Summary:

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses. The conventional wisdom of financial advisors–to save money and invest it in stocks and bonds “for the long haul”–a “buy and hold” strategy that has functioned as the default setting of financial planning for the past 60 years–may well be disastrously wrong for the next decade. This “buy and hold” strategy is based on a very large and unspoken assumption: that every asset bubble that pops will be replaced by an even bigger (and therefore more profitable) bubble if we just wait a few years. The last time this conventional wisdom came into serious question was in the

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses. The conventional wisdom of financial advisors–to save money and invest it in stocks and bonds “for the long haul”–a “buy and hold” strategy that has functioned as the default setting of financial planning for the past 60 years–may well be disastrously wrong for the next decade. This “buy and hold” strategy is based on a very large and unspoken assumption: that every asset bubble that pops will be replaced by an even bigger (and therefore more profitable) bubble if we just wait a few years. The last time this conventional wisdom came into serious question was in the

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

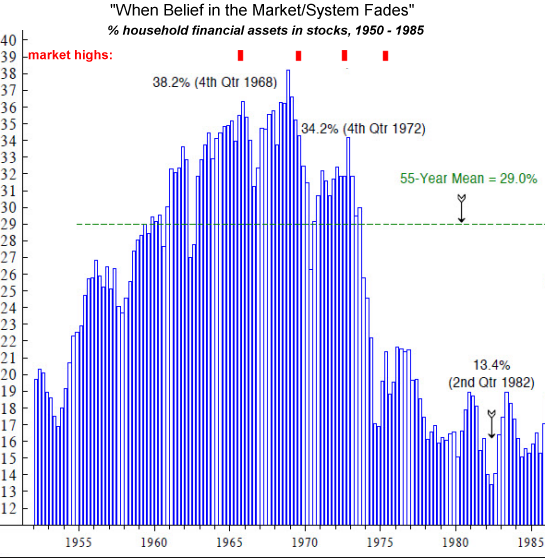

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses.

The conventional wisdom of financial advisors–to save money and invest it in stocks and bonds “for the long haul”–a “buy and hold” strategy that has functioned as the default setting of financial planning for the past 60 years–may well be disastrously wrong for the next decade.

This “buy and hold” strategy is based on a very large and unspoken assumption: that every asset bubble that pops will be replaced by an even bigger (and therefore more profitable) bubble if we just wait a few years.

The last time this conventional wisdom came into serious question was in the stagflationary 1970s, when stocks and bonds, when adjusted for inflation, lost over 40% of their value. The decade was punctuated by numerous rallies, but each one petered out.

The only way to profit in this sort of market is to trade, i.e. buy the lows and sells the highs. Buy and hold is a disastrously wrongheaded strategy when the underpinnings of the status quo are eroding.

The 36-year bull market in bonds is drawing to a close, as yields are rising even if official inflation is moribund. Buying and holding bonds will guarantee steadily increasing losses as existing bonds lose value as rates rise.

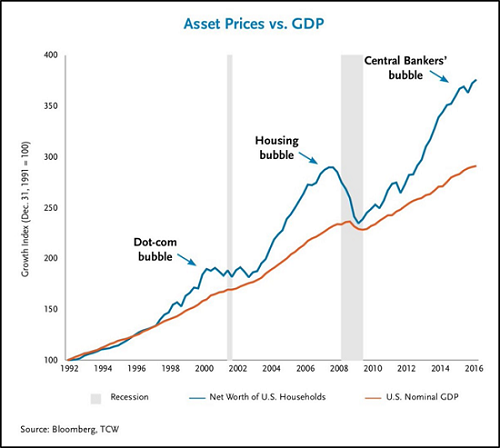

Stocks have risen solely on the back of central bank stimulus, which is now being reduced/ended. In my view, the political blowback of soaring income inequality due to central banks rewarding capital at the expense of labor will place limits on future central bank largesse.

These long-term reversals of trend make everyone a trader, whether they like it or not: buying and holding might work for real-world assets if inflation really gathers steam, but if markets gyrate in the winds of uncertainty, every asset might rise and fall or simply stagnate.

Being a trader simply means selling an asset when it has topped out relative to other asset classes, and shifting the proceeds into assets that have been crushed and are beginning an up-cycle. It sounds so absurdly simple: buy low, sell high. But it’s not that easy to accomplish in the real world.

It takes discipline to buy when others are selling (the low point of any asset cycle) and to sell when when everyone else is confident (and greedy for even more gains).

As a general rule, letting others take the risks required to skim the last 10% of gains is a prudent strategy: take profits when they arise, and don’t assume uptrends of the sort we’ve enjoyed for the past 9 years will last.

As a trader as well as an investor, I’ve learned the hard way that the barriers to successful trading are largely psychological/emotional: we are all too easily swayed by the emotions of greed, fear and group-think.

Buying and holding is a relatively painless strategy in a rising tide that raises all boats. But when markets gyrate up and down, only those able and willing to trade–to take a modest profit and then buy another asset and then sell that when profits arise–will actually prosper in terms of increasing the purchasing power of their holdings.

The final and perhaps most difficult piece of trading is to gain the ability to recognize a decision to buy an asset isn’t working as planned, and to sell the asset for a loss. Nothing is more difficult for humans than admitting to ourselves that we were wrong and a decision isn’t playing out as planned.

Taking a loss is remarkably difficult as well. Modern psychology informs us that the sting of losses is far more potent than the euphoria of reaping gains, and mastery of trading requires the trader to “make all things equal,” to use the Taoist phrase: losses and gains are treated equally.

Like the football quarterback, we can’t dwell on the interception we just threw; we must clear our minds for the next successful throw/completion.

This discipline takes much practice, and most participants in the markets are ill-prepared to acquire the necessary discipline.

Here’s another metaphor: sailing in calm seas and light, steady breezes makes sailing seem easy to the beginner. But when the seas roughen and the wind gusts unpredictably, it doesn’t seem so easy any more.

Everyone who buys or owns any asset from now on –currency, cash, real estate, cryptocurrency tokens, stocks, bonds, options, farmland, copper futures, oil wells, everything–is a trader. Those who don’t understand this may suffer potentially catastrophic losses.

From now on, everything is a trade that might have to be sold to avoid losses.

“Buy and hold” is based on the belief that each popped bubble will be replaced by an even bigger bubble. As I’ve discussed before, there are solid reasons to suspect that there won’t be a fourth bubble after this one finally pops: three bubbles and you’re out.

|

It’s instructive to refer to a chart of the percentage of household assets invested in the stock market. Buy the dip and buy and hold worked consistently from 1950 until 1969, when the wheels fell off the stock market. (The wheels fell off the bond market a few years later.)

Households kept putting more and more of their assets into the “can’t lose” stock market until the stagflationary losses of the 1970s destroyed their stock portfolios and their belief in buy and hold.

|

Asset Prices vs GDP, 1992 - 2016 |

|

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses–a process punctuated by numerous sharp rallies, each of which faded.

President Richard Nixon famously observed, “We’re all Keynesians now,” indicating the triumph of Keynesian policies within the political system. Perhaps in a few years someone will mutter “we’re all traders now,” and that utterance will mark the passing of buy and hold as the status quo’s “can’t fail” strategy.

|

Market/System Fades, 1955 - 1985 |

Tags: Featured,newsletter