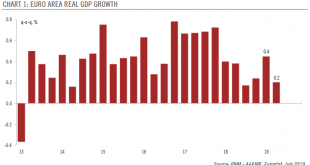

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year. The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1. While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy. Tentative signs of...

Read More »BREXIT UNCERTAINTY TO WEIGH ON YIELDS

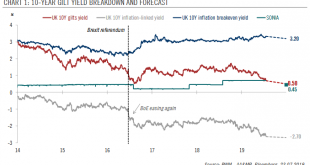

We expect the BoE to cut rates in November, even if a Brexit deal is reached by October. UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall. Taking stock of this...

Read More »DM credit caught between opposing forces

Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019. Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional...

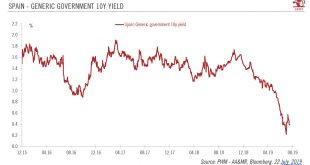

Read More »Semaña grande for Sánchez

The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well. April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a...

Read More »Euro area manufacturing is not out of the woods

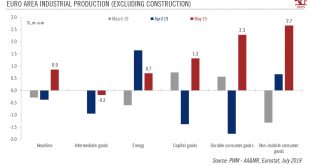

Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead. After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations. Production of consumer goods surged in May. Output of capital goods and...

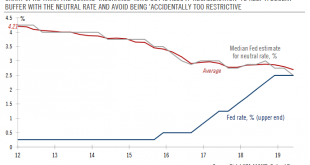

Read More »Powell’s Congressional testimony sets the scene for rate cut

The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September. During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July. Powell’s priority is to preserve the...

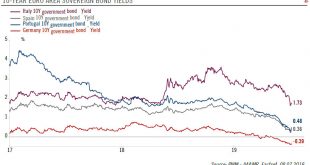

Read More »The ECB moves to keep euro bond yields down

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds. Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below...

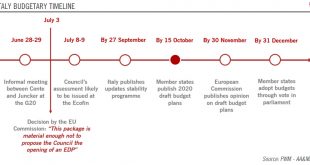

Read More »A truce between Rome and Brussels

For now, Italy has avoided Brussels’ Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package. In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other...

Read More »China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector. Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the...

Read More »Bund yields-Heading further down?

Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside. Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org