USD/CHF extends Thursday’s downpour, nears short-term key supports. An upside break of 0.9985 could recall June month highs. Given the failure to rise past-0.9980/85 area, USD/CHF carries the previous day’s declines while trading around 0.9913 ahead of the Europe markets open on Friday. The bearish signal from 12-bar moving average convergence and divergence (MACD) indicates brighter chances of pair’s further declines to 100-bar moving average on the four-hour chart,...

Read More »USD/CHF technical analysis: 0.9950 to question buyers inside a rising wedge

USD/CHF takes the bids inside a six-week-old rising wedge bearish formation. 200-DMA, 50% Fibonacci retracement could restrict immediate upside. 0.9880 becomes the key support. Despite the recent rise, USD/CHF trades below the confluence of 200-day simple moving average (DMA) and 50% Fibonacci retracement of April-August declines, close to 0.9940, while heading into the European session on Wednesday. Even if the pair manages to overcome 0.9950 immediate resistance...

Read More »CHF/JPY: Eyes on central banks and geopolitics

This week the BoJ will hold its regular policy meeting. Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen. CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend. Both the CHF and Yen picked up a bid as...

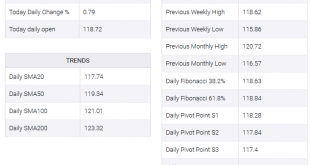

Read More »EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today. EUR/JPY is currently trading at...

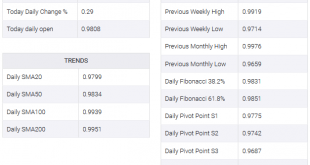

Read More »USD/CHF technical analysis: 0.9890 is the level to beat for sellers

USD/CHF fails to sustain the bounce off key support-confluence including 200-HMA and 38.2% Fibonacci retracement. A downside break highlights the 61.8% Fibonacci retracement level while 200-DMA caps the upside. Failures to sustain the bounce off 200-hour moving average (HMA) and 38.2% Fibonacci retracement of latest run-up drag the USD/CHF back to the key support-confluence while taking rounds to 0.9900 ahead of Friday’s European open. Should prices slip below 0.9890...

Read More »EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank – a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed. Nevertheless, the price action is all the counts from a technical analysis perspective. EUR/CHF has...

Read More »USD/CHF technical analysis: Remains inside 4-day old triangle after Swiss unemployment rate

USD/CHF clings to 0.9890 after unemployment data. A four-day-old symmetrical triangle limits the pair’s near-term moves. 200-HMA adds to the support while 0.9920 limits the upside. USD/CHF remains largely unchanged after the headline job data as it trades near 0.9890 ahead of Monday’s European session open. August month seasonally adjusted Unemployment Rate for Switzerland matches 2.3% forecast and prior. Hence, the pair is more likely to continue within immediate...

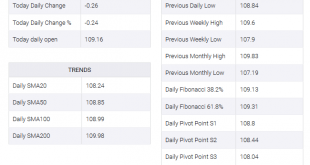

Read More »USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the...

Read More »USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

Extends overnight retracement slide from an ascending trend-channel resistance. A follow-through selling has the potential to drag the pair towards channel support. The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session. The pair on Tuesday started retreating from a resistance marked by the top end of a short-term ascending trend-channel,...

Read More »USD/CHF Technical Analysis: 61.8% Fibo, 0.9822/17 Confluence on Sellers’ Radar

USD/CHF extends declines on the break of one-week-old support-line (now resistance). Sellers look for key technical levels amid bearish signals from MACD. Following its break of immediate support-line, the USD/CHF pair remains on the back foot while taking rounds to 0.9870 amid Wednesday’s Asian session. Sellers now aim for 61.8% Fibonacci retracement level of August month downpour, at 0.9854, as immediate support ahead of targeting 0.9822/17 confluence including...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637031895419073883-310x165.png)