Highly integrated into global value chains, the euro area is vulnerable to their disruption.Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly vulnerable to such indirect effects given its relatively high degree of openness to trade. For all the talk about ‘Euroboom’, about one quarter of euro area GDP growth in 2017 was driven by net trade.Euro area exports amounted to 47% of GDP in 2017 compared with 12% in the US. Importantly, the euro area is

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Highly integrated into global value chains, the euro area is vulnerable to their disruption.

Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly vulnerable to such indirect effects given its relatively high degree of openness to trade. For all the talk about ‘Euroboom’, about one quarter of euro area GDP growth in 2017 was driven by net trade.

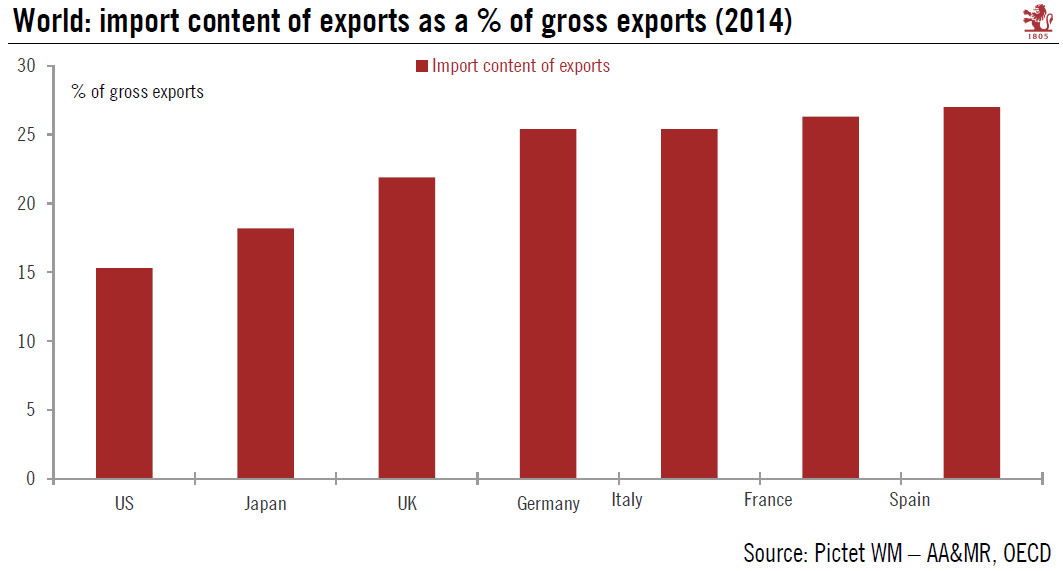

Euro area exports amounted to 47% of GDP in 2017 compared with 12% in the US. Importantly, the euro area is also highly integrated into global value chains. The import content of exports, which the OECD calculates as the foreign value-added as a share of total gross exports, indicates just how dependent euro area countries are on the global manufacturing cycle driving investment at home. By this measure, euro area countries look more exposed to fluctuations in global trade than most advanced economies, with foreign value-added accounting for 25-27% of German, Italian, French and Spanish exports, compared with 15% of US exports. Countries with higher foreign value-added include China (29.5%) and smaller emerging market economies.

The US alone accounts for 13% of euro area exports, followed by the UK (12%), China (7.5%) and Switzerland (6%). Even if the EU is exempted from US tariffs, the latter could weigh on activity through other channels. The impact on the price and volume of intermediate inputs could be amplified by third countries adopting retaliatory measures. Last but not least, a sustained downturn in business confidence could hit investment eventually.