The cut to our growth forecast reflects slippage in euro area data. According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that even with zero growth in the remainder of 2018, euro area GDP would grow by 1.7% on average this year. The breakdown of euro are a growth by expenditure components will be published on 7 September. Based on high-frequency data and some country-specific releases, domestic demand was again the main driver

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, euro area, Euro area GDP growth, Euro area Q2 GDP, Featured, Macroview, newslettersent, Pictet Macro Analysis

This could be interesting, too:

RIA Team writes The Benefits of Starting Retirement Planning Early in Your Career

Swissinfo writes Swiss residential real estate to remain in demand in 2025

Thomas J. DiLorenzo writes Stakeholder Capitalism and the Corporate KPI Cult

Swissinfo writes Parliament stalemate on abolishing Swiss homeowner tax

The cut to our growth forecast reflects slippage in euro area data.

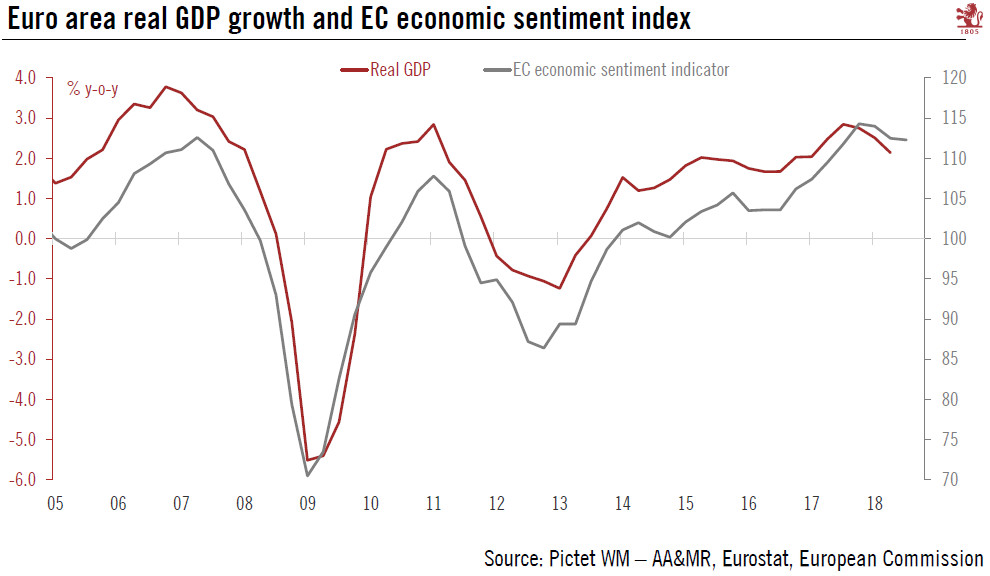

| According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that even with zero growth in the remainder of 2018, euro area GDP would grow by 1.7% on average this year. The breakdown of euro are a growth by expenditure components will be published on 7 September. Based on high-frequency data and some country-specific releases, domestic demand was again the main driver of growth in Q2.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018. We now expect euro area real GDP to grow by 2.0% on average this year (down from our previous forecast of 2.3% for 2018). We remain constructive on the cyclical outlook for the euro area. Forward-looking indicators (purchasing manager indexes (PMI) and the European Commission’s economic sentiment indicator) have recently shown signs of stabilising after weakening earlier this year (see chart 1). Fundamentals supporting household spending and business investment remain solid so that the euro area is likely to continue growing at rates that above its long-term potential, despite a slowdown from 2017. But risks to the growth outlook remain tilted to the downside, with global trade tensions the most prominent of them. |

