Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter? For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work. And if Ben Bernanke grew so concerned he felt a second dose was required… Put another way, if a central bank keeps doing “bigger” things, that isn’t a basis for optimism because it calls for a starkly sobering re-assessment of a situation that just so happens to be causing central bankers to panic. Monetary policies since August 2007 aren’t a fix, but a warning. The more they have to do, the worse it is likely going to be. Today,

Topics:

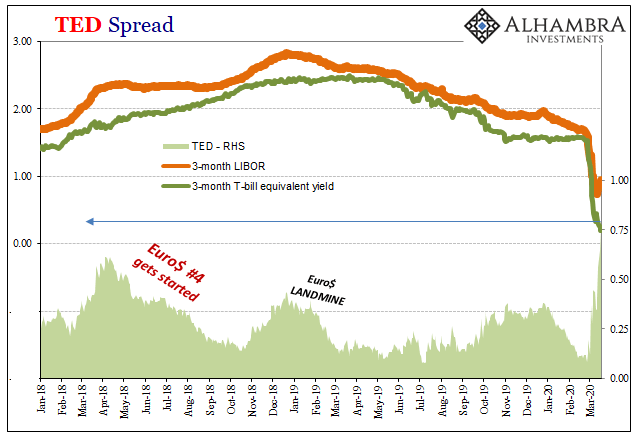

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, depression, economy, Euro$ #3, Euro$ #4, exports, Featured, Federal Reserve/Monetary Policy, GFC1, GFC2, global trade, Markets, Milton Friedman, newsletter, plucking model, potential, Recession, v-shape, worst case, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?

For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work. And if Ben Bernanke grew so concerned he felt a second dose was required…

Put another way, if a central bank keeps doing “bigger” things, that isn’t a basis for optimism because it calls for a starkly sobering re-assessment of a situation that just so happens to be causing central bankers to panic.

|

Monetary policies since August 2007 aren’t a fix, but a warning. The more they have to do, the worse it is likely going to be. Today, obviously, isn’t the day for many markets to be thinking this way. That day will come, however. One big reason why is the shape of tomorrow. Right now, as disease modeling proves to be as ridiculously inaccurate as econometric modeling, it’s really good news. The pandemic is nowhere near, not even in the same zip code, as it was once thought – even two weeks ago. Cause for euphoria, right? On the one hand, absolutely; a miniscule death toll relative to early projections in the millions (including those that had incorporated mitigation efforts within their “math”) is a rightful reason for celebration once it gets confirmed. On the other hand, the unbelievable devastation wrought across the global economy. |

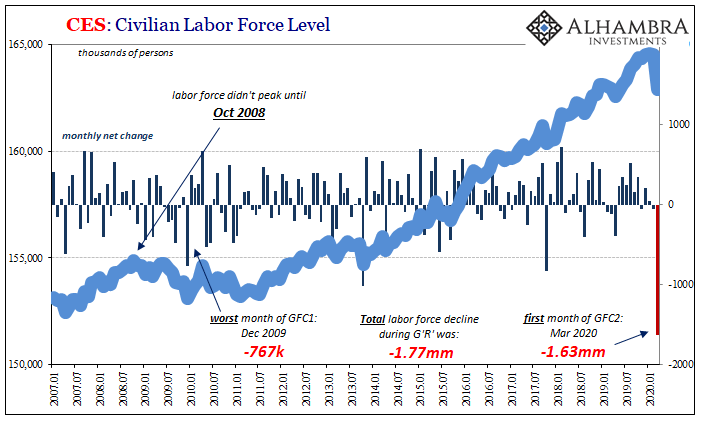

CES: Civilian Labor Force Level, 2007-2020 |

| What some markets are pricing is that as the disease conforms to the best-case scenario the economic recovery will, too. The shorter the shutdown, the thinking goes, the greater the intensity of the “V” in the coming recovery.

