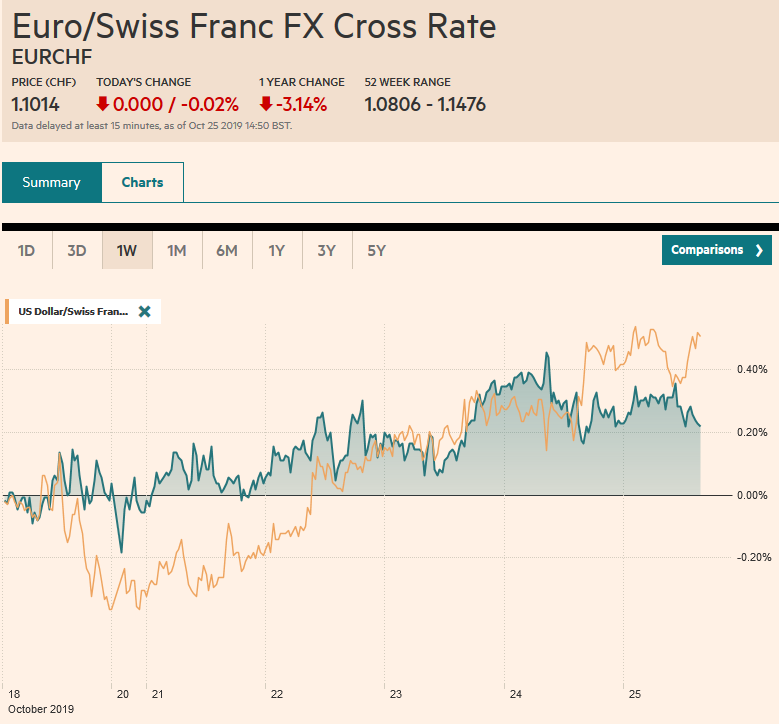

Swiss Franc The Euro has fallen by 0.02% to 1.1014 EUR/CHF and USD/CHF, October 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe’s Dow Jones Stoxx 600 is little changed, and it too is closing in on its third weekly advance. US shares are little changed, and the S&P 500 is up about 0.8% this week, coming into today’s session. It has finished a week above 3000 only once since the end of July and closed at 3010 yesterday. Except for Australia and New Zealand, major

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, Featured, newsletter, Singapore, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.02% to 1.1014 |

EUR/CHF and USD/CHF, October 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

