The Fed has been reticent to become involved in the debate over trade tariffs and still looks like placing policy normalisation on ‘auto pilot’.Among the many questions posed by the recent more aggressive trade rhetoric from the Trump Administration is whether it will ‘scare’ Federal Reserve officials, and therefore interrupt the current US tightening cycle. But recent comments from Fed policymakers, including from Chair Jerome Powell, suggest that officials remain cool-headed about recent Trump rhetoric. Powell has insisted that it is “too early to tell” the impact of recent trade actions.Therefore, gradual hikes in the Fed’s interest rates remain the order of the day. We continue to expect three additional quarter-point rate hikes this year, the next one at the Fed’s 13 June meeting. We

Topics:

Thomas Costerg considers the following as important: Fed dots, Macroview, Trump's trade rhetoric, US economy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The Fed has been reticent to become involved in the debate over trade tariffs and still looks like placing policy normalisation on ‘auto pilot’.

Among the many questions posed by the recent more aggressive trade rhetoric from the Trump Administration is whether it will ‘scare’ Federal Reserve officials, and therefore interrupt the current US tightening cycle. But recent comments from Fed policymakers, including from Chair Jerome Powell, suggest that officials remain cool-headed about recent Trump rhetoric. Powell has insisted that it is “too early to tell” the impact of recent trade actions.

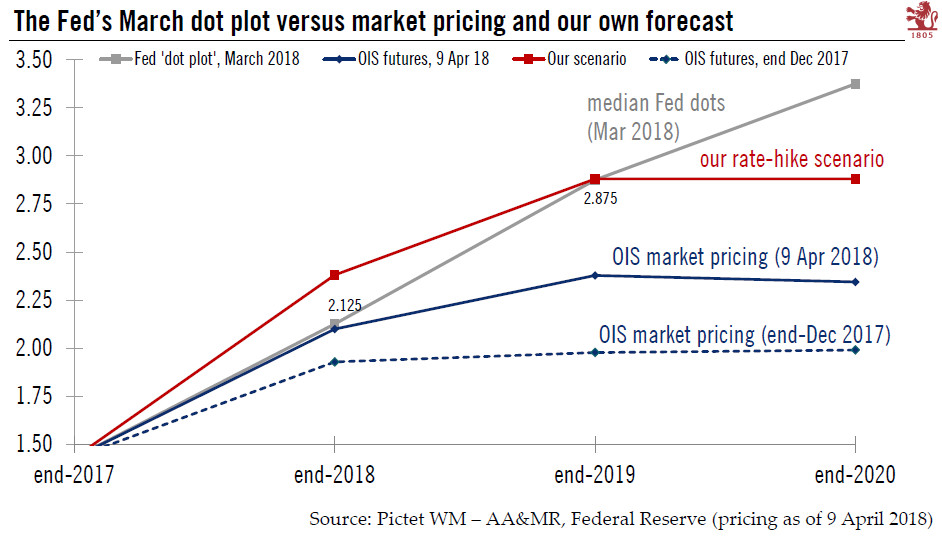

Therefore, gradual hikes in the Fed’s interest rates remain the order of the day. We continue to expect three additional quarter-point rate hikes this year, the next one at the Fed’s 13 June meeting. We still expect two additional rate hikes in 2019.

The Fed seems mostly focused on the solid economy at home. There are ongoing concerns about the risk of overheating if rates stay at current levels given the tight labour market. But in our view, as long as payrolls remain above 100,000/month (roughly the current pace of labour force growth) and core inflation remains in the 1.5-2.5% range, there is no reason for the Fed to turn off the ‘auto pilot’ pointing towards one rate hike per quarter this year with a significant tightening in US and global financial-market conditions the most likely to disrupt the policy flight path.

We believe that the Fed will continue to pay particular attention to whether trade rhetoric reverberates in US business surveys and hard data. So far this has not been the case. Another consideration is whether financial conditions tighten. The Fed is more likely to be waiting for concrete evidence of the impact of tariffs rather than ‘front run’ Trump’s trade rhetoric. Recent comments from Fed policymakers seem to suggest that most believe Trump’s rhetoric is precisely that.

At the same time, the Fed has become more internationally aware than it was in recent years, and it is probable that behind the innocuous comments it remains vigilant about tensions with China, which could have sharp implications on the global economy.