Just as the rewards of central-bank bubbles have not been evenly distributed, the pain created by the collapse of the bubbles won’t be evenly distributed, either. We’ve reached an interesting juncture in history, and I don’t mean the pandemic. I’m referring to the normalization of extremes in the economy, in social decay and in political dysfunction and polarization. Let’s ask a very simple question. The S&P 500 stock index went up five-fold from its 2009 low at 667 to a recent high around 3,400. Did your income rise five-fold since 2009? Probably not. Houses that sold for 0,000 in 2000 are now valued at 0,000, a six-fold increase since 2000. Did your income rise six-fold since 2000? Probably not. State university tuition has risen about 2.5 times from

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

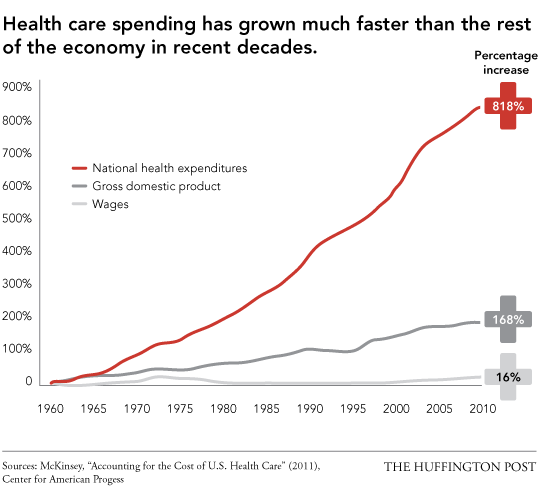

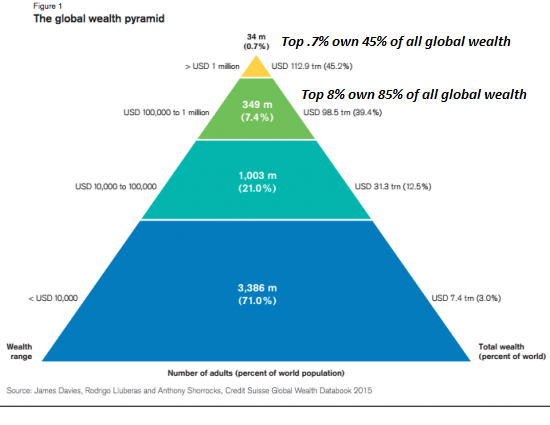

Just as the rewards of central-bank bubbles have not been evenly distributed, the pain created by the collapse of the bubbles won’t be evenly distributed, either. We’ve reached an interesting juncture in history, and I don’t mean the pandemic. I’m referring to the normalization of extremes in the economy, in social decay and in political dysfunction and polarization. Let’s ask a very simple question. The S&P 500 stock index went up five-fold from its 2009 low at 667 to a recent high around 3,400. Did your income rise five-fold since 2009? Probably not. Houses that sold for $150,000 in 2000 are now valued at $900,000, a six-fold increase since 2000. Did your income rise six-fold since 2000? Probably not. State university tuition has risen about 2.5 times from 2004 to 2019. Did your income rise 2.5-fold since 2004? Probably not. Even burritos from the local taco truck have tripled in price in the past 15 years. Did your income triple? Probably not. The average household income in 2000 was about $42,000. To match the six-fold increase in urban housing valuations, that household would have to earn $252,000 this year. How many households saw their income soar from $42,000 to $252,000? Not many. The average household income in 2009 was about $50,000. To match the five-fold increase in stock market valuations, that household would have to earn $250,000 this year. How many households saw their income soar from $50,000 to $250,000? Not many. |

US Health care, 1960-2010 |

| To keep up with tuition (never mind healthcare insurance), the household earning $45,000 in 2004 would have to bring home $112,000 this year.

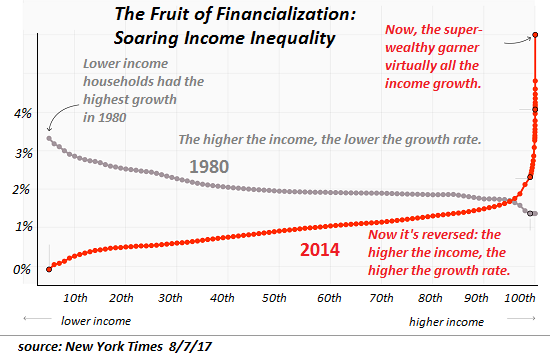

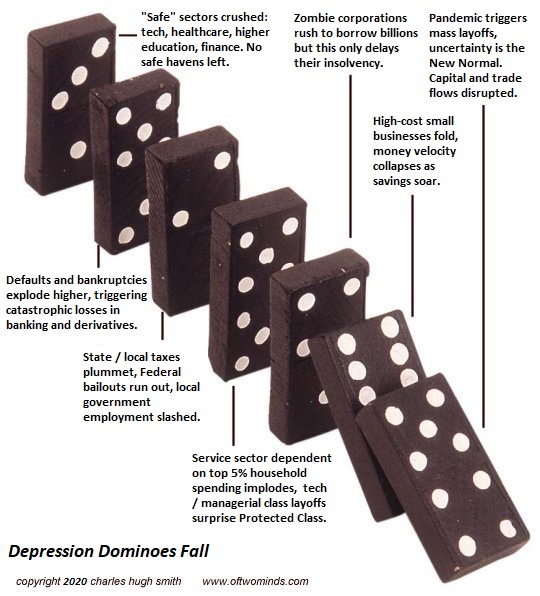

The household earning $100,000 in 2004 would need to boost its income to $250,000 to keep up with college tuition. How many households boosted their income from $100,000 to $250,000 in the past 15 years? Not many. In other words, what’s been normalized over the past 20 years is the total subjugation of labor by central-bank inflated asset bubbles that benefit the top 0.1%. Labor has lost ground while assets have soared, leaving those whose income is earned less able to buy over-valued assets and more prone to borrowing money to maintain their lifestyle– a situation I call debt serfdom. Two generations ago, nobody knew the name of the Federal Reserve’s chairperson. Now that chairperson is in the news virtually daily. The media exposure of the Fed chair far exceeds that of elected officials such as the Speaker of the House of Representatives or the Senate Majority Leader, or the Chief Justice of the Supreme Court. In effect, the nation has become dependent on its central bankers and their limited agenda (expand the wealth and power of the financial sector). The elected government and the real-world production of goods and services both have taken a back seat to conjured “wealth.” The ascendance of finance and the decay of labor’s value is the result of the ascendance of monetary stimulus as the core driver of “wealth” and thus “growth.” It was once expected that consumption would be funded by wages earned by labor, and investment would be funded by savings set aside from earnings. That era is long past. What’s been normalized is a systemic reliance on debt to fund consumption and on the euphoric “animal spirits” of the wealth effect generated by soaring assets such as homes and stocks. History offers a number of parallels to the ascendance of borrowed capital over labor and central bank money-printing over the creation of productive value. History suggests eras that have normalized economic and financial extremes–extremes of inequality, policy, and decay–haven’t ended well for anyone. Just as the rewards of central-bank bubbles have not been evenly distributed, the pain created by the collapse of the bubbles won’t be evenly distributed, either. |

The Fruit of Financialization |

Tags: Featured,newsletter