The outcome of the March Fed meeting had a strong dovish undertone, crystallising the dovish policy shift at play since early January.The Fed confirmed the end of balance sheet reduction for September 2019. Meanwhile, the dot plot showed an overwhelming majority of members expected no rate hike at all this year (versus two rate increases expected at the December meeting).As expected, Powell took his ‘central banker to the world’ hat, expressed concern about the global economy, including the...

Read More »Federal Reserve December meeting preview

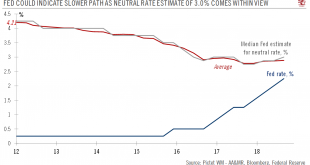

Fed shows shows signs of adopting a more flexible approach to future rate hikes.The Federal Reserve (Fed) is widely expected to increase the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, marking the fourth rate increase of 2018. This increase would push up the new FFTR range to 2.25%-2.50%.The focus will be on the rate guidance for 2019, including the one given by the ‘dot plot’ (summary of Fed policymakers’ interest rate forecasts). We think the 2019 median...

Read More »US November job numbers paint a strong macro picture

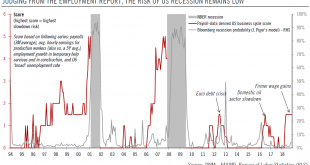

But there is some softness at the microeconomic level.US employment rose by 155,000 in November (+1.7% year on year (y-o-y), decelerating from +237,000 in October. The three-month average dropped as well, but is still a healthy 170,000/month (it was 214,000 up to October 2018). November’s wage growth was unchanged from October’s pace of 3.1% y-o-y.Most cyclical indicators continue to flash green, and there are limited signs of a downturn in the US economy right now; the solid macro picture...

Read More »Throw the textbook away: US inflation is still modest

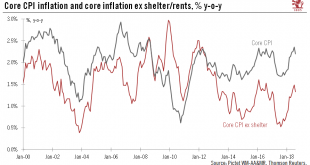

August CPI data once again underscores ongoing puzzle of a strong US economy creating little inflationary pressure.Core CPI inflation was relatively modest in August, rising only 0.08% month on month, while the year-over-year (y-o-y) rate slowed to 2.2% from 2.4% in July. Core inflation was up only 0.08% m-o-m, and the y-o-y reading slowed to 2.2% from 2.4% in July. This means that for all its recent strength of the economy (underlying growth of 3% and unemployment below 4%), the US is still...

Read More »ISM business survey rises to highest level since 2004

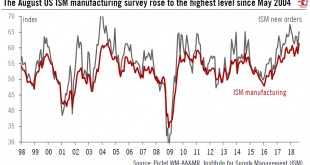

August’s US ISM manufacturing survey rise confirms that economic momentum is strong.The flagship ISM manufacturing survey, a series released by the Institute for Supply Management, with data going back to 1948, rose to 61.3 in August, its highest level since May 2004. Details of the survey were strong, for instance ‘new orders’ rose to 65.1, from 60.2 in July. The ISM index is a diffusion index, with any reading above 50 indicating expansion in activity.These healthy data are another...

Read More »Federal Reserve’s tightening still on track

The Fed has been reticent to become involved in the debate over trade tariffs and still looks like placing policy normalisation on ‘auto pilot’.Among the many questions posed by the recent more aggressive trade rhetoric from the Trump Administration is whether it will ‘scare’ Federal Reserve officials, and therefore interrupt the current US tightening cycle. But recent comments from Fed policymakers, including from Chair Jerome Powell, suggest that officials remain cool-headed about recent...

Read More »US chart of the week – Low macro vol

Volatility in US payroll data has remained low lately. We see limited signs of imminent overheating or slowing in the US.Volatility has picked up significantly on US equity markets lately. But does it reflect higher volatility in US macroeconomic data?So far, not really. Take US payroll data. If one looks at the one-year rolling standard deviation of the monthly data, one can see volatility is still subdued: it now stands at 68,000 (new payrolls/month), which is close to the average since...

Read More »Wages on the rise as US maintains cyclical momentum

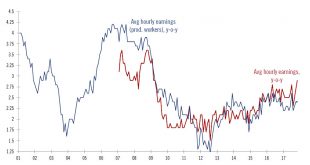

Solid US wage growth could lead to a more hawkish tone at the Federal Reserve.The January employment report showed that the US economy started 2018 on a strong footing, with particularly robust momentum in cyclical sectors such as construction and manufacturing. This supports our scenario that US growth will step up to 3% in 2018, from 2.3% in 2017, driven by an uptick in investment. With January’s increase of 200,000, the 3-month average growth in payrolls stands at 192,000/month, well...

Read More »Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December)....

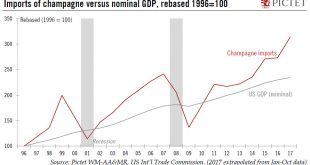

Read More »Effervescence, not exuberance

Despite the length of the current expansion, we believe US growth still has some way to go. But there are signs the economy is becoming bubbly.The key debate right now among economists revolves around how further will the expansionary phase of the US business cycle go. We are already over 100 months into the current phase (it started in July 2009), making it the third-longest period of post-World War II expansion. The longest was 119 months, between April 1991 and February 2001. Our view is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org