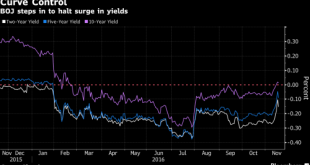

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »“Subtle forward guidance”: The marriage between best practice central banking and commodity markets

In the years following the 2008 crash and today, the use of forward guidance from central banking policy makers has become increasingly important. What this nonsense ultimately has translated into is a ridiculous track record in posting upbeat assessments on the economic environment, aimed at trying to fool the marginal investor into believing “there are no need for worry, central bankers have everything under...

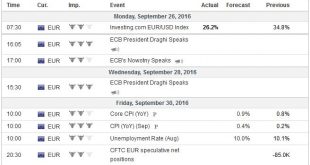

Read More »FX Weekly Preview: Politics to Overshadow Economics in the Week Ahead

The major central banks have placed down their markers and have moved to stage left. There are the late-month high frequency data, which pose some headline risks in the week ahead. The main focus for most investors will be on several political developments. The first US Presidential debate is wild card, in the sense that the outcome is unknown. In recent weeks, the polls have drawn close. In early August, Nate Silver’s...

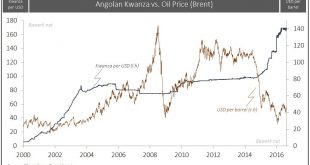

Read More »The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

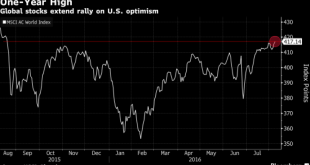

Read More »S&P To Open At New Record High As Commodities Rise, China Trade Disappoints

The meltup continues with the S&P500 set to open at new all time highs as futures rise 0.2% overnight, with European, Asian stocks higher, as job data pushed MSCI Asia Pacific Index towards highest close since Aug. 2015. Germany, U.K. economic data seen positive, with dollar, oil rising, and gold declining. Global equities advanced with commodities and emerging markets on speculation the U.S. economy is strong enough to sustain growth while only triggering a gradual increase in interest...

Read More »The World’s Central Banks Are Making A Big Mistake

Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »Oil: The Great Rebalancing

On June 8, the price of Brent crude ticked above $50 a barrel for the first time since August 2015. But the new $50-plus era came to an end two days later, amid a broader selloff that affected multiple asset classes. Energy analysts with Credit Suisse’s Global Markets team point out, however, that both supply (which is shrinking) and demand (which is growing steadily) point to firming oil prices ahead. Indeed, the bank’s analysts think that after two years of oversupply, the crude oil market...

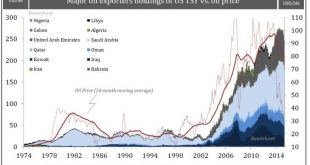

Read More »Saudi-Arabia: Peg or Banking Crisis?

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More »OPEC’s Game within a Game

The fact OPEC just agreed to agree on nothing in Vienna isn’t particularly surprising given Doha wounds are still festering from the last attempt at ‘petro-diplomacy’. But the engagement ultimately has to been knocked up as a partial success for Saudi Arabia, where it’s managed to put itself back at the centre of cartel politics by thawing the ‘freeze discussion’ on Riyadh’s terms. Confused? Don’t be. As we flagged in OPEC Politics, Doha’s failure left a very dangerous door open for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org