Summary: FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to be slowing. The UK economy was unable to recover much after a soft Q1. The Japanese economy is still not generating price pressures, but growth, led by the export/industrial production capex, is also fueling somewhat better consumption. The Federal Reserve meeting is not live in the sense that anyone

Topics:

Marc Chandler considers the following as important: EUR, Featured, Federal Reserve, FX Trends, GBP, inflation, JPY, newsletter, OPEC, U.K., USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Summary:

FOMC is the highlight of the week.

Early look at July inflation in Europe may see less pressure.

Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures.

The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to be slowing. The UK economy was unable to recover much after a soft Q1. The Japanese economy is still not generating price pressures, but growth, led by the export/industrial production capex, is also fueling somewhat better consumption.

The Federal Reserve meeting is not live in the sense that anyone expects a change in the policy of any kind. For reasons beyond our ken, the Federal Reserve insists on making changes only at the half of the FOMC meetings which are followed by a press conference. Since there are several workarounds, including, as we have suggested, holding press conferences after every meeting, which the ECB and BOJ already do, for example.

In any event, the market understands full well where the Fed is. It is getting close to allowing its balance sheet to begin shrinking. After raising rates in March and June, officials are not ready to go again: Not in July and not September. December is a closer call. The softer price pressures rather than, the weaker growth impulses become the focal point in Q2. It will take a few months of data to assuage these concerns. The main argument that what the headwind on prices is transitory seems to assume that decline in prices is narrow. Breadth indicators of price changes, therefore, be more important than usual in the current context. Sure enough, the diffusion indicators for the CPI were narrow, until the recent June reading.

When the balance sheet issue was being discussed, NY Fed President Dudley suggested that the central bank may have a brief pause in its efforts to normalize the Fed funds target rate around the time that it decides to begin allowing the balance sheet to shrink. This still seems the most likely scenario. Given the apparent consensus to begin not reinvesting in full the proceeds from maturing issues sooner rather than later, the September FOMC meeting is a compelling venue to make such an announcement. Deferring a rate decision until the December meeting, by which time the inflation picture may clarify, seems prudent.

One of the consequences of this scenario is that it would allow Fed officials to talk more about why the core inflation measures have weakened. An FOMC statement that does not show more puzzlement, if not a concern, risks a more dramatic reaction a couple of days later when the first estimate of Q2 GDP is reported. The GDP price deflator is expected to slow to 1.3% from 1.9%, and, potentially of greater importance; the core PCE deflator may slow more dramatically–to below 1% from 2.0% in Q1. At the same time, these GDP figures are reported, the US will release its Q2 estimate for Employment Cost Index, a broader measure of labor costs (includes wages and benefits), which is also expected to show no acceleration in what is understood to be a key driver of core inflation.

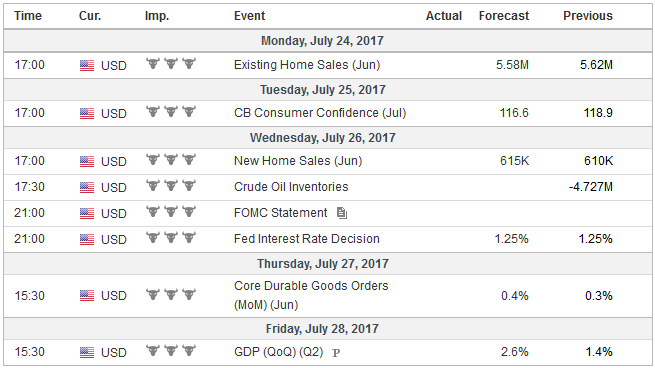

United StatesUS earnings season kicks into high gear with nearly 20% of the S&P 500 reporting in the week ahead. Among the highlights include Amazon, Facebook, Alphabet, Caterpillar, GM, and Chipotle. With about a third already reporting, it appears that earnings growth is on track for around a 10% pace. Fund managers who push back against claims that the market is overvalued point to the strong earnings growth underpinning prices. Despite investors’ preference for European shares over the US, we note that the S&P 500 has begun outperforming the Dow Jones Stoxx 600–5.75% over the past three months. Meanwhile, the summer drama will continue in Washington, as President Trump’s son, son-in-law and former campaign manager are set to testify before Senate committees next week. News that Exxon was fined $2 mln last week for violating sanctions against Russia, while Secretary of State Tillerson was the CEO is an additional distraction from the economic agenda that is beginning to press. Leaving aside health care reform, the infrastructure initiative, and tax reform, the constraints of the debt ceiling are already evident in the T-bill market, and the FY2018 fiscal year begins in a little more than two months. |