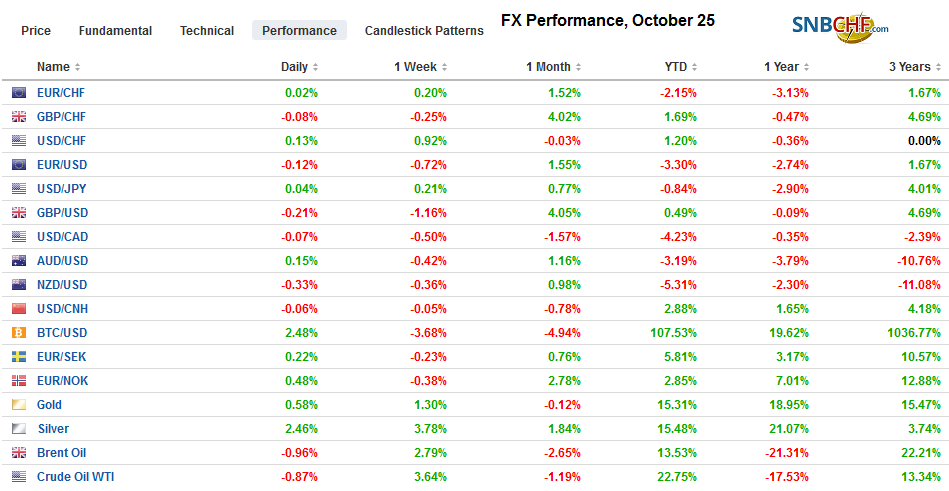

FX RatesOverview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe’s Dow Jones Stoxx 600 is little changed, and it too is closing in on its third weekly advance. US shares are little changed, and the S&P 500 is up about 0.8% this week, coming into today’s session. It has finished a week above 3000 only once since the end of July and closed at 3010 yesterday. Except for Australia and New Zealand, major 10-year benchmark yields are higher today to pare this week’s decline. China’s 10-year bond is an exception. Its 10-year yield rose a few basis points on the week and just below 3.25%, it is at four-month highs. The dollar trading decidedly mixed today. Against the majors, the New Zealand dollar’s 0.25% decline is the most, but the Scandis are trading slightly heavier as well. Sterling and the yen straddling unchanged levels, while the Australian dollar, euro and Canadian dollar are a little firmer. December WTI is paring this week’s nearly 4% gain. Gold is edging higher to extend its streak to a fourth session. Its roughly 1% weekly gain has lifted it through the $1500-mark. |

FX Performance, October 25 Source: investing.com - Click to enlarge |

Asia Pacific

China appeared to offer a new twist to the trade negotiations with the US. It offered to return its buying of US agriculture products back to 2017 levels of about $20 bln a year if the US returned its tariffs to 2017 levels.The “art of the deal” seems to be an expensive way to return to the status quo ante. It suggests that phase one of the trade deal, which the Trump Administration initially proclaimed was mission accomplished, may still prove elusive. China’s waivers on tariffs on US soy shows that a new agreement is not completely necessary even if desirable. US Vice President Pence’s speech claimed the US does not seek disengagement but aimed his most acerbic criticism was of Nike and the National Basketball Association for cooperating with China. Previously, Trump seemed to order US companies to leave China. The US Vice President also seemed to give credit to the US for China’s success: “We rebuilt China over the past 25 years, but those days are over.” Pence was critical of Chinese action in Hong Kong, but it is not clear what he thinks the Chinese are doing, and given what is happened recently in Chile, Ecuador, Spain, Lebanon, Hong Kong’s response does not stand out.

The decline of China’s import of US (and Canadian pork) may be more complicated than the conventional narrative. There is a drug that boosts the weight of pigs (ractopamine). The US approved the drug in 1999, and China banned it in 2002. Some US farms have eliminated the drug. One study estimated that if all US pork farmers stopped using the drug, it would reduce US production by 110 mln pounds a year.

Japan’s trade minister unexpectedly resigned after six weeks on the job. It offers a stark contrast with other countries. Sugawara’s secretary reportedly offered JPY20k (~$185) to a braved family of a supporter in his district. Japanese law bans politicians makes donations to voters in their district.

Two other regional developments are notable. First, South Korea has abandoned its “developing country” status at the World Trade Organization. Developing countries are given special trade privileges. That said, South Korea announced that it will continue to protect its agriculture sector. Second, Singapore’s September industrial output figures blew away market expectations anticipating almost a 1% decline. Instead, it jumped 3.7%, and the August decline was shaved to show a 7.3% drop rather than a 7.5% fall. That was sufficient to turn the year-over-year rate positive (0.1%) after August’s contraction was revised to -6.4% instead of -8.0%. As an entrepot, Singapore often is seen reflecting regional trends.

The dollar is confined to less than a 15 tick range below JPY108.70 so far today. It finished last week near JPY108.45.The repeated tests of JPY109, the upper end of the recent range that is also marked by the 200-day moving average, have thus far been in vain. The technical indicator appears to be rolling over, but the sideways movement leaves participants will little near-term conviction. The Australian dollar fell to new lows for the week near $0.6810 but rebounded in late Asia/early Europe to around $0.6835. It needs to resurface above $0.6855, for which the intraday technical indicators warn is unlikely, in order to extend its three-week rally. The greenback edged a little higher against the Chinese yuan today, but on the week, it eased slightly for the third consecutive weekly loss. The downdraft has been minor, but it is the longest since the start of the year.

Europe

UK Prime Minister Johnson’s hubris is his main nemesis. His sense of superiority leads him to consistently expect his inferior adversaries to capitulate, and they do not. In some ways, it is was he did not replace Cameron as Prime Minister. He expected the EC to compromise, but instead, his withdrawal plan was jettisoning of red lines his predecessor drew. He expected the Democrat Union Party to roll-over and accept being the sacrificial lamb, but they did not. He expects Labour to accept his push for an election, and they are balking. Corbyn insists that until a no-deal is ruled out, Labour will not support a snap election. The Chancellor of the Exchequer Javid said that the government cannot rule that out. The default setting, if you will, is for the UK to crash out of the EU on October 31 unless a delay is granted, and an EU decision might not materialize until early next week (though it could come today). Labour may seek a new law to prevent a no-deal exit.

