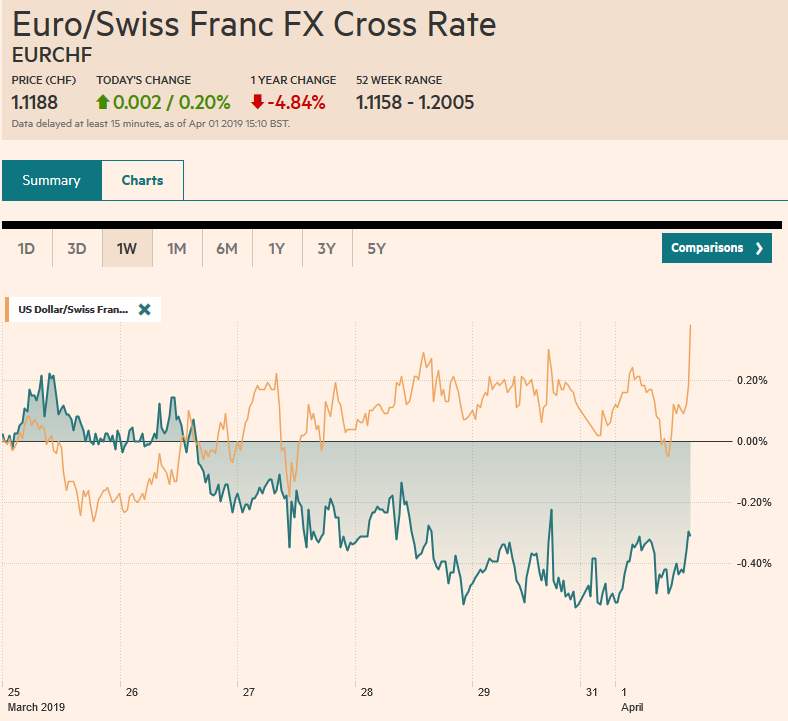

Swiss Franc The Euro has risen by 0.20% at 1.1188 EUR/CHF and USD/CHF, April 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China’s official PMI and Caixin’s manufacturing reading. However, the spillover from China was limited in Asia. Japan’s Tankan survey and outlook disappointed and South Korea’s exports and imports were weaker than expected. Most manufacturing PMI in the region improved, but many, including Japan, Korea, Taiwan, Thailand, and Malaysia remain below the 50 boom/bust level. Europe’s PMI mostly disappointed, but risk

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, EMU, Featured, newsletter, Turkey, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss FrancThe Euro has risen by 0.20% at 1.1188 |