Euro area real GDP growth and EC economic sentiment index, 2005 - 2018 |

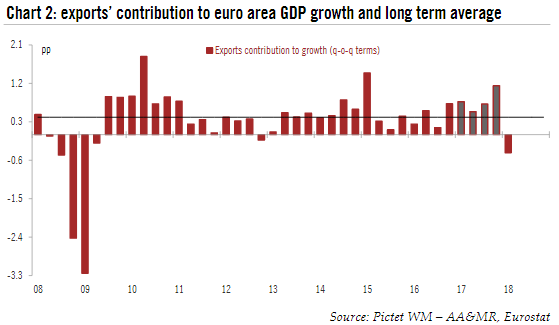

Anatomy of a slowdownEuro area economic activity was buoyant in 2017. While a slowdown this year was expected, its magnitude has surprised. Several one-off factors are seen as having hurt growth data. First, weather conditions may have distorted supply and demand. Second, a winter flu outbreak that was more severe and more long lasting than usual may have increased absenteeism in February and March, particularly in Germany, where the delay in forming a new government may also explain the significant decline in government consumption in Q1 (-2.1% q-o-q, the largest quarterly contraction since Q2 2010). Third, strikes affected important sectors (the metalworking industry in Germany, the transport industry in France). Finally, the timing of Easter may also have distorted data. While it is difficult to quantify precisely the exact impact of all these factors on growth, the first release of Q2 French GDP for example confirmed that unusual weather conditions and strikes had dampened private consumption. But the loss of economic momentum is also the result of more persistent factors. First, supply-side constraints (delivery times, backlogs, inventories) and labour bottlenecks have restrained output growth. Second, Q1 GDP reports revealed a sharp slowdown in exports from most euro area countries. This behaviour may reflect a reversion of export growth to levels more in line with cyclical conditions following high growth last year (see chart 2), especially in the second half. The delayed effect of the euro’s appreciation late last year and the slowdown in global trade suggested by some indicators may also be hurting export growth in 2018. It cannot be excluded that part of the drop in momentum is due to a lowering of expectations linked to trade tensions. Nonetheless, euro area economic fundamentals remain robust. In spite of the slowdown from 2017, the euro area economy is likely to continue to grow at rates above its long-term potential. Solid job creation, monetary policy that is still highly accommodative and favourable financial conditions all continue to support household spending and business investment. |

Euro Area Exports Contribution to Growth, 2008 - 2018 |

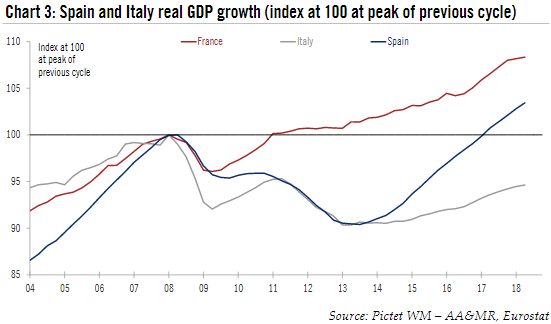

Italy and Spain decelerated in Q2Some euro area countries have also published Q2 preliminary figures. Among the four biggest economies, only Germany has yet to publish its flash GDP reading (it will come out on 14 August). French GDP grew at the same pace as in Q1 (0.2% q-o-q, see our previous Flash Note for more details). In Italy, GDP growth decelerated to 0.2% q-o-q in Q2 from 0.3% q-o-q in Q1, in line with consensus expectations. The breakdown of Italian growth by expenditure components will be published on 31 August. Finally, in Spain, GDP growth slowed to 0.6% q-o-q (2.7% y-o-y) in Q2 from 0.7% q-o-q (3.0% y-o-y) in Q1, below consensus expectations (0.7%). It was the lowest reading since Q2 2014. The GDP breakdown was mixed. Investment (+2.6% q-o-q after 0.8% in Q1) accelerated thanks to a strong rebound in investment in equipment and machinery, but private consumption, a leading driver of the recovery, slowed to 0.2% q-o-q (from 0.7%), the lowest quarterly rate since Q1 2014. Furthermore, exports (-1.0% q-o-q after 1.3% in Q1) contracted for the first time Q3 2016. That said, Spanish economy is still out performing its euro area peers. |

France, Italy and Spain Real GDP Growth, 2004 - 2018 |

Euro area economic activity was buoyant in 2017. While a slowdown this year was expected, its magnitude has surprised. Several one-off factors are seen as having hurt growth data. But the loss of economic momentum is also the result of more persistent factors, such as supply-side constraints and a sharp slowdown in exports.

Nonetheless, euro area economic fundamentals remain robust. In spite of the slowdown, the euro area economy is likely to continue to grow at rates above its long-term potential. Solid job creation, monetary policy that is still highly accommodative and favourable financial conditions all continue to support household spending and business investment. We therefore remain constructive on the cyclical outlook for the euro area. Forward-looking indicators (purchasing manager indexes and the European Commission’s economic sentiment indicator) have recently shown signs of stabilising after weakening earlier this year. But risks to the growth outlook remain tilted to the downside, with global trade tensions the most prominent of them.

Tags: Euro area,Euro area GDP growth,Euro area Q2 GDP,Featured,Macroview,newslettersent