I wish it was that simple. In fact, Jay Powell in his unending crusade to not become Ben Bernanke (by being Ben Bernanke; the central banker’s paradox?) demonstrates the dangers in this thinking. The virus’ effects may not be anywhere near as bad, but the economic effects are already. Another 6 million Americans have filed for jobless claims, bringing the 3-week total to 16 million. One in ten workers is no longer employed. According to the BLS Current Employment Situation report for March, 1.6 million of them had already left the labor force. But that’s not really the issue. The ultimate level of unemployment induced by the current global situation will matter, of course, what matters far more is when, or if, all those workers get to go back. The huge number who exited the US labor force last month is a strong negative indication along those lines. What’s shaping up in markets is an almost binary set of outcomes to bet on – either right back to normal, or to begin yet another new normal. How do we tell which one is more likely? Recent history is a very good place to start. As is global trade. The WTO announced today its projections for the unfolding economic contraction. |

Wold Merchandise Trade Volume, 2000-2022 |

| Total merchandise trade is now expected to plummet anywhere between 13% and 32% for 2020. The possible good news and the focus of much attention is 2021; trade growth into perhaps the +20%s for that V-shape back to normal.

There are caveats, though, and, really, it’s the big one:

The WTO has even produced a handy chart which perfectly illustrates the gravity of the situation and just how much the bolded part above might make all the difference. If all goes right, worldwide policy response perfect, global trade ends up just slightly behind its prior 2011-18 baseline. Should policy interventions (including fiscal) perform flawlessly. Yeah, OH SH%$ is right. Why such pessimism? It’s already right there on the same chart. Notice what happened the last time this happened, when the world absolutely needed global policy responses to be enormously effective…in 2008. The result instead was how GFC1 changed the whole global economic baseline because the response to it was botched so badly. The trajectory for global trade in and after 2008 turned out to be way too much like the red line scenario for 2020-21. Not the green line. It’s not as if there is a new way of thinking, either. Officials didn’t learn anything from GFC1, so why on Earth would anyone expect GFC2’s aftermath to work out so much better? |

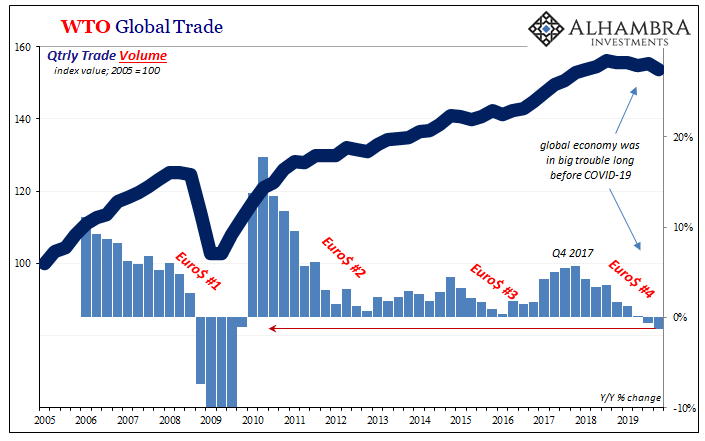

WTO Global Trade, 2005-2019 |

| There’s the non-trivial matter of 2019 to consider, too. Because nothing substantial changed following 2008 these same officials right now crafting these necessarily perfect policy responses got last year all wrong.

Thinking that they had done a good job before, that globally synchronized growth was a real trend and not some made-up bumper sticker slogan, they were caught completely by surprise as the global economy entered a serious and sustained downturn they downplayed and ignored even though (or because) it was right when they thought the economy would’ve been accelerating. This is exactly the scenario I had feared. In 2016, thinking about what Reflation #3 might really mean, it was the worst of all worst cases; no longer any recovery potential, Euro$ #3 had confirmed only new normals one after another.