EUR/CHF and USD/CHF, April 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

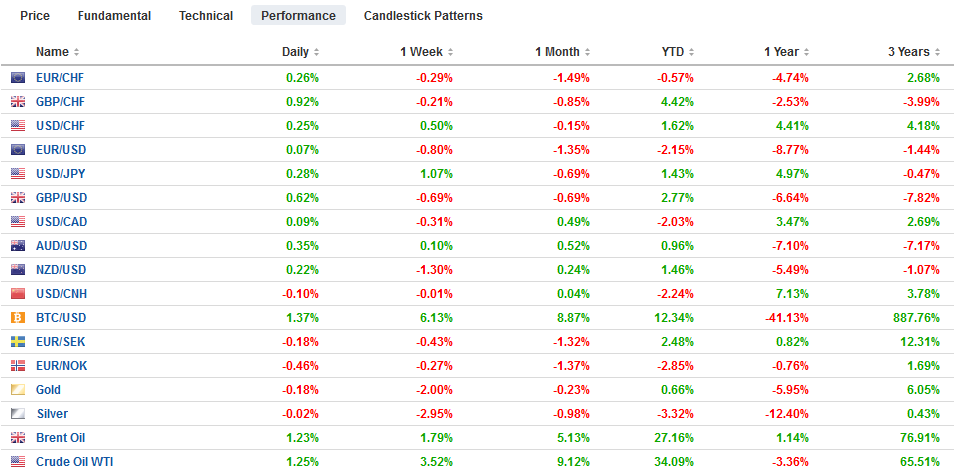

FX RatesOverview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China’s official PMI and Caixin’s manufacturing reading. However, the spillover from China was limited in Asia. Japan’s Tankan survey and outlook disappointed and South Korea’s exports and imports were weaker than expected. Most manufacturing PMI in the region improved, but many, including Japan, Korea, Taiwan, Thailand, and Malaysia remain below the 50 boom/bust level. Europe’s PMI mostly disappointed, but risk appetites were fanned. Many Asian equity markets gapped higher and closed firmly, with China leading the way. The Dow Jones Stoxx 600 rose nearly 1.0% in the European morning, with materials and consumer discretionary pointing the way. US shares are trading firmer, and the S&P 500 is also poised to gap higher. Benchmark bond yields are firmer, and the US 10-year is back above bill rates. Most benchmark yields are two-three basis points higher. The dollar is trading heavier against most of the major currencies. The yen is the main exception. The soft data, risk-on sentiment, and the beginning of the new fiscal year were the drags. Waning support for Erdogan weighed on the Turkish lira, which is trading near the pre-weekend lows (~TRY5.66). Separately, oil prices are extending last week’s rally with May WTI approaching $61 a barrel and Brent nearly $69. Our technical call is for WTI to reach $67. |

FX Performance, April 01 |

Asia Pacific

China’s official March PMI showed signs that the economy may have begun finding traction as the tax cuts and other measures go into effect this month. The manufacturing PMI rose to 50.5 from 49.2. It was the biggest gain in several years. New orders and export orders improved, but remain soft. The non-service PMI rose to 54.8 from 54.3. This lifted the composite to 54.0 from 52.4, a six-month high. The Caixin manufacturing PMI rose to 50.8 from 49.9. The median forecast (Bloomberg survey) was for 50. Separately, note that US-China trade talks continue this week, with Vice Premier Liu He visiting Washington. He has been proceeded with additional gestures from China, extending the suspension of retaliatory tariff on autos and recognizing fentanyl as a controlled substance.

The BOJ’s Tankan survey was expected to show some deterioration since the December report. The results were generally worse than expected, and the outlook suggested the situation has not reached a turning point. Sentiment among the large producers weakened, but the capex plans were a little better than forecast. Among large manufacturers, the diffusion index has not risen since 2017. The market barely responded to the data, knowing that there were no policy implications and not changing the general view that the ended Q1 with little momentum. The large manufacturers expect the dollar to average a little less than JPY109 this fiscal year. It averaged a little less than JPY111 in the fiscal year that just ended. The manufacturing PMI edged higher to 49.2 from 48.9. Pressure may build on Prime Minister Abe to postpone (again) the sales tax increase for October 1, but because the government has enacted other incentives to offset the tax increase, the bar to increase it is high.

The larger than expected decline in South Korea’s exports, the fourth consecutive decline, will likely be seen as a bellwether for the region. Exports were off 8.2%, year-over-year. It was worse than the 7% decline expected but better than the 11.4% slump in February (originally -11.1%). Imports fell 6.7% year-over-year. Economists hoped they would fall only 5.3% after a 12.6% decline in February. South Korea’s manufacturing PMI rose to 48.8 from 47.2

The Australian dollar gapped higher, spurred by China’s PMI surprise. It filled the gap by late-morning and extended its gains to $0.7130 in early Europe. The momentum stalled in front of last week’s highs just shy of $0.7150. The dollar rose above JPY111.00 for the first time in nearly two weeks. It ran into offers near JPY111.20, where a downtrend line since mid-March intersects today. With JPY111.00 now serving as support, the greenback can extend its gains. JPY111.60-JPY111.70 is the next target.

Europe

The euro and European asset markets have taken the disappointing manufacturing PMI in stride. The aggregate reading slipped to 47.5 from 47.6 of the flash estimate. It is down from 49.3 in February and 51.4 at the end of 2018. German and French dismal flash reports were revised lower to 44.1 and 49.7 (from 44.7 and 49.8 respectively). Italy’s manufacturing PMI slipped to 47.4. from 47.7. Spain, which goes to the polls late this month, bucked the trend. It rose to 50.9 from 49.9.

