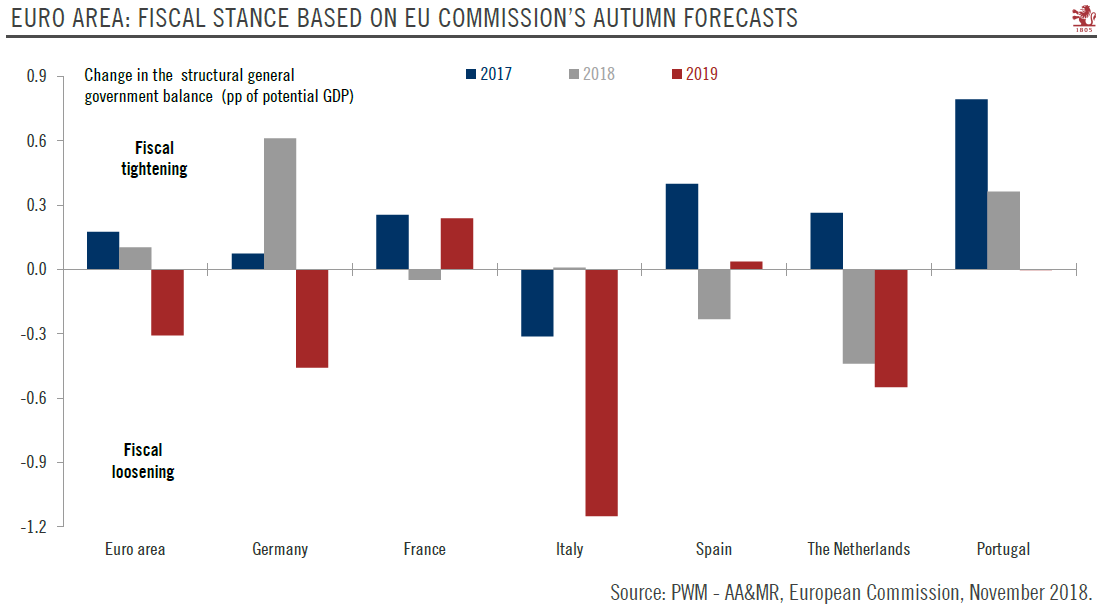

SUMMARY The Euro area’s fiscal stance will turn expansionary in 2019. Among the five biggest economies, this shift mainly reflects significant fiscal loosening in Germany, Italy and the Netherlands. France and Spain plan modest fiscal tightening, but less that what the European Commission (EC) demanded. In Italy, the government budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm wrestling between Rome and Brussels is still uncertain. Euro area fiscal easing may be coming at the right time, as external downside risks are mounting and GDP growth so far in H2 2018 has been weaker than expected. A heterogeneous fiscal stance Euro area member states have all submitted their 2019

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, euro area, Euro area GDP growth, Featured, Macroview, newsletter, Pictet Macro Analysis, Uncategorized

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

- The Euro area’s fiscal stance will turn expansionary in 2019. Among the five biggest economies, this shift mainly reflects significant fiscal loosening in Germany, Italy and the Netherlands. France and Spain plan modest fiscal tightening, but less that what the European Commission (EC) demanded.

- In Italy, the government budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm wrestling between Rome and Brussels is still uncertain.

- Euro area fiscal easing may be coming at the right time, as external downside risks are mounting and GDP growth so far in H2 2018 has been weaker than expected.

A heterogeneous fiscal stanceEuro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance 1 will turn supportive in 2019, although it varies significantly from one country to the next (see chart). Germany, Italy and the Netherlands are planning fiscal expansions, but Spain, France and Portugal have pledged to work towards further fiscal consolidation next year. Admittedly, there remain significant uncertainties as to whether these plans will be implemented and whether they will have the expected impact on growth. First, the fiscal loosening may turn out to be smaller than indicated in Germany’s DBP, as that country has had a tendency to under-deliver on fiscal easing pledges in recent years. In Italy, the budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm wrestling between Rome and Brussels is still uncertain. Beyond the confrontation between the EC and the Italian government, fiscal loosening may turn out to be self-defeating when it comes to growth, as it could well be more than counterbalanced by the increase in interest rates. The minority government in Spain may be unable to push its fiscal plans though parliament, so major changes to the composition of the budget and fiscal targets cannot be ruled out. On balance, however, 2019 has a good chance of being the year when euro area fiscal policy finally becomes a tailwind for growth, albeit a modest one. Small compared to the US, but a tailwind nonetheless Euro area stimulus still pales compared with that seen in the US. Nevertheless, coming at a time of weaker-than expected GDP growth so far in H2 2018, ebbing monetary support and mounting external downsides risks, fiscal easing may provide a (modest) boost to euro area growth in 2019. |

Euro Area: Fiscal Stance chart |

Tags: Euro area,Euro area GDP growth,Featured,Macroview,newsletter,Uncategorized