Economic Events: United States, Week July 24 |

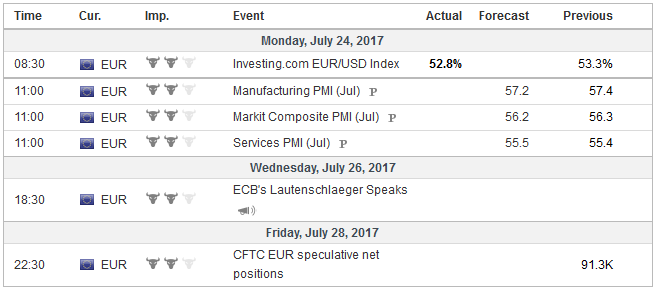

EurozoneECB President Draghi signaled that central bank would reconsider policy at the September meeting when officials return from summer holidays, and new staff forecasts will be available. Draghi’s suggestion that the market over-interpreted his “reflation” comment at the Sintra conference implies that the ECB may have been somewhat surprised by the market’s reaction. Nevertheless, Draghi showed barely any concern about the rise in European interest rates and the euro’s appreciation. Money supply growth (M3) is expected to have expanded at a steady pace of 5% over the past year. through June. The Bank Lending Survey, released on July 18, confirmed that improvement in credit conditions. Lending is slowly improving, and there has been a small pickup in demand from non-financial businesses. The flash PMI for the eurozone will also be released. It is expected to soften slightly. Country-data may be more interesting than the aggregate data. In particular, Germany, France, and Spain offer preliminary looks at July inflation. On a monthly basis, consumer prices may have eased, but the year-over-year rates are expected to be little changed at 1.4%, 0.8%, and 1.6% respectively. Only the German reading is changed from the June pace and by 0.1% at that. France and Spain also report early estimates of Q2 GDP. A 0.5% quarterly expansion in France would lift the year-over-year rate to 1.6% from 1.1%, which would be the quickest pace since Q3 11. Spain’s economic growth remains among the strongest in the OECD. A 0.9% Q2 expansion would translate to a little more than a 3% year-over-year pace. |

Economic Events: Eurozone, Week July 24 |

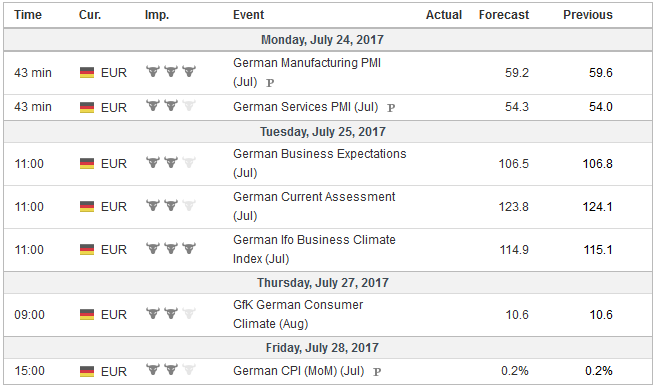

GermanyThe German 10-year Bund yield will begin the new week carrying over a six-day decline. The yield has returned to the breakout level of 50 bp. The technical indicators of the September 10-year Bund futures contract warn of additional gains (lower yields) in the period ahead. We suspect there is potential toward 40 bp. |

