Summary:

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading.

Europe's Stoxx 600 rose 0.4% with miners and energy producers trimming losses, as crude pared a drop of as much as 1.5 percent after the IEA forecast, Bloomberg reports. Asian equities fell. New Zealand’s dollar surged to a one-year high after the country’s central bank cut interest rates and signaled a more gradual easing path than some investors had anticipated. Nickel snapped a four-day advance. Ukraine’s 2019 Eurobond fell the most since June amid signs tension is increasing with Russia.

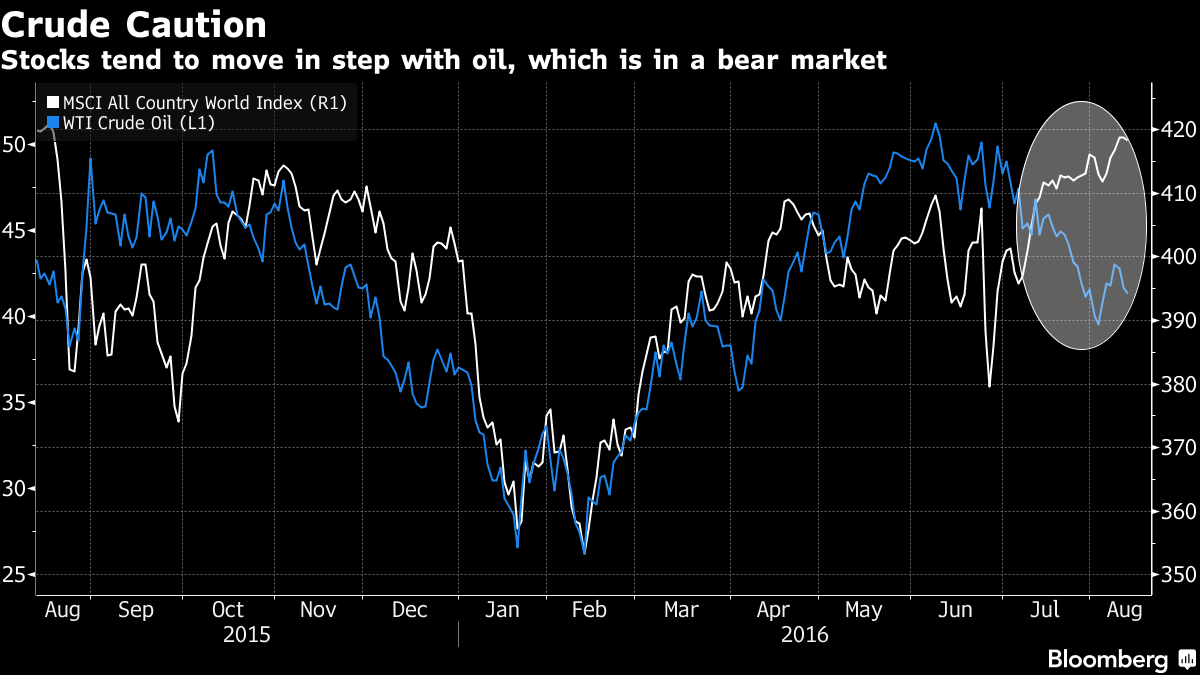

The modest rebound in oil could not have come at a more important time, just as the black gold was sliding and set to retest the support level, below which JPM believes SWF would resume liquidation.

Topics:

Tyler Durden considers the following as important:

Abenomics,

Bank of England,

Bear Market,

BOE,

Central Banks,

Chrysler,

CPI,

Crude,

Equity Markets,

European Central Bank,

Federal Reserve,

fixed,

Ford,

Foreign Central Banks,

France,

Freddie Mac,

Futures market,

Gilts,

Hong Kong,

Housing Market,

Initial Jobless Claims,

International Monetary Fund,

Iran,

Ireland,

Italy,

Japan,

Jim Reid,

Market Conditions,

Market Sentiment,

Market Share,

Mexico,

natural gas,

New Zealand,

OPEC,

Price Action,

RANSquawk,

Reality,

Saudi Arabia,

Shenzhen,

Twitter,

Unemployment,

Unemployment Benefits,

World Gold Council,

Yen,

Yuan,

Zurich

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the

IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading.

Europe's Stoxx 600 rose 0.4% with miners and energy producers trimming losses, as crude pared a drop of as much as 1.5 percent after the IEA forecast,

Bloomberg reports. Asian equities fell. New Zealand’s dollar surged to a one-year high after the country’s central bank cut interest rates and signaled a more gradual easing path than some investors had anticipated. Nickel snapped a four-day advance. Ukraine’s 2019 Eurobond fell the most since June amid signs tension is increasing with Russia.