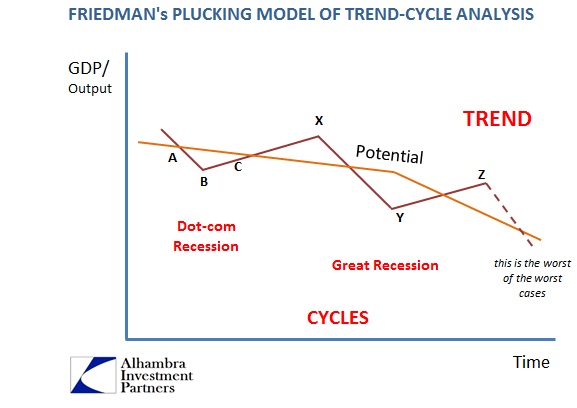

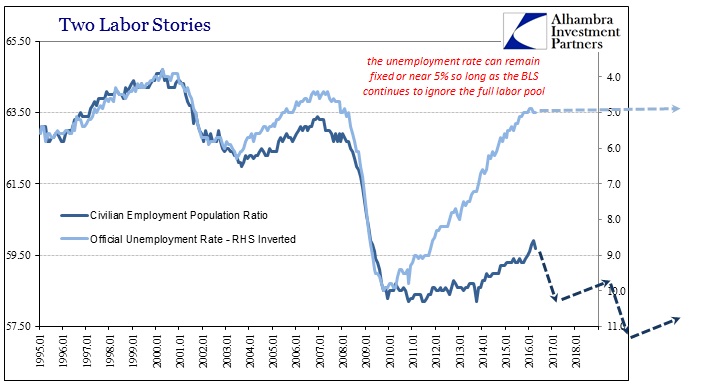

My 2016 illustration, using Milton Friedman’s intuitive “plucking model”, is horrifyingly similar to the WTO’s today. The current issue before us is not coronavirus; that’s just the latest shock.The real problem is GFCs, plural. I had even sketched it out in terms of the US labor market: |

Wold Merchandise Trade Volume, 2000-2022 |

| Using my 2016 prediction, millions of American workers get thrown out of work (for some unknown shock) but not all, not anywhere close to enough of them get to come back. Exactly what’s playing out right now in front of us.

Maybe the WTO’s optimistic scenario does pan out; anything is possible, even the chance Jay Powell wakes up tomorrow in a cold sweat experiencing a total breakdown, a crisis of confidence which forces him to face up to this last dozen years of surreal reality in an honest way. Yeah, no. I figured I might as well include a bad joke in this dose of hard reality. Far, far more likely, though, is that he and the other central bankers keep throwing together alphabetic combinations in the vain hope something just works. As I wrote in 2010, fingers crossed is not a strategy. That’s why the aftermath of GFC1 turned out the way it did. And now GFC2? Even the WTO knows which one is more probable. The pessimistic red line isn’t way down near the bottom by accident, a half recovery even its Economists can see is not just idle artwork. |

Friedman's Plucking Model of Trend-Cycle Analysis |

| Using my 2016 prediction, millions of American workers get thrown out of work (for some unknown shock) but not all, not anywhere close to enough of them get to come back. Exactly what’s playing out right now in front of us.

Maybe the WTO’s optimistic scenario does pan out; anything is possible, even the chance Jay Powell wakes up tomorrow in a cold sweat experiencing a total breakdown, a crisis of confidence which forces him to face up to this last dozen years of surreal reality in an honest way. Yeah, no. I figured I might as well include a bad joke in this dose of hard reality. Far, far more likely, though, is that he and the other central bankers keep throwing together alphabetic combinations in the vain hope something just works. As I wrote in 2010, fingers crossed is not a strategy. That’s why the aftermath of GFC1 turned out the way it did. And now GFC2? Even the WTO knows which one is more probable. The pessimistic red line isn’t way down near the bottom by accident, a half recovery even its Economists can see is not just idle artwork. |

Two Labor Stories, 1995-2018 |

Tags: currencies,depression,economy,Euro$ #3,Euro$ #4,exports,Featured,Federal Reserve/Monetary Policy,GFC1,GFC2,global trade,Markets,Milton Friedman,newsletter,plucking model,potential,recession,v-shape,worst case,WTO