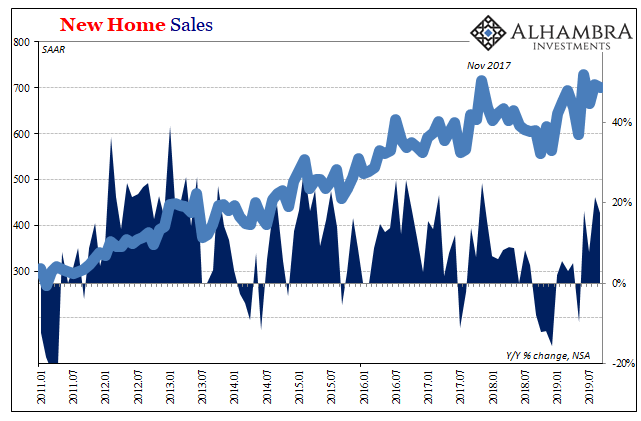

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that way. From yesterday: More than interest rates, perhaps the biggest factor has been prices – especially the price at which developers are able to sell off their inventory. New Home Sales, 2011-2019 - Click to enlarge Like any other kind of business, home builders have to manager theirs, too, and only have a few tools at

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, currencies, Deflation, economy, Featured, Federal Reserve/Monetary Policy, housing, Markets, median new home price, New Home Sales, newsletter, Real estate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that way.

|

New Home Sales, 2011-2019 |

| Like any other kind of business, home builders have to manager theirs, too, and only have a few tools at their disposal in which to do it.

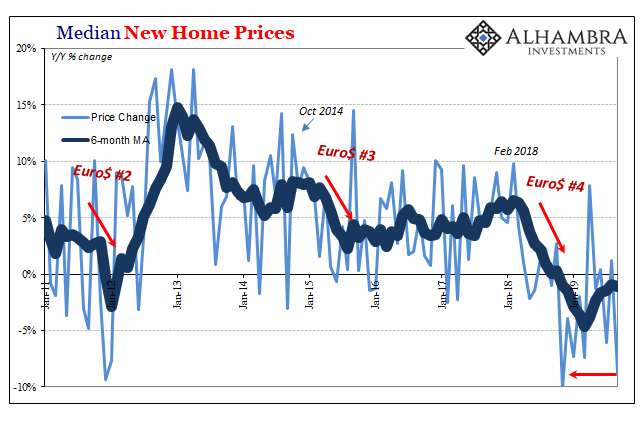

In a pinch, if demand tails off, you slow down your production so as to avoid too much unsold product (new homes) piling up and then as a last resort you start discounting the price to move what’s already on hand. There’s an added pressure in housing due to financing and liquidity constraints – you can’t hold on to unwanted completions forever. The latest update for September in terms of the median price of new homes sold pretty much confirms (for another month, anyway) the view. The Census Bureau believes that that particular price point declined by almost 9% year-over-year, the largest drop since last November’s landmine reaction. |

Median New Home Prices, 2011-2019 |

| As it stands right now before revisions, this is the third biggest year-over-year decline since the housing bust. That doesn’t suggest organic rebound due to increasingly good economic conditions thanks to Jay Powell’s timely mid-cycle adjustment(s). Quite the opposite, actually.

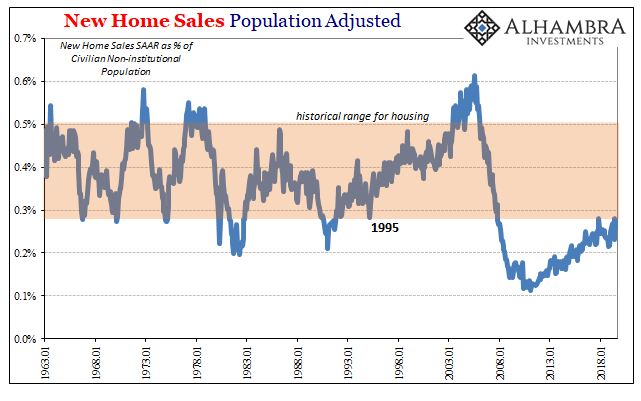

If it takes that much of a sustained, serious rate of discounting in order to attract a minimal level of buyers that’s a warning sign. After all, we need to keep in mind the context – it’s not as if the housing market has ever recovered from that last big bust. It hasn’t come anywhere close. |

New Home Sales Population Adjusted, 1963-2019 |

| Adjusting for population growth, the level of new homes being built and sold remains below the historical minimums – and only in 2019 because builders are cutting their prices so significantly.

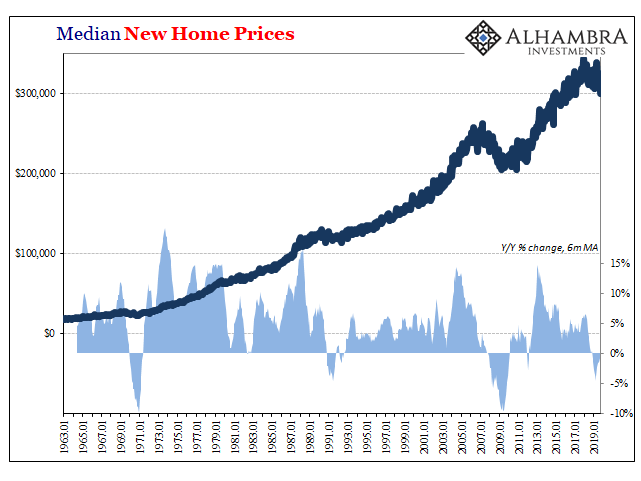

Just how unusual are these price sorts of reductions? Extremely rare. You just don’t see them outside of recessions. The indicated average decline in the median price during 2019 has been about the same as it was during the 1990-91 recession when the S&L crisis had choked off mortgage credit across the whole economy. |

Median New Home Prices, 1963-2019 |

This doesn’t mean the current economy is necessarily operating under the same level of recession as 1990-91, or any level of recession. But at the same time, this is far from a good look, hardly the kind of conditions that would suggest and promote the positive forces among consumers, no less, the FOMC believes is underlying their view of a “strong” economy now and moving forward.

Like PMI’s and even sideways durable goods, more toward serious downturn.

Tags: currencies,Deflation,economy,Featured,Federal Reserve/Monetary Policy,Housing,Markets,median new home price,New Home Sales,newsletter,Real Estate