The modest rebound in oil could not have come at a more important time, just as the black gold was sliding and set to retest the $40 support level, below which JPM believes SWF would resume liquidation. Crude entered a bear market last week and the outlook remains clouded as Saudi Arabia and Iran refuse to give ground in their war for market share, with both boosting output just days after OPEC announced an informal meeting to discuss ways to stabilize falling prices. Exacerbating the problem is global demand, which remains weak even as policy makers from Frankfurt to Tokyo engage in unprecedented stimulus to boost their economies. A strengthening jobs market in the U.S. has yet to convince traders that the world’s biggest economy is strong enough for the Federal Reserve to raise interest rates this year.

"The biggest risk to the market at the moment is a huge drop in oil prices,” James Woods, strategist at Rivkin Securities in Sydney, said by phone. “Recent gains, particularly in U.S. equities, are becoming exhausted. We’ll see some near-term weakness in the coming weeks. Investors are likely to be buying on these dips as central bank policies remain supportive of equities.”

In another reminder that Brexit may not be contained, a gauge of U.K. home sales pointed to the fastest decline in transactions since the global financial crisis in 2008, Royal Institution of Chartered Surveyors data showed on Thursday. As a result, sterling snapped lower and cable dropped below 1.3000, trading at 1.296 at last check. Singapore cut the top end of its 2016 growth forecast after the economy expanded less than previously estimated in the second quarter.

Asia started off on the wrong goot, with the MSCI Asia Pacific excluding Japan Index falling 0.2 percent, down from a one-year high. Australia’s S&P/ASX 200 Index dropped 0.6 percent as benchmarks lost ground in Shanghai and Taiwan. Hong Kong’s Hang Seng Index climbed 0.4%, led by financial companies, after the head of the city’s bourse operator told CNBC an exchange trading link with the Chinese city of Shenzhen will soon be announced. Hong Kong Exchanges & Clearing Ltd. jumped 2.9 percent, its biggest increase since May. The MSCI Emerging Markets Index slipped 0.1 percent after advancing five days to the highest close since July 2015. Gulf stocks declined on Thursday, with the Bloomberg GCC 200 Index losing 0.4 percent, trimming this week’s gain to 1.3 percent.

The rebound in the commodity complex translated into strength for European equities, as the Stoxx 600 rebounded from a decline of as much as 0.2%, as miners and oil companies came off session lows. Volume remains lethargic, and the number of shares changing hands was about a third less than the 30-day average according to Bloomberg. Zurich Insurance Group AG added 4.2 percent after saying earnings fell less than projected. KBC Group NV advanced 5.5 percent after posting better-than-expected profit and revenue and cutting its forecast for 2016 loan-loss provisions in Ireland. K+S AG, Europe’s biggest potash producer, plunged 9.2% after saying it expects lower earnings in 2016. Thyssenkrupp AG lost 0.7 percent after Germany’s biggest steelmaker reported a decline in quarterly profit.

S&P 500 futures rose 0.2% after the underlying equity benchmark declined 0.3 percent on Wednesday, retreating from a near-record high.

The yield on 10Y U.S. Treasuries rose two bps to 1.51%. It fell on Wednesday as 10-year notes were auctioned at the lowest yield in four years amid near-record demand from a group of buyers that includes foreign central banks and mutual funds. The U.S. is scheduled to sell $15 billion of 30-year bonds Thursday. U.K. 10-year bonds were little changed, after a three-day rally in the securities pushed yields to a record low on Wednesday. Gilts have been boosted this week on signs the Bank of England may need to pay higher prices to purchase enough to meet the target for its expanded quantitative-easing program.

Investors will look Thursday to earnings from retailers including Macy’s Inc. for indications of the health of the American consumer, as well as the latest weekly jobless claims report, where 265k Americans are expected to have filed unemployment benefits.

