Summary The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates. Brazil President Temer survived a lower house vote that sought to put him on trial for corruption. Fitch moves its outlook on Mexico’s BBB+ rating from negative to stable. The US put sanctions on Venezuelan President Maduro. Stock Markets In the EM equity space as measured by MSCI, Hungary (+2.9%), Brazil (+2.4%), and

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

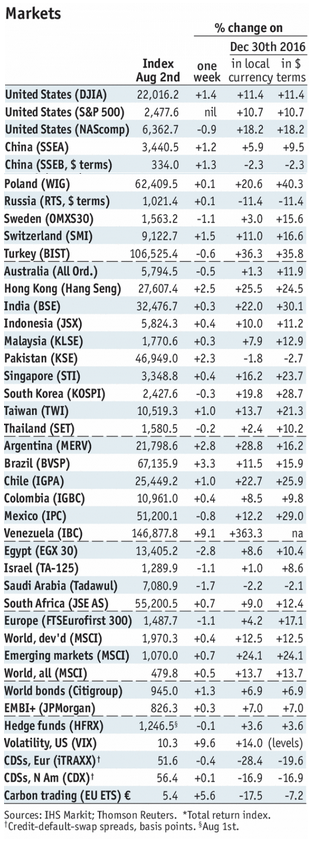

Stock MarketsIn the EM equity space as measured by MSCI, Hungary (+2.9%), Brazil (+2.4%), and Hong Kong (+2.0%) have outperformed this week, while Egypt (-2.2%), Philippines (-1.9%), and Qatar (-1.6%) have underperformed. To put this in better context, MSCI EM rose 0.4% this week while MSCI DM rose 0.3%.

In the EM local currency bond space, Brazil (10-year yield -18 bp), Russia (-10 bp), and Philippines (-6 bp) have outperformed this week, while Colombia (10-year yield +7 bp), China (+6 bp), and Czech Republic (+4 bp) have underperformed. To put this in better context, the 10-year UST yield fell 2 bp to 2.27%. In the EM FX space, COP (+1.3% vs. USD), ARS (+1.0% vs. USD), and INR (+0.9% vs. USD) have outperformed this week, while ZAR (-3.0% vs. USD), ILS (-2.0% vs. USD), and RUB (-1.0% vs. USD) have underperformed. |

Stock Markets Emerging Markets, August 2nd Source: economist.com - Click to enlarge |

IndiaThe Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. This reverses the 25 bp hike in the reverse repo rate back in April. Going forward, RBI policy will get harder to predict. After cutting rates, it kept a neutral stance and said inflation will rise in H2. We’ll have to take it meeting by meeting but we believe the RBI will err on the side of caution for the time being.

IndonesiaBank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Governor Martowardojo said “Bank Indonesia sees that inflation continues to be manageable, and provided conditions remain good with supporting data, we aren’t closed to the possibility of easing.” He added that “we will consider [a cut] as we head into the upcoming meeting of board of governors.” The next policy meeting is August 22, and the odds of a cut have risen.

Czech Republic

Czech National Bank became the first in Europe to hike. Market was split between no hike and the 20 bp hike that was seen. Going forward, the pace of tightening will depend in large part on how strong CZK gets. The central bank estimates a 1% appreciation has the same impact as a 25 bp hike.

IsraelPolitical risk is rising in Israel. Police reportedly questioned Netanyahu twice in recent weeks over receiving gifts from businessmen. Also, press reporting that police have a tape of him offering to help a newspaper owner in return for more favorable press coverage. Netanyahu denies any wrongdoing, but opposition leaders are calling on him to resign.

RussiaPresident Trump signed the Russia sanctions bill. He didn’t have much choice, as both houses of Congress passed it by overwhelming, veto-proof majorities. In turn, Russia ordered the US to cut its embassy staff by 755, or nearly two thirds. Trump blamed the US Congress for worsening relations between the two nations.

NigeriaNigeria is trying to unify its system of multiple exchange rates. Authorities have asked banks to use the prevailing rates in the FX window created for foreign investors to make their quotes, rather than the official rate. Trades in the so-called Investors’ & Exporters’ FX Window are thought to better reflect true underlying FX supply and demand. The official rate is currently 305, the I&E (or Nafex) rate is around 365-370, and the black market rate is around 365. BrazilBrazil President Temer survived a lower house vote that sought to put him on trial for corruption. Temer’s allies defeated the motion by a solid 263-227 vote. The result should allow Temer to complete his term next year. However, advancement of labor reforms is by no means assured as the pension reform bill needs 308 votes in the lower house to proceed.

MexicoFitch moves its outlook on Mexico’s BBB+ rating from negative to stable. The agency said that the move reflects reduced downside risks to the growth outlook, which is expected to help stabilize the public debt burden. Our own ratings model puts Mexico at BBB and so we think Fitch’s move was premature.

VenezuelaThe US put sanctions on Venezuelan President Maduro in the wake of the controversial elections for the new Constituent Assembly. This comes a week after the US put sanctions on 13 other Venezuelan nationals. Still, the US has so far refrained from taking measures that would harm Venezuela’s oil industry. Such a move would likely hasten a default scenario. |

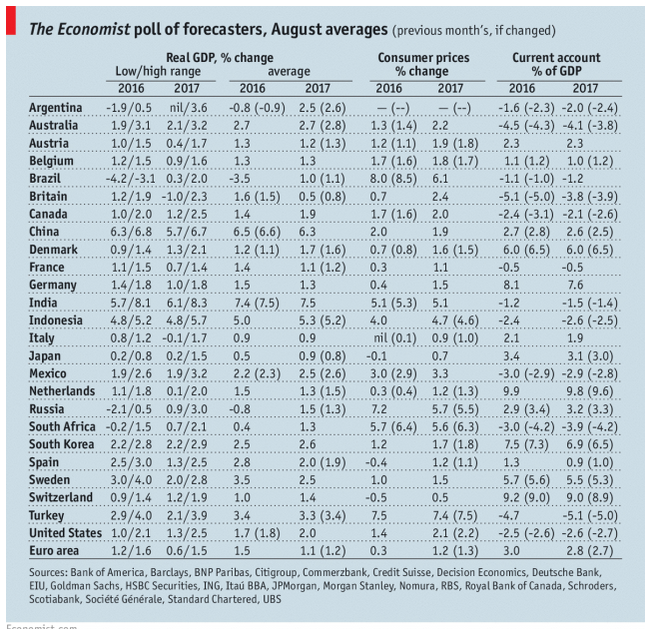

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin