While our central scenario remains unchanged, we still see downside risks increasing from recent trade escalation.Following on from President Trump’s announcement of a 25% tariff on USD50bn of unspecified imports from China, the US Trade Representative (USTR) last week detailed the list of China-made goods that will be targeted. China reacted swiftly by detailing its own list of counter-tariffs on USD50bn worth of imports from the US. Trump then escalated the rhetoric further when he suggested the US could cast a wider net to include USD150bn of imports from China in the new tariffs (out of USD500bn in total imports from China).That said, President Trump subsequently seemed to back off over the weekend, using a Twitter message to highlight his friendship with President Xi Jinping. The

Topics:

Thomas Costerg and Dong Chen considers the following as important: Macroview, Trump trade tariffs, us china trade, US China trade tension

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While our central scenario remains unchanged, we still see downside risks increasing from recent trade escalation.

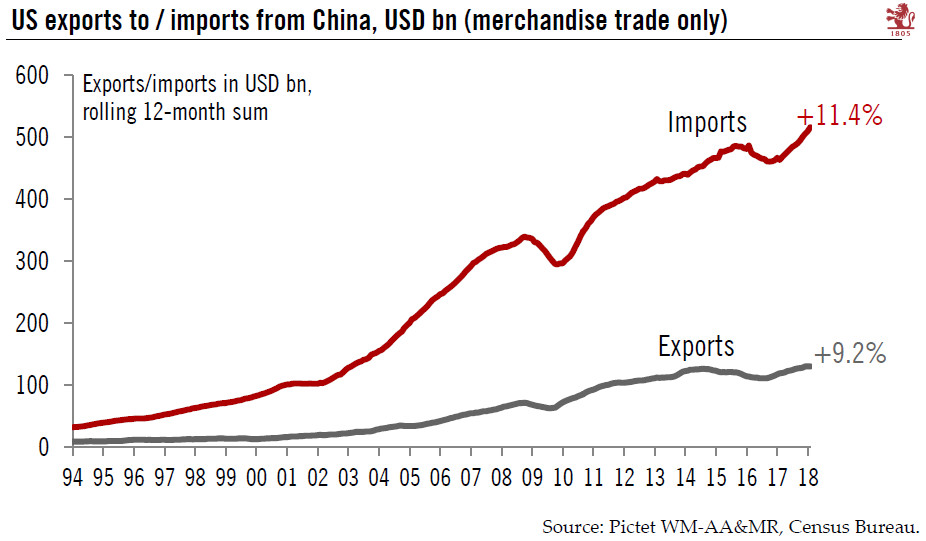

Following on from President Trump’s announcement of a 25% tariff on USD50bn of unspecified imports from China, the US Trade Representative (USTR) last week detailed the list of China-made goods that will be targeted. China reacted swiftly by detailing its own list of counter-tariffs on USD50bn worth of imports from the US. Trump then escalated the rhetoric further when he suggested the US could cast a wider net to include USD150bn of imports from China in the new tariffs (out of USD500bn in total imports from China).

That said, President Trump subsequently seemed to back off over the weekend, using a Twitter message to highlight his friendship with President Xi Jinping. The latter also made some soothing comments on 10 April, promising lower tariffs and wider market access. Still, last week’s ‘tit-for-tat’ moves have revived fears about additional escalation in protectionist rhetoric and the risk of sharp disruption in US-China trade flows.

At this stage, we continue to believe that Trump’s trade threats will remain just rhetoric and ought to be seen as a negotiating tool aimed at gaining concessions in trade talks with China. The macro impact of the tariffs on USD50bn of imports should be limited (less than 0.1ppt on both US and China’s GDP by our estimate).

We do not expect additional tariffs at this moment. Our central scenario therefore remains unchanged. However, we see some increasing downside risks stemming from last week’s escalation. In addition, the US-China trade tension could last longer than a typical dispute as some geopolitical elements may be at play.