Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign. Summer slowdown extends in Industrial Production. According to the Federal Reserve, the outfit which has kept tabs on this economic sector for more than a century, the...

Read More »The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter? For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work. And if Ben Bernanke grew so concerned he felt a second dose was required… Put another way, if a central bank keeps doing “bigger” things,...

Read More »Stagnation Never Looked So Good: A Peak Ahead

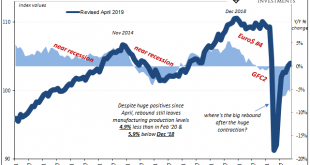

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry. The latest sentiment figures from ZEW as well as IFO are sobering. Taking the former first, it had been quite buoyant last year on the false...

Read More »Is GFC2 Over?

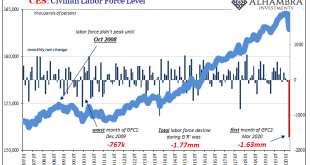

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either. Stocks rebounded because of “major helicopter stimulus” or because that’s just what stocks do during times like these. Some of the biggest up days have followed, and are often found in between, the greatest...

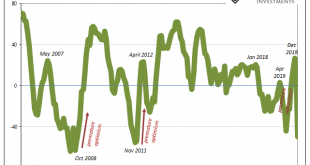

Read More »Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

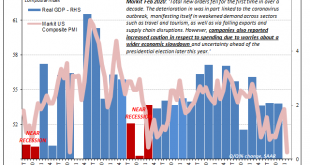

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January. Today’s update to that flash estimate with more survey responses in hand validated the 49.6....

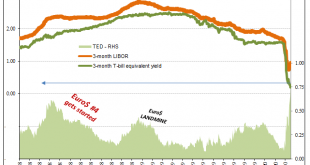

Read More »Schaetze To That

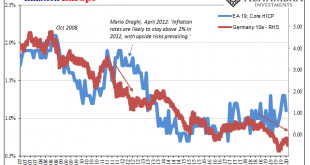

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil. The non-standard “flood of liquidity” was an about-face from his predecessor (who had been raising rates in 2011 before the wheels...

Read More »Was It A Midpoint And Did We Already Pass Through It?

We certainly don’t have a crystal ball at the ready, and we can’t predict the future. The best we might hope is to entertain reasonable probabilities for it oftentimes derived from how we see the past. Which is just what statistics and econometrics attempt. Except, wherein they go wrong we don’t have to make their mistakes. For example, in the Fed’s main model ferbus there’s no way to input a global dollar shortage. Even if there was, to this statistical...

Read More »European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way. We’ve seen all this before, repeatedly. Part of the...

Read More »COT Black: German Factories, Oklahoma Tank Farms, And FRBNY

I wrote a few months ago that Germany’s factories have been the perfect example of the eurodollar squeeze. The disinflationary tendency that even central bankers can’t ignore once it shows up in the global economy as obvious headwinds. What made and still makes German industry noteworthy is the way it has unfolded and continues to unfold. The downtrend just won’t stop. According to Germany’s deStatis, factory orders in December 2019 were down sharply yet again....

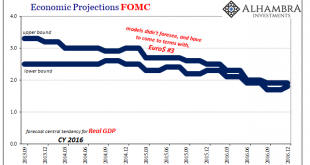

Read More »The FOMC Channels China’s Xi As To Japan Going Global

The massive dollar eruption in the middle of 2014 altered everything. We’ve talked quite a lot about what Euro$ #3 did to China; it sent that economy into a dive from which it wouldn’t escape. And in doing so convinced the Chinese leadership to give growth one more try before changing the game entirely once stimulus inevitably failed. In many other places around the world it has been the same. Not just developing economies, either. You wouldn’t have known from how...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org