Economic Events: Germany, Week July 24 |

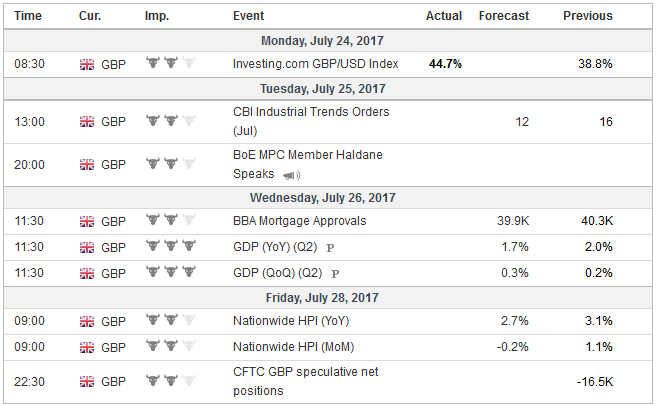

United KingdomThe UK reports Q2 GDP. It is expected to remain lackluster. After a 0.2% pace in Q1, the British economy may have expanded by 0.3% in Q2. Still, the year-over-year pace would still slow from 2.0% in Q1 to 1.7%. A weak US dollar environment may conceal sterling’s underlying weakness. Since the middle of the month, it has depreciated two percent on a trade-weighted basis. The euro has returned to the GBP0.9000 area, having had finished Q1 below GBP0.8500. Sterling also appears to be rolling over against the yen. It was turned back from JPY148 around the middle of the month, which is where turned from in May as well. Sterling fell every day last week against the yen, and technical potential extends toward JPY144. |

Economic Events: United Kingdom, Week July 24 |

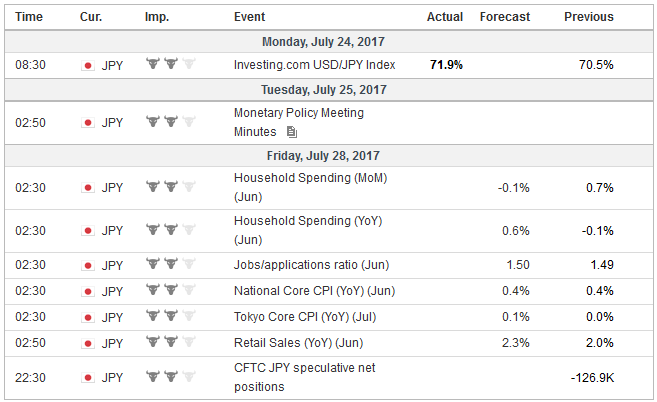

JapanThe market will likely learn very little from Japan next week. Headline inflation and the core rate, which excludes fresh food, likely remained unchanged in June at 0.4%. However, excluding fresh food and energy, the rate may have dipped to -0.1% from zero. Contrary to the claims, the truly stable price environment does not necessarily preclude consumption. In fact, if the consensus is right, overall household spending will turn positive for the first time since in 16 months. Meanwhile, the labor market remains tight. The unemployment rate is expected to tick down to 3.0% from 3.1%, and the jobs-to-applicant ratio may edge higher. Lower yields would seem to favor the yen playing some catch-up. The dollar fell 0.7% against the yen before the weekend, its largest single-day decline since early June. There is scope for a third consecutive week of a little more than 1% fall, which would take the dollar toward JPY110. The euro may have reversed lower against the yen before the weekend after having found offers in front of the high seen earlier this month. OPEC’s monitoring committee meets in Russia at the beginning of the week. Private estimates point to increased OPEC output, not all of which is coming from Libya and Nigeria, which were excluded from the quotas. Efforts to coax them into capping output seem to have fallen on fallow fields. Ecuador’s decision to drop out of the quota system, though not significant in terms, it is a timely reminder that the agreement to cut output is finite, fragile, and does not appear to be particularly effective. |

Economic Events: Japan, Week July 24 |

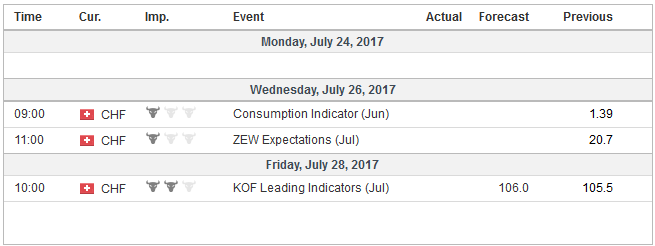

Switzerland |

Economic Events: Switzerland, Week July 24 |

Tags: #GBP,#USD,$EUR,$JPY,Featured,Federal Reserve,inflation,newsletter,OPEC,U.K.