* * *

Markets Snapshot

- S&P 500 futures up 0.2% to 2178

- Stoxx 600 up 0.4% to 345

- FTSE 100 down 0.4% to 6841

- DAX up 0.5% to 10704

- German 10Yr yieldunchanged at -0.11%

- Italian 10Yr yield up less than 1bp to 1.08%

- Spanish 10Yr yield down less than 1bp to 0.94%

- S&P GSCI Index down less than 0.1% to 341.5

- MSCI Asia Pacific down 0.2% to 139

- Nikkei 225 closed

- Hang Seng up 0.4% to 22581

- Shanghai Composite down 0.5% to 3003

- S&P/ASX 200 down 0.6% to 5508

- US 10-yr yield up less than 1bp to 1.51%

- Dollar Index up 0.18% to 95.82

- WTI Crude futures down 0.6% to $41.47

- Brent Futures down 0.4% to $43.88

- Gold spot down less than 0.1% to $1,346

- Silver spot up 0.2% to $20.20

Global Headline News

- Valeant Reported to Be in Criminal Probe Over Pharmacy: Prosecutors are pursuing legal theory that Valeant, its mail-order pharmacy, Philidor Rx Services LLC, allegedly defrauded insurers by hiding their close relationship, WSJ said.

- Wal-Mart Sells Mexico Clothing Chain to Liverpool for $1b: WMT’s Mexican unit agreed to sell Suburbia clothing chain to El Puerto de Liverpool in deal valued at MXN19b; WMT Said to Require Jet.com CEO to Stay for 5 Yrs: Recode

- Williams Partners Sees $820m Upfront Cash From Chesapeake Pact: Co. says deal will bring back natural gas exploration there, make money-losing wells profitable again.

- Cheap Loonie Not Helping Business Case for Canada: GM: Ford, Fiat Chrysler, GM are starting negotiations with Unifor, which represents ~23k workers those at 3 cos., against backdrop of declining production in Canada.

- Marcato Pushes Goodyear to Return $4.5b to Investors: WSJ: Activst seeking returns over next 3 years.

- Twitter Ruled Not Liable for ISIS Tweets Leading to Attack: U.S. law protects Twitter from being treated as publisher of any information provided by another content provider, federal judge in S.F. ruled.

- Alphabet GV CEO Maris to Leave Venture Capital Arm: Maris’ last day to be Friday.

* * *

Looking at regional markets, we start in Asia which traded mixed following the energy-triggered weakness in the US, while Chinese markets outperformed on renewed Shenzhen-Hong Kong stock connect optimism. ASX 200 (-0.6%) was severely pressured and retreated below 5500 weighed on by declines in energy and financials after WTI crude futures suffered from an unexpected build in DoE inventories, while financials were down on bad loan concerns with Westpac stating its stressed assets rose in the June quarter. Chinese markets pared gains to close lower Shanghai Comp (+0.1%) and Hang Seng (+0.4%) despite reports the CSRC are to establish a team to organize preparations for the Shenzhen-HK stock connect. As a reminder, Japanese markets were closed for Mountain Day.

Top Asian News

- Singapore Cuts Top End of 2016 GDP Forecast on Weak Outlook: Economy grew less than previously estimated in 2Q

- New Zealand Cuts Interest Rates to Record Low; Kiwi Soars: Governor Wheeler signals at least one more rate reduction

- BOK Holds Key Rate at Record Low as It Assesses Economy: Governor Lee Ju Yeol says central bank still has policy room

- Australia Bars Power Grid Sale to Foreigners on Security Concern: State Grid Corp., CKI are vying for state distributor Ausgrid

- China Mobile Profit Beats Estimates on 4G Subscriber Gains: World’s largest phone carrier added 116m 4G accounts

- Pitfalls of Global Hunt for Yield Highlighted in Mongolia Crisis: Govt 2022 bonds fall most on record after FinMin warning

European bourses trade modestly higher with the Euro Stoxx 50 cash up 0.2%, despite the FTSE cash (-0.5%) being the laggard due to a large amount of ex -Dividends trimming around 36 points of the index. 12 out of 19 Stoxx 600 sectors rise with construction, food & beverages outperforming and basic resources, oil & gas underperforming. The SMI is up 0.2% after index heavy weight Zurich Insurance (+3.8%) exceeded expectations with their pre-market earnings update. Fixed income markets are still pushing higher with Bunds hitting 168.0 with a lack of supply and thin market conditions taking their toll. Elsewhere, Gilt yields on the long and short end of the curve marginally increased, after falling for three straight days with the 2, 10 and 30 year all climbing by 0.01 basis point.

Top European News

- Brexit Hits U.K. Housing as

Property Sales Drop Most Since 2008: Brexit undermining near-term

outlook for U.K. housing market, with both demand, sales dropping in

July.

- Sports Direct Worker Exodus Adds to Woes for Founder

Ashley: Turnover among Sports Direct’s salaried U.K. staff rose by more

than 300bps last year to 22%.

