Swiss Franc The Euro has risen by 0.03% to 1.1957 CHF. EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to .2155. So far, today is the first session since January 11 that the euro has not traded above .22. The euro stabilized as the European morning progressed, but there seems to be little real buying interest it ahead of Draghi’s press conference following the ECB decision. There is also a very large option (5.2 bln euros) struck at .22 that expires at shortly after when the press conference typically ends. FX Daily Rates,

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, EUR/CHF, Featured, GBP, JPY, newslettersent, SEK, U.S. Durable Goods Orders, U.S. Initial Jobless Claims, USD, USD/CHF

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

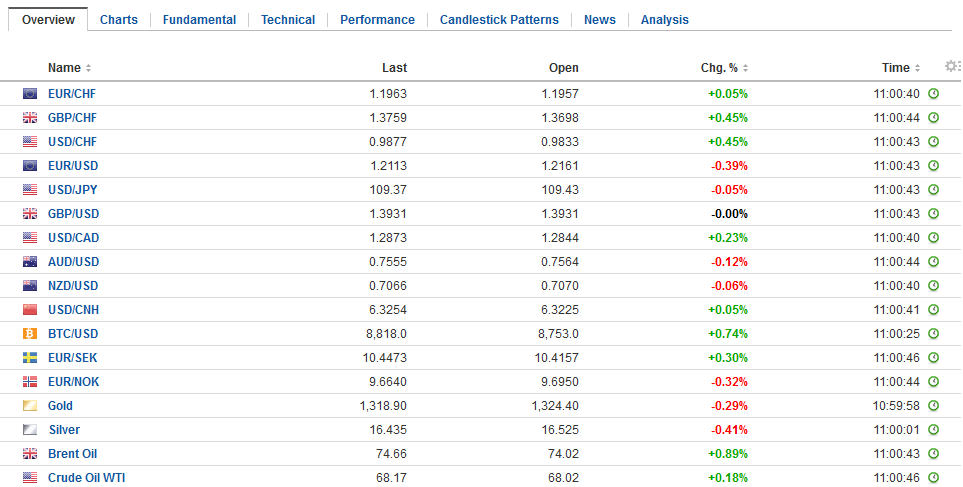

Swiss FrancThe Euro has risen by 0.03% to 1.1957 CHF. |

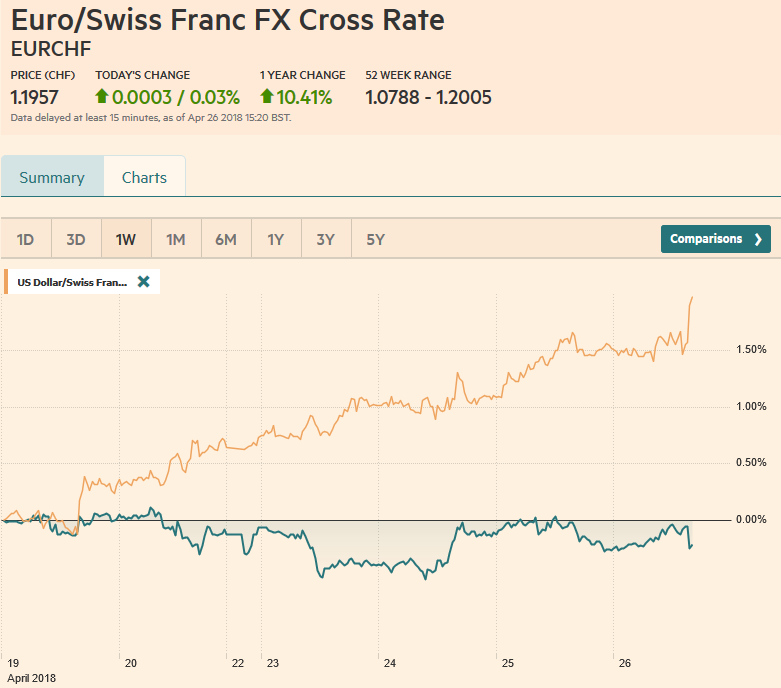

EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to $1.2155. So far, today is the first session since January 11 that the euro has not traded above $1.22. The euro stabilized as the European morning progressed, but there seems to be little real buying interest it ahead of Draghi’s press conference following the ECB decision. There is also a very large option (5.2 bln euros) struck at $1.22 that expires at shortly after when the press conference typically ends. |

FX Daily Rates, April 26 |

| Based on recent comments by Draghi, we expect the ECB to look past the recent softer economic data and have confidence that with continued “patience and persistence” the inflation target will be achieved. Given the price action, we suspect that such sentiment would be seen as less dovish and spur a euro bounce. A squeeze higher would be tested in the $1.2240-$1.2250 area, where incidentally there is a 717 mln euro option expiry today ($1.2255).

Also, as noted yesterday, although the euro at the lower end of a three-month range against the dollar, it is firm within its range on a real trade-weighted basis, and this is ultimately more important for policymakers than a bilateral nominal rate. There is little for Draghi to say about the currency, which he often reminds, is not a policy objective in itself but feeds into its economic assessment. |

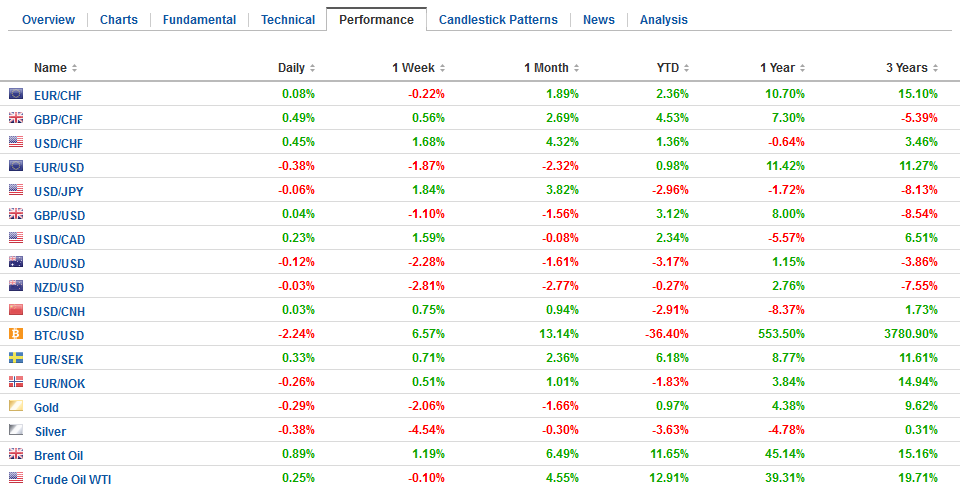

FX Performance, April 26 |

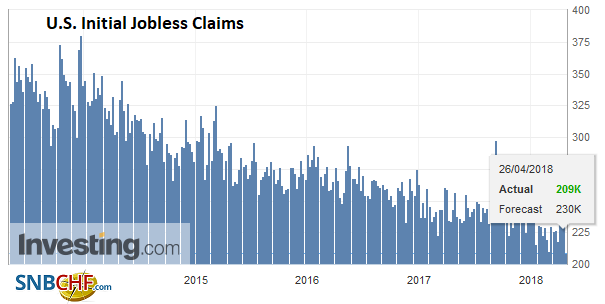

United StatesThe US economic calendar picks up today, but the interest lies with tomorrow’s first look at Q1 GDP and next week’s employment data. On tap today are weekly jobless claims, March durable goods orders, advanced goods trade balance, inventory data, and the KC Fed manufacturing survey. |

U.S. Initial Jobless Claims, May 2013 - Apr 2018(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

| The most important may be durable goods orders. Here is a sector that one expects to have been helped by lower taxes, but like consumption, the tax benefits are not apparent in Q1. Durable goods orders, excluding transportation, may have experienced its weakest quarter since Q2 17. |

U.S. Durable Goods Orders YoY, March 2018(see more posts on U.S. Durable Goods Orders, ) Source: Zerohedge.com - Click to enlarge |

One of EMU’s trading partners is Sweden, and the euro is making new nine-year highs against the krona today, following the Riksbank meetings. It tweaked its guidance for its first hike into the end of the year rather than in the second half. The market put more emphasis in this than in dropping the caution against the krona appreciating too quickly and that it was prepared to ease further if necessary.

