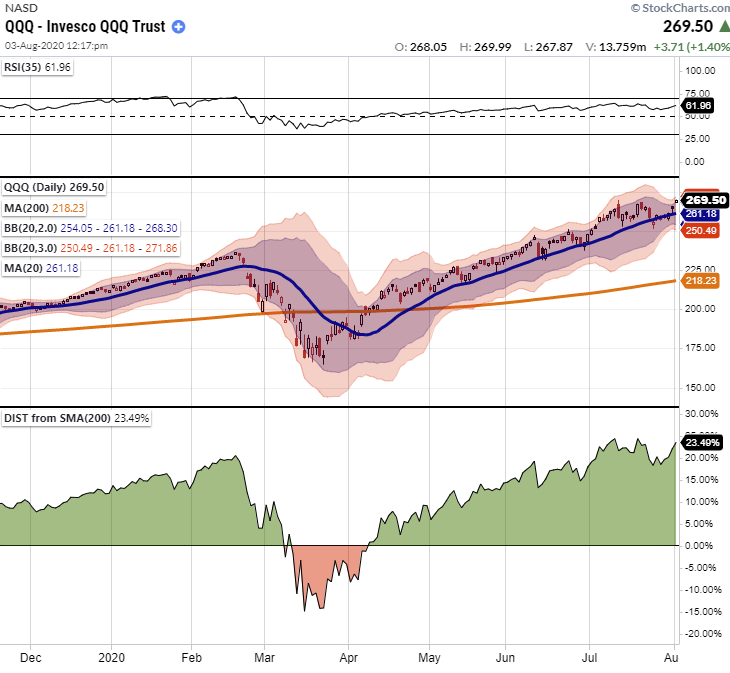

Depending on which index you are following, the bull market is back! It is now time to reflect on the bear market. If your portfolio is not yet out of the red, it does not hurt to be prepared. We have already discussed the things you should do during a bear market. The most important of these things is not to panic. But when the stock market recovers, there are a few more things you can do. It is now time to think about what happened and analyze how you have acted and reacted during these times. The reason you should think about that is that if you are investing for the long-term, you will see other bear markets. The stock market is a long cycle of bull and bear markets. And you need to be prepared for both. Living through a bear market is not a pleasant

Topics:

Mr. The Poor Swiss considers the following as important: 9) Personal Investment, 9) The Poor Swiss, Featured, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Depending on which index you are following, the bull market is back! It is now time to reflect on the bear market. If your portfolio is not yet out of the red, it does not hurt to be prepared.

We have already discussed the things you should do during a bear market. The most important of these things is not to panic. But when the stock market recovers, there are a few more things you can do.

It is now time to think about what happened and analyze how you have acted and reacted during these times.

The reason you should think about that is that if you are investing for the long-term, you will see other bear markets. The stock market is a long cycle of bull and bear markets. And you need to be prepared for both.

Living through a bear market is not a pleasant experience but probably not a please one. This experience will teach you a lot about investing and about yourself. And if you made some mistakes during this bear market or if you were not prepared, then now is a perfect time to prepare yourself to do a better job during the next one.

After a bear market

A bear market is over when the stock market gets back to where it started. It means that the bear market ends when the stock market reaches new highs.

Unfortunately, there are several definitions of bear and bull markets. For some people, the next bull market starts when the market is up 20% from the new lows.

For me, I prefer to think that the bear market is over once we are back to where it started. But the exact definition does not really matter. What is important is what you doing when the market goes down and what you are doing when the market goes back up.

A bull market does not directly follow a bear market. Generally, the next bull market starts when prices are rising for more than 20% from the start point. So, a bear market could be followed by another one directly, but this is unlikely, at least historically.

There is one thing we can be sure of: there will be more bull markets, and there will be more bear markets. We do not know how long they will last. But we know they will happen. It means you need to learn how to deal with them. And for this, reflecting on your experience is an excellent way of learning.

Investing in a bull market is much easier. People make mistakes during a bull market too. But errors in a bear market are generally more costly than during a bull market.

Now, regardless of the future, the current bear market is over or at least almost over, and it is time to assess the situation:

- Did you panic during the bear market?

- How did you react?

- How did your portfolio suffer?

Now is a great time to improve your situation for the next bear market. because another bear market will come, this is the only thing we know! Nobody can tell you when and how. But we need to assume there will be another one. And we need to be prepared as much as possible.