- Symrise Profit Beats as CEO

Bertram Boosts Goal for Margins: Co. reported profit that beat analysts’

estimates and said its target for profitability is now set at >20%

- French

Voters’ Islamism Fears Put Hollande in Political Bind: He’s stuck

between desire for tougher measures to provide security amid historic

reluctance by his own party to impinge on basic democratic freedoms.

In FX, the kiwi rose as high as 73.41 U.S. cents, its strongest level since May 2015, before trading 0.4 percent stronger on the day at 72.32 after the Reserve Bank of New Zealand reduced its key rate by 25 basis points to 2 percent. While the cut was expected by all 16 economists surveyed by Bloomberg, the swaps market had priced in a 20 percent chance of a half-point reduction. “Even though the 25 basis-point rate cut was fully priced in, there was uncertainty that the RBNZ could even have opted for a 50 basis-point rate cut,” said Angus Nicholson, a market analyst in Melbourne at IG Ltd. “Once the 50 basis-point fears turned out to be unfounded the kiwi dollar promptly rallied.” The Bloomberg’s dollar index, a gauge of the greenback versus 10 major peers, rose 0.1 percent. It ended the last session at a seven-week low as the probability of a U.S. interest-rate increase this year slipped by four percentage points to 41 percent in the futures market. The MSCI Emerging Markets Currency Index dropped 0.1 percent. South Korea’s won snapped a five-day advance, weakening 0.5 percent after reaching its strongest level in more than a year on Wednesday. Bank of Korea Governor Lee Ju Yeol kept the benchmark interest rate at 1.25 percent and said the authority has scope for more policy adjustments. The ringgit slid 0.5 percent as declines in crude prices dimmed prospects for Malaysia, the region’s only major net oil exporter. The MSCI currency gauge has climbed 3.6 percent since China’s surprise yuan devaluation a year ago roiled global markets. Brazil’s real led gains in the past 12 months, up 11 percent, followed by South Korea’s won with a 7.2 percent jump. The biggest loser was Argentina’s peso, declining 37 percent after the country scrapped currency controls. The yuan has dropped 4.8 percent in the period.

In commodities, The Bloomberg Commodity Index, which measures returns on raw materials, fell for a third day as oil and most base metals declined. West Texas Intermediate crude rebounded from session lows after dropping 1.2% to $41.21 a barrel in early London trading, as official data showed U.S. supplies increased by 1.06 million barrels last week. Analysts surveyed by Bloomberg had forecast a drop of 1.5 million barrels. Weakness in global crude markets may persist as demand slows seasonally and fuel inventories remain abundant, the Organization of Petroleum Exporting Countries said Wednesday. Saudi Arabia, the world’s largest crude exporter, boosted oil output to a record 10.67 million barrels a day in July, according to OPEC data published Wednesday. In Iran, production has risen to 3.85 million barrels a day -- the highest since 2008 -- according to comments from Oil Minister Bijan Namdar Zanganeh reported by the Fars news agency. Declines in oil hurt sentiment on demand for commodities, ending a four-day rally in nickel. The metal dropped 1.2 percent to $10,735 a metric ton after Monday touching a one-year high. Zinc and tin lost at least 0.3 percent. “Crude oil’s damping market sentiment for metals,” Zhao Qiannan, an analyst with Beijing Newnie E-commerce Co., said by phone from Shanghai.

On today's US calendar we will see the initial jobless claims numbers (265k expected; 269k previous) for the first week of August and the import price data for July (-0.4% mom expected; +0.2% previous). DB economist Joe LaVorgna notes that claims have hovered around multi-decade lows for the past four months, thus indicating that the labor market has likely reached full employment. Given the present stage of the business cycle, he advises keeping a close watch for any potential spike in claims given the existing pressure on corporate profit margins.

* * *

Bulletin Headline Summary from RanSquawk and Bloomberg

- European equities trade mostly higher, albeit modestly so with newsflow once again remaining on the light side

- The main mover in FX overnight was the NZD after the RBNZ cut rates by 25bps as expected but said there was no discussion of a 50bps cut

- Looking ahead, highlights include the weekly US jobs data

- Treasuries slightly lower in overnight trading, European equities near seven-week high (Japan closed for Mountain Day)while oil and gold move lower; auctions conclude with $15b 30Y bonds, WI 2.25%, last sold at 2.172% in July, lowest 30Y auction stop on record.

