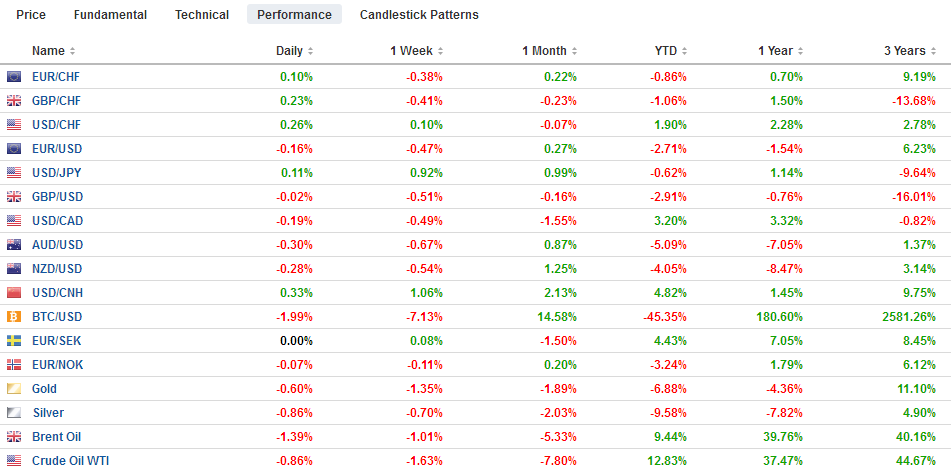

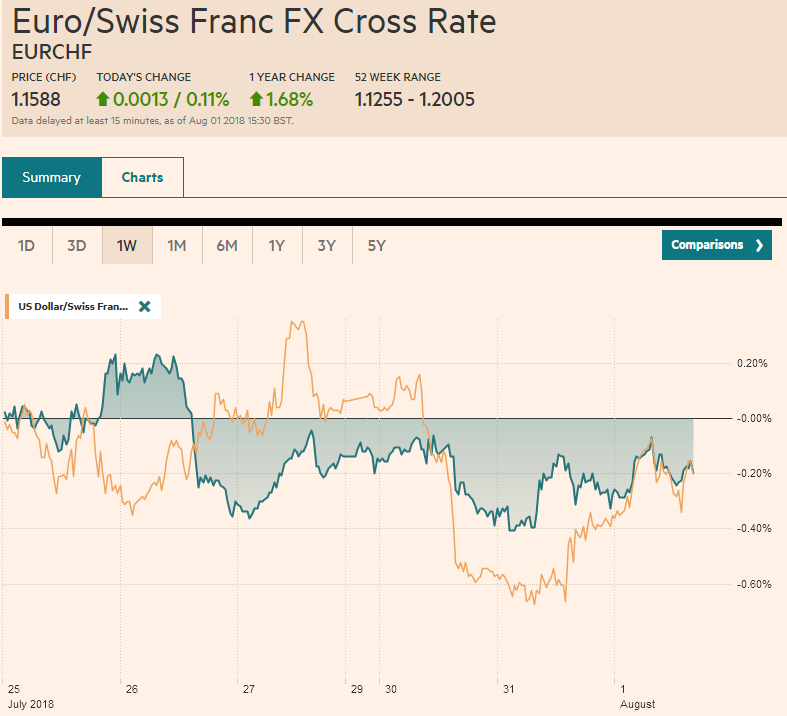

Swiss Franc The Euro has risen by 0.11% to 1.1588 CHF. EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Investors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage in high-level talks, which have not taken place for two months according to reports, the US signaled that the 10% tariff on 0 bln of Chinese goods could now face a 25% tariff instead. There is a public comment period from August 20-23, which allows for implementation as soon as the end of August.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Bank of Japan, EUR, Featured, Federal Reserve, GBP, JPY, newslettersent, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.11% to 1.1588 CHF. |

EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesInvestors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage in high-level talks, which have not taken place for two months according to reports, the US signaled that the 10% tariff on $200 bln of Chinese goods could now face a 25% tariff instead. There is a public comment period from August 20-23, which allows for implementation as soon as the end of August. Meanwhile, the 25% tariff on $16 bln more of Chinese goods (bringing the first round to $50 bln) could be implemented as early as tomorrow. Success in like South Korea, for example, which has struck a new trade agreement with the US, or Mexico, that US reports suggest is getting close to capitulating to US demands, is more difficult to replicate against larger countries, like China, blocs, like the EU, or where the US may have less leverage, like North Korea. While trade issues are increasing part of the macro backdrop, there are other market movers. Among these continues to be Japanese government bonds. The BOJ widened the band for the 10-year yield from 10 bp to 20 bp around zero. Investors immediately took advantage of this and drove the 10-year yield up 6 bp to 11.5 bp, reaching an 18-month high. Yes, the 10-year yield doubled. The move was so sharp that it spurred margin calls in the futures market press reports. The BOJ did not intervene. The market appears to be fishing for the official threshold or where it will offer its first fixed rate purchases. Some suspect that it could be near 15 bp, but, depending on market conditions, we suspect that the BOJ will wait for closer to the 20 bp band as it did with the 10 bp ceiling previously. Officials may also welcome the steeper yield curve. The US dollar has moved higher against the yen despite because of the higher yields. The dollar knocked on JPY112.15 area which houses the 61.8% retracement of the greenback’s drop from the July 19 high a full yen higher. Support now is seen near JPY111.70. A JPY112.00 option for nearly $400 mln is set to expire today. We have suggested that after trading in a JPY105-JPY108 trading range earlier this year, and then a JPY108-JPY111 trading range, the dollar may have entered a JPY111-JPY114 trading range. The price action now is probing the range. |

FX Performance, August 01 |

Markit confirmed the flash EMU manufacturing PMI of 55.1. This was a small pickup from the 18-month low recorded in June 54.9. However, the country breakdown was different. Germany’s reading was revised to 56.9 from 57.3 flash and 55.9 in June. The French report was revised up top 53.3 from the flash 53.1 and 52.5 in June.

Spain and Italy were a bit softer. Spain slipped to 52.9 from 53.4, and Italy’s loss of momentum was more pronounced, falling to 51.5 from 53.3. Spain’s manufacturing PMI is at its lowest level since last August. Italy’s has not been this weak since October 2016. The divergence between the core and periphery may be an important fissure if it persists and would complicate the ECB’s efforts.

The UK’s manufacturing PMI softer than expected at 54.0 and a downward revision June reading (54.3 from 54.4). It had appeared to stabilize after falling in the first four months of the year, but the July decline offsets most of the gains in the May-June period.

It is hard to say that the currencies showed much reaction. The euro and sterling are trapped in narrow trading ranges. Sterling is holding above yesterday’s lows a little below $1.3100. The nearby cap is seen near $1.3130, while there is an option at $1.3150 for about GBP320 mln that expires today. UK Prime Minister May’s Brexit team is reportedly trying to secure some Labour support, while she will cut short her holiday to call on France’s Macron.

The euro’s losses were extended to almost $1.1670 in late Asia and early European activity. This area may prove sticky with 2.2 bln euros in options struck between $1.670 and $1.1685 expiring today. So far, it is the first session in nearly two weeks that the euro has not been above $1.1700. Many short-term speculators are favoring an eventual upside break for the euro. Note that in the week through last Tuesday, speculators in the futures increased their gross long euro position for the first time in seven weeks, and with gross shorts covering, the net long position rose by the most since mid-April. However, given the rate differential, it is expensive to be short dollar against the euro. A break of the lower end of the wedge or pennant formation, seen near $1.16 now, may be needed for the euro bulls to throw in the towel again.

Focus in North America is four-fold: The ongoing corporate earnings, the data, which include the ADP jobs estimate and the ISM/PMI manufacturing readings, the refunding announcement, and the FOMC statement. The US manufacturing sector is operating at elevated levels. So far the benefits of the import substitution effect of the tariffs appear to have shown up in the data, but we suspect that the impact on businesses where the tariffs are on input and other disruptions w.ill begin to show shortly as well. ADP private sector jobs estimate is expected to remain firm (Bloomberg median is 186k after 177k in June). Auto sales, which surprised on the upside in June (17.38 mln) likely softened in July, though anything above 17 mln is strong.

The FOMC statement is primarily about the updated economic assessment. It is clear from the FOMC minutes that there is a discussion of how to evolve the statement so that monetary policy is not judged to be accommodative. There is some speculation that such a change could be seen today. However, without a change it rates, it does not seem appropriate to do much, though there could be a word clue or two. Moreover, with headline CPI expected to print 3% next week with the July report, the real Fed funds rate remains below zero, which in past cycles was needed to help lift the economy out from contraction.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Bank of Japan,Featured,Federal Reserve,newslettersent