On top of the economic weakness, price softened. The preliminary March CPI slipped to 1.4% from 1.5%, while the core rate eased to 0.8% from 1.0%. The core rate is the lowest since last April, while the headline returns to January levels, which were also the lowest since last April. The ECB’s statement and commitment to a new targeted loan facility last month seemed to anticipate the disappointing reports. The euro seemed unfazed by the data. While there may be some distortions due to the coming Easter holiday, and if tortured sufficiently and stripped to its “super core” the data may not be as poor as the optics suggest.

The UK reported an upside surprise. The manufacturing PMI jumped to 55.1 from 52.1 and economists had warned of weakness. It is the strongest showing since February 2018. It appears to have been flattered by inventory stocking, ostensibly related to Brexit preparations. If Brexit faces a long delay, which seems reasonable, de-stocks could weigh on current output. New orders and production increased. The PMI showed the first increase in employment in three months.

The focus remains on Brexit. The House of Commons will debate and vote on alternatives to the Withdrawal Bill in hopes of finding a majority. The UK Sun reports that 170 of the 314 Tory MPs including 11 cabinet officials have sent a letter to Prime Minister May demanding Brexit within a few months with or without a deal. Many observers see an election, which would be the third in four years, as the only way to break the impasse. The latest polls show a virtual dead heat with Labour.

The euro firmed to $1.1250 from a low near $1.1215 in Asia. The intra-day technical indicators warn that the session high may be in place. There is a 708 mln euro option at $1.12 that expire today. For the third session, the single currency has found support near $1.1210-$1.1215. Sterling is trading within last Friday’s range (~$1.2980-$1.3135). It has traded comfortably with a $1.30 handle.

America

The US reports February retail sales and construction spending and March PMI/ISM. Given the role of consumption in the US economy and the fact that the retail sales report covers a little more than 40% of US household consumption, it is the most important data point today. Autos and gas weighed on the headline report in January, and excluding them, retail sales rose 1.2%. Rather than retreat after such a heady gain, a modest 0.3% rise is expected. The same is generally true of the components used for GDP. After rising 1.1% in January, they are expected to have risen by 0.3% in February. On the other hand, construction spending, which jumped 1.3% in January may have slipped 0.2% in February. The PMI/ISM may offer a mixed review, but the takeaway is that after a poor start to Q1, with the government shut and cold weather, the economy appears to have found better traction. The Atlanta Fed’s GDP tracker has edged up from under 0.5% to 1.7% last week, which is just below the median Fed view of trend growth.

President Trump cut off aid to Central America’s Guatemala, Honduras, and El Salvador last week in a pique over the flood of immigrants headed through Mexico into the US. Now he is threatening to shut the entire border. At the same time, Trump is demanding that Russia stops aiding Venezuela’s Maduro government. It is likely to take more than demands. Consider that in the Cuban Missile Crisis, Russian ships did not simply turn back after approaching the US Navy, but the US quietly removed missiles from Turkey. Venezuela is not just about the people suffering there, it is also a chip on the great chessboard of geopolitics. Russia and China are not about to give up a potential stronghold so close to the US without getting a juicy plumb for it. Meanwhile, Turkey, a NATO-member, is still going forward with its purchase of Russia’ S-400 air defense hardware (July delivery). The US has threatened to not deliver 100 fighter jets Turkey has ordered.

The Canadian dollar is consolidating its pre-weekend gains scored on the back of the better than expected January GDP (0.3% vs. 0.1). The US dollar had been near CAD1.3450 the day before the GDP report and is now near CAD1.3350. Support for the greenback is seen in the CAD1.3320-CAD1.3340 area. It probably takes a move above CAD1.3380 to signal anything important. The risk-on mood has seen the Mexican peso shrug off the border tension with the US. The dollar has approached MXN19.50 before the weekend and is testing the pre-weekend low near MXN19.27. A move below MXN19.20 would suggest the week, and a half short-squeeze may be over. The Dollar Index is consolidating last week’s advance and is trading within the pre-weekend range. A break of 97.00 would likely spur a test on the 96.70-96.80 support to determine the near-term outlook.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,EMU,Featured,newsletter,Turkey