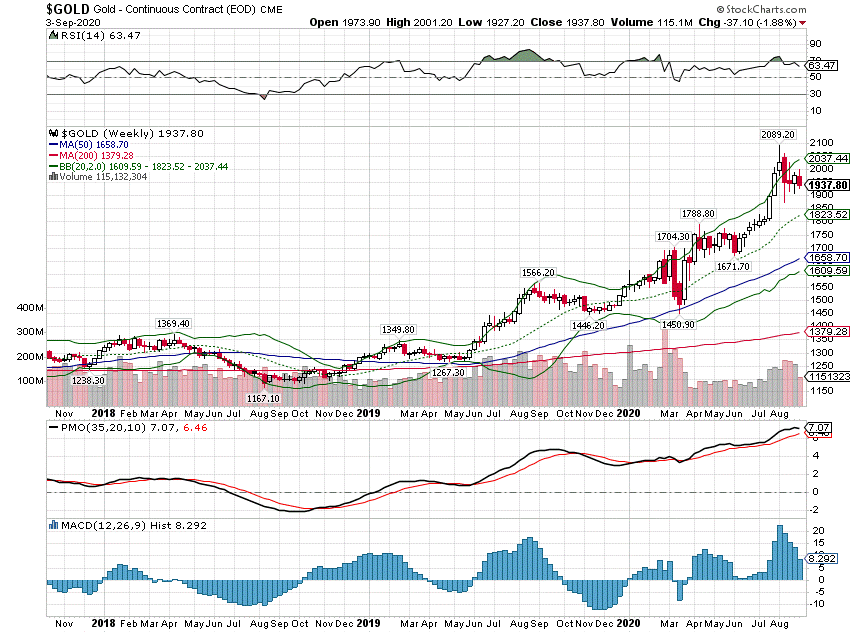

| Gold hit a new high in the first week of August but has since pulled back to the trend. That probably is a reflection of rising optimism about a vaccine although you would be hard-pressed to find any evidence of rising growth expectations in the bond market: |

Gold |

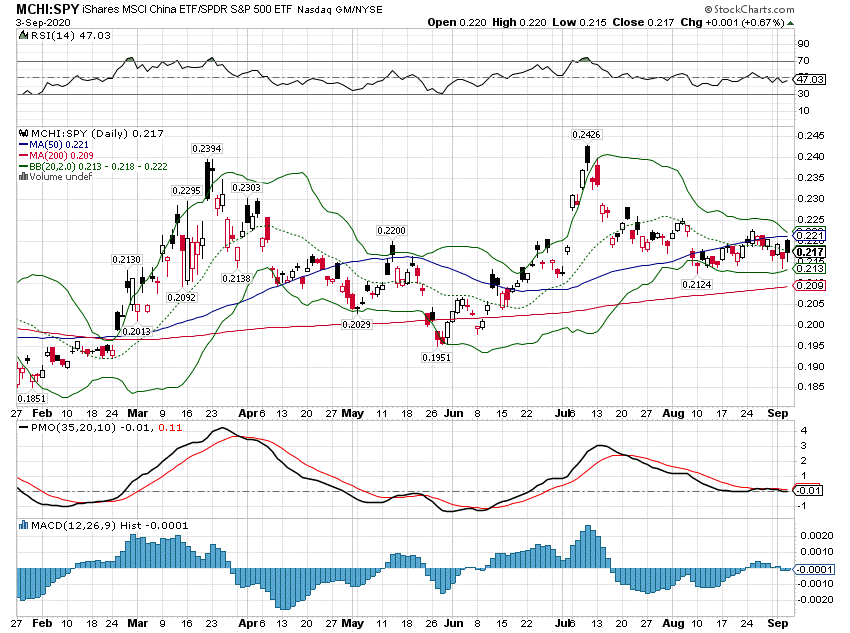

| Chinese stocks have outperformed the US this year and continued to do so in August: |