In addition to the poorly thought out referendum, former Prime Minister Cameron also bequeathed the Fixed Term Parliament Act that requires a 2/3 majority of the House of Commons to support an election before the end of the legislative session. When May insisted on the last election, the Tories had a parliamentary majority and were running 25 percentage points over Labour. The Tories lost their majority. For the third time in his brief tenure, Johnson reportedly will push for an election at the start of the new week. Press reports suggest Labour is split, and it is not clear if it will provide the support needed to give Johnson his election on December 12. A ComRes poll asked in the middle of the month, voters’ intentions if the UK did not leave by the end of October and Labour and the Tories were in a practical dead heat with each drawing a little more than a third of the vote. Farage’s Brexit Party polled about a fifth of the vote, and the Liberal Democrats trailed them by a couple percentage points. The Greens polled a little less than 5%. If his election bid is blocked, Johnson has threatened to essentially hold up the government activity until a general election is approved. The budget that was due in early November has been canceled.

Germany’s October IFO survey provides a sliver of hope that the world’s fourth-largest economy may be bottoming. The current assessment fell back to 97.8 after firming to 98.6 in September. The cyclical low was in August at 97.4. The expectations component rose for the first time since March to stand at 91.5 (vs. 90.9 in September). The overall assessment of the business climate was unchanged at 94.6.

The euro dipped below $1.11 yesterday for the first time this week as it recorded an outside down day (traded on both sides of Wednesday’s range and closed below its low). However, there has been no follow-through selling, and the single currency is in about a quarter-cent range above $1.1100. About 1.2 bln euro in options are struck between $1.1090 and $1.1100 that will expire today. There is another option for 880 mln euros at $1.1150 that will also be cut. We suspect that area cap the upside in ahead of the weekend. After probing $1.30 at the start of the week, sterling is consolidating today in a roughly $1.2825-$1.2865 range. There are expiring options at $1.28 and $1.29 (~GBP680 mln and ~GBP875 mln, respectively).

America

The economic calendar is light for North America today. Two reports are featured. In the US, the University of Michigan’s final consumer confidence survey for October will be released. Sentiment rose in the preliminary report to 96.0 from 93.2. However, the drop in long-term (5-10 year) inflation expectations fell to a new low of 2.2%. Many Fed officials seem to track inflation expectations as an important metric to inflation itself. The second data point today is Mexico’s August retail sales. The median forecast in the Bloomberg survey is for a 0.1% decline. Mexico’s monthly retail sales have not risen since May. Note that the economic diary picks up next week with the FOMC and Bank of Canada meetings, as well as US jobs data and auto sales figures.

The January 2020 fed funds futures contract implies a yield of 1.505%. The effective average rate, which is what the futures contract settles at (not the midpoint of the target range), is 1.85%. That means that 34.5 bp in cuts is expected before the end of the year. Next week’s rate cut, which seems to be nearly fully discounted, suggests the market is split about the possibility of another cut at the December FOMC meeting.

The US dollar has not risen above the previous day’s high against the Canadian dollar since mid-October. It has fallen below the previous session’s low for the past seven sessions coming into today. Yesterday’s low was a little above CAD1.3050. Today’s low through the European morning is about CAD1.3060. There are about $1.7 bln in options that expire today between CAD1.3000 and CAD1.3020. The proximity of important support near CAD1.30 and the stretched technical indicators would seem to discourage new US dollar sales now. Consider monitoring the five-day moving average (~CAD1.3080), which the greenback has not closed above since October 9. Similarly, the dollar has approached the MXN19.00 level. It has dipped below MXN19.10 on an interday basis but has not closed below it this week. Here too, the risk-reward does not seem to favor new dollar shorts here. The Dollar Index is up about 0.3% for the week, and if these upticks are sustained, a three-week decline would be snapped. A close above 97.70 would help lift the tone, but a move above the 98.10 area is needed to give hope that a near-term low is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,Featured,newsletter,Singapore,South Korea