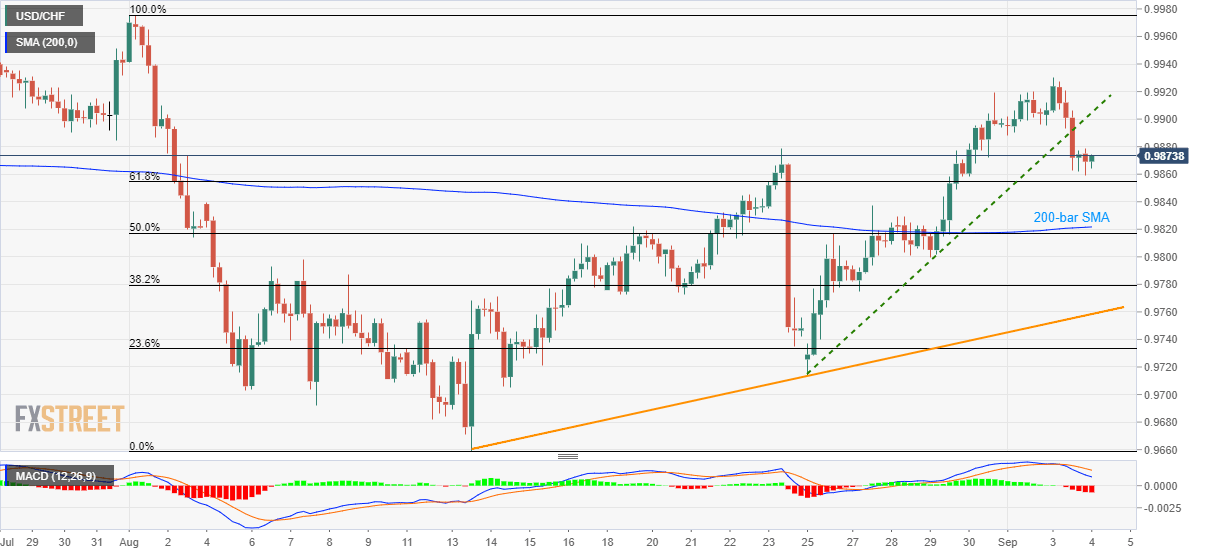

USD/CHF extends declines on the break of one-week-old support-line (now resistance). Sellers look for key technical levels amid bearish signals from MACD. Following its break of immediate support-line, the USD/CHF pair remains on the back foot while taking rounds to 0.9870 amid Wednesday’s Asian session. Sellers now aim for 61.8% Fibonacci retracement level of August month downpour, at 0.9854, as immediate support ahead of targeting 0.9822/17 confluence including 200-bar simple moving average (SMA) and 50% Fibonacci retracement level. In a case prices slip beneath 0.9817, 38.2% Fibonacci retracement of 0.9780 may offer an intermediate halt to the south-run towards three-week-long rising trend-line close to 0.9760. Adding to the sellers’ favor is a bearish signal

Topics:

Anil Panchal considers the following as important: 4) FX Trends, 4.) FXStreet, Featured, newsletter, USD/CHF

This could be interesting, too:

Alex J. Pollock writes How Does the Federal Reserve Fit into Our Constitutional Order?

Adnan Al-Abbar writes What Can Carl Menger Teach Us about Falafel Sandwiches?

James Bovard writes Biden Perpetuates Washington’s Idiotic Steel Trade Policies

Alex J. Pollock writes The Federal Reserve’s Capital Has Now Plummeted to Negative 1 Billion

Following its break of immediate support-line, the USD/CHF pair remains on the back foot while taking rounds to 0.9870 amid Wednesday’s Asian session. Sellers now aim for 61.8% Fibonacci retracement level of August month downpour, at 0.9854, as immediate support ahead of targeting 0.9822/17 confluence including 200-bar simple moving average (SMA) and 50% Fibonacci retracement level. In a case prices slip beneath 0.9817, 38.2% Fibonacci retracement of 0.9780 may offer an intermediate halt to the south-run towards three-week-long rising trend-line close to 0.9760. Adding to the sellers’ favor is a bearish signal from the 12-bar moving average convergence and divergence (MACD) indicator. Alternatively, Monday’s low near 0.9890 and Tuesday’s top surrounding 0.9930 can offer immediate resistance to the pair, a break of which can escalate the run-up towards August month high surrounding 0.9980. |

USD/CHF 4-hour Chart(see more posts on USD/CHF, ) |

Trend: pullback expected

Tags: Featured,newsletter,USD/CHF