The krona is the weakest of the major currencies this year, off 4.7% against the dollar with today’s losses, and 6.2% against the euro. In contrast, the Norwegian krone is the strongest of the majors, up nearly 3.2% against the dollar. Oil, you say? Perhaps, but the Canadian dollar, is off 2.2% year-to-date.

The recovery in US shares yesterday did not universally lift Asian shares, and the MSCI Asia Pacific Index is fractionally lower; its third loss of the week. One bright spot was Korea. Foreign investors have been large sellers in the first part of the week but turned to the buy side today and helped lift the KOSPI by 1.1%. Samsung earnings beat expectations, though it offered a cautionary word about the cell phone outlook. Separately, note that South Korea’s Q1 GDP was in line with expectations, rising 1.1% for a 2.8% year-over-year rate.

There were three weights on China’s equities. First, reports suggest that Huawei is under investigation by US authorities for trade violations with Iran. Second, a Shenzhen-listed company (Gree Electric) announced it would not pay a dividend for the first time in 11 years. Reports indicate the company recorded a 45% increase in profits but insists on using the funds for research and development. Third, there were heavy sales of Shenzhen shares (~-2.2%) on from the link with Hong Kong. The CNY3.2 bln of sales was the most since December 2016, according to reports.

News that China may reduce its tariffs on auto imports may have helped minimize losses for that sector. Ultimate, we suspect that the preferred way for foreign producers to service the Chinese market will be to build locally; that is to say a direct investment strategy rather than export-oriented.

European activity is quiet. Stocks are firm and retracing less than half of yesterday’s losses. The Dow Jones Stoxx 600 is up nearly 0.25%, led by telecoms, utilities and consumer staples. Real estate, materials, and information technology are the drags. Energy is lower, though oil prices are firm. French President Macron’s indication that he expected Trump to withdraw from the agreement with Iran may have encouraged participants to do what they already appeared eager to do, and that is buy the pullback in oil.

Bonds are firm. The US 10-year yield has eased back to 3.0%, while European benchmark yields are 2-3 basis points lower. The US yield curve (2y-10y) is broadly stable. It edged to almost 54 bp yesterday. Recall it was near 43 bp as recently as April 17. Dollar LIBOR is also stabilizing. It is up less than a basis point over the past week. One of the considerations that is said to have deterred foreign demand for US bonds is the cost of hedging. The costs of hedging has stabilized (even if at elevated levels). Some asset managers (e.g., Japanese lifer insurers) are boosting the unhedged allocation. The trend in the foreign exchange market is a contributor rather than a detractor of the total return.

Sterling briefly dipped below $1.39 for the first time since March 16. It needs to resurface above $1.40 to lift the tone. Tomorrow’s Q1 GDP report, though backward looking, may shape expectations for the BOE meeting on May 10. There is a GBP368 mln option struck at $1.3930 that expires today.

The dollar edged to a new high against the yen but stopped shy of JPY109.50. The rise in US yields has been more important than the equity volatility. The objective of the head and shoulders bottom pattern that we saw traced out in March projected to around JPY110. As the target is approached, the risk-reward changes. The BOJ’s meeting concludes tomorrow. No change in policy is expected. See our note later today sketching the outlook and challenges going forward.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,EUR/CHF,Featured,newslettersent,SEK,U.S. Durable Goods Orders,U.S. Initial Jobless Claims,USD/CHF