Assess your financial situation

At the end of the bear market, you should make a good point about your current financial situation. It is very important to know where you stand financially. But a lot of people do not know how much their net worth is, for instance.

The first thing you should is to compute your net worth. You take the sum of all your assets, and you remove the sum of all your liabilities (debts). And this gives you your net worth.

Ideally, you should track this number. So, you can see how your net worth suffered during the bear market. If you simply continued investing, your net worth should be higher than when it started since you also bought shares when the price was low.

Of course, it can happen that you lost your job during a bear market if a recession followed it. In this case, you are likely to have a smaller net worth than before.

Review your asset allocation

A bear market is a bad time to change your asset allocation. Most likely, your decisions will be driven by emotions or panic. But after a bear market ended, it may be a good time to do so.

Based on your asset allocation, your unrealized losses during the bear market would have been different. If you are 100% in stocks, you may have seen your portfolio halve in value. But if you have more bonds, it would have been better.

If you felt during the bear market that you could not take it, then maybe you have a too large allocation to stocks in your portfolio. In that case, it could be useful to increase your allocation to bonds for the future.

On the other hand, if you did not feel scared with your paper losses and you felt very confident, you probably have the right amount of stocks. You could even take on more risks if you feel like it. But do not go overboard and keep a level of risk that you will be comfortable with during the next bear market.

It may also be an excellent time to take a good hard look at your Investor Policy Statement if you have any.

Refill your emergency fund

If something extraordinary happened during a bear market, you might have needed to use your emergency fund. If it is linked to a recession, you may have seen your salary cut or worse lost. In these cases, you are very likely to have used your emergency fund.

So, now that the bear market is ended, you need to make sure to refill your emergency fund. Every time you use it, your next savings should go towards it. If you do not refill your emergency fund, it is useless.

It may also be an excellent time to rethink your emergency fund. If it was not enough during this crisis, maybe you need a larger emergency fund. There is nothing wrong with that. It is better to realize that now and take action than do nothing and fall into the same issue the next time.

Revisit your goals

A lot of people are feeling very confident once the bull market starts again. Many of them imagine that this will last forever. But it never does.

If you were one of them, it might be time to revisit your goals. For instance, if your goal is to become Financially Independent, now would be a great time to see if your plan would have held during the bear market.

Could you have lived through this market with your plan? If not, maybe it is time to improve your goals. Perhaps you can be more defensive. For instance, you can plan for a larger cash buffer. Or you can plan for a lower withdrawal rate.

If you are already retired, you can still plan and think about what will happen during the next bear market. There is less you can do if you are already retired unless you want to go back to work for a few years. But most people do not want that. What you could do is reducing your expenses if you can. Reducing your expenses would lower your withdrawals in the future.

Stay the course

Just because a new bull market is going to start does not mean you should adapt your strategy based on that. The bear market may have ended, but we do not know what the future will be.

You need to keep investing as during the previous bull market. Do not feel too optimistic, but do not feel too pessimistic either. These should be treated like regular times. We are back on track on a regular market.

Prepare for the next bear market

You have just experienced a bear market. Hopefully, the next one will not happen for a long time. But there is no way of knowing that. It could happen very quickly. You need to be prepared for this eventuality.

You cannot be ready for everything. But you can be prepared as much as you can. Now that you have witnessed one, you know how it is. Maybe your previous plan was overly optimistic, or perhaps it was too pessimistic. So, you can adapt yourself to the next one.

Now, all bear markets are different. Some are very fast, and some are very long. Some are coming with a recession, while others do not cause a recession.

You should not make the mistake of thinking the next bear market will be the same as this one. It may be similar, but it may also be entirely different. So, keep an open mind! You can prepare yourself for most things. But you should make sure to always have some margin for error.

Conclusion

After a bear market, you will probably just want to be happy that it is over. But there are a few things that people can do after a bear market. It may not be a pleasant experience, but investors learn a lot during stock market crashes.

During a bear market, the most important thing is not to panic. You do not want to make changes to your investments when the market is in panic.

After a bear market, you can make some changes if they are necessary. Based on what happened during the crisis, you must reassess your finances and your investment strategy.

On our side, we are not going to change anything significant after this bear market. If the next bull market lasts long enough, we are probably going to prepare an opportunity fund. And I am going to consider investing in gold as well in the future. But these are small changes.

What about you? Do you know any other things people should do after a bear market?

Tags: Featured,Investing,newsletter