iShares MSCI China / S&P 500 ETF |

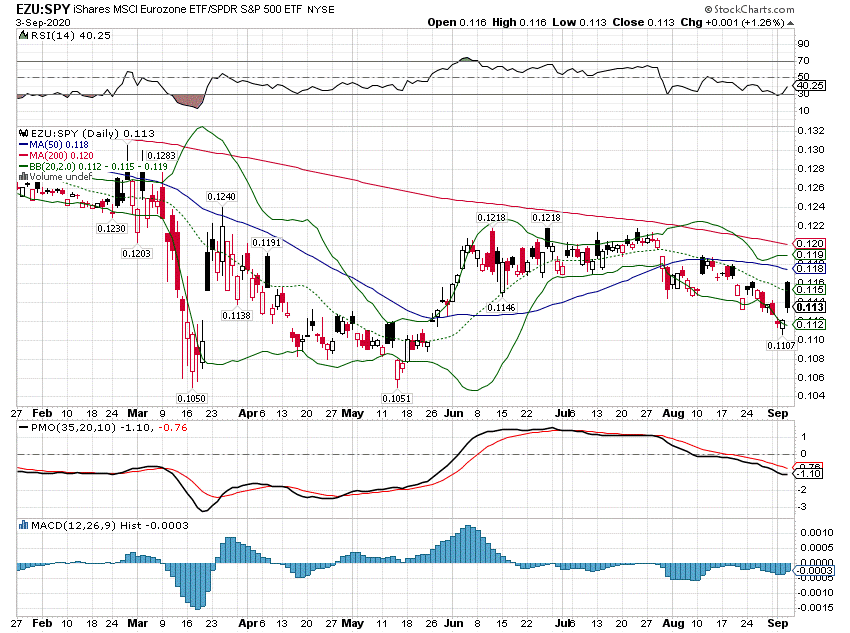

| Europe has outperformed the US since the spring lows (and the dollar index top) but lagged last month. If this trend is going to endure the Euro will have to stay strong. |

iShares MSCI Eurozone/ S&P 500 ETF |

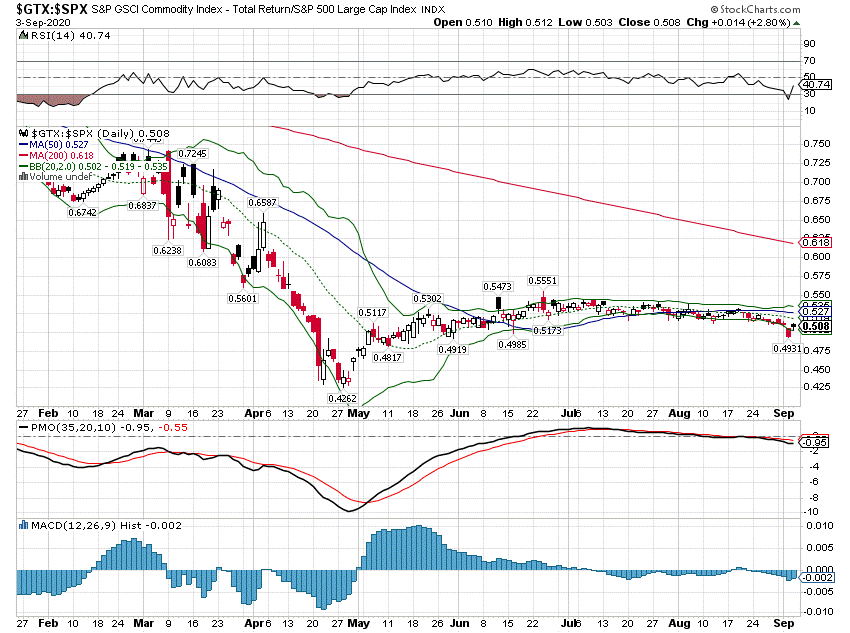

| Commodities have also outperformed during the weak dollar period but, like European stocks, lagged in August. |

S&P GSCI Commodity Index / S&P 500 Large Cap Index |

| The dollar has fallen about 10% from its high (depending on what index you use) and is now at the bottom of the range that has prevailed since 2015 (with two outlier exceptions). I expect a bounce from here but I am not looking for a big move. We don’t see any real stress out there right now that makes us believe another dollar squeeze is in the works. But neither do we see any big catalysts that might push the dollar down rapidly.

The short-term trend for the dollar is down and I think portfolios should continue to be positioned to benefit from weakness – for now. But measured from almost any time frame other than the panic peak in March tells a different story. The dollar has been and remains fairly strong against other global currencies. |

US Dollar Index, 2009-2020 |

| But the dollar has been weak against gold for a longer period and that gives me pause. Gold prices are correlated with the dollar but the better correlation is with real interest rates. If real rates remain low – if real growth expectations remain muted – then gold strength and dollar weakness are likely to go hand in hand. |

Gold, 2018-2020 |

The extremes that exist in the markets will eventually be corrected. But no one knows when that will be. And the end of this wild bull market could be caused by anything – or nothing. The dot com boom ended in March of 2000 because….of nothing that I can remember. It just seemed like everything that was working so easily suddenly stopped working. Sort of like what happened today.

Tags: Alhambra Research,Bonds,commodities,currencies,Featured,Markets,newsletter,Real Estate,stocks