- New Zealand’s central bank cut interest rates to a fresh record low of 2% and flagged more easing to combat low inflation, disappointing some investors who were looking for a more aggressive signal. The local dollar surged

- The central bank said markets missed the downside risks to the outlook for interest rates in Thursday’s policy document and got ahead of themselves by driving the currency to a one-year high

- The European Central Bank may need to rely more on asset purchases for monetary stimulus as its negative interest rates approach the limit of their effectiveness, economists at the International Monetary Fund said

- BOE’s asset purchase plan has U.K. gilts storming down the path carved out by their Japanese peers as yield premium offered by 10-year gilts over similar-maturity Japanese bonds shrank to the lowest on record

- South Korea’s central bank held its key interest rate at a record low 1.25% as board members deferred further policy action until they have a clearer picture of the economy’s path

- Investors who piled into some of the world’s riskiest bonds to escape near-zero interest rates got a reality check on Wednesday when Mongolia sent its debt plunging by sounding the alarm on its economic crisis

- Japanese distrust of Abenomics, negative interest rates and a rising yen have all combined to boost their investment in bars and coins, the World Gold Council said in a report

US Event Calendar

- 8:30am: Import Price Index, July, est. -0.4% (prior 0.2%)

- 8:30am: Initial Jobless Claims, Aug. 6, est. 265k (prior 269k)

- 9:45am: Bloomberg Consumer Comfort, Aug. 7 (prior 43)

- 10am: Freddie Mac mortgage rates

- 10:30am: EIA natural-gas storage change

DB's Jim Reid concludes the overnight wrap

This time last year holidays were starting to be disturbed by China's stealth devaluation. A year on things are a lot quieter on a global scale but if there are any long Gilt traders and investors on holiday at the moment I suspect they'll be close to a phone or a screen. Or maybe they're all on holidays without phones which is why the BoE couldn't buy enough bonds back on Tuesday. In my first job 21 years ago I was a sales person on the sterling credit desk and the long Gilt traders were the scariest people on the floor. They were also the least likely to own a mobile phone. I suspect things have changed a lot over the years but I still sometimes have nightmares about them shouting at me.

Indeed Gilts continue to be the main story this week. 10Y and 30Y Gilt yields fell by -6bps and -13bps yesterday to hit fresh all-time lows as reverberations continued post Tuesday's failed reverse auction at the long-end. Yesterday we highlighted that given how much 30 year yields Gilts are above core European 30 year yields, and given how technical the long-end of the Gilt market is, and that the first reverse auction at this maturity failed it seems inevitable that further convergence is the order of the day for now.

We would highlight however that things are easier shorter down the curve for the BoE as it reported that it received offers for 4.71 times the debt it planned to buy yesterday in the 7-15 year range. Gilts yields briefly rose after the afternoon news of a more successful QE operation but rallied again into the close. There were even a couple of short-dated issues (March 2019 and March 2020) that briefly traded at negative yields yesterday thus welcoming a new member to a growing global club.

The BoE also noted that Tuesday’s shortfall would be incorporated into the second half of the six-month QE programme announced in November. Whether long end UK investors will have any additional appetite to sell at that point is debatable given how much liability matching goes on in this part of the curve in the UK.

The shenanigans in the Gilt markets have helped kicked start a fresh rally in government bonds this week with US 10yrs now reversing most of the post payroll 9bps sell-off. A slight risk-off tone helped yesterday as US 10Y and Bund yields both fell by -3bps on the day. This has coincided with markets repricing the next Fed rate hike to May 2017 (from March 2017) although we were at December 2017 before payrolls. This slight repricing helped see increased downward pressure on the dollar (-0.51%). Gold benefited from these moves as it rose by +0.4% on the day. Oil had a bad day though falling by around 2.5% as US crude inventories rose 1.06m barrels against a decline of -1.5m expected.

Oil has fallen another 0.5% in Asia which seems to have impacted sentiment to a degree. Headline index price action is again relatively subdued. The Hang Seng is +0.19% with the Shanghai Comp -0.23%. Japan is closed for a holiday.

The Kiwi dollar is at a 1-year high as its central bank signalled a less aggressive easing trajectory than expected after cutting rate 25bps as expected.

The Asian session follows a slightly negative session yesterday. The STOXX 600 (-0.20%) fell from its highest level since the Brexit vote while the S&P500 (-0.29%) also dipped below recent all time highs. German equities (DAX -0.39%) fell after posting strong gains on Tuesday. The FTSE (+0.22%) did however manage to stay in positive territory and post gains for the fifth consecutive day. Credit markets largely saw spreads widen as moves tracked equity markets. Over in Europe iTraxx Main and Crossover both widened by +2bps and +5bps respectively. CDX IG and HY also edged wider.

Yesterday had little to offer in terms of new data. In Europe we got some soft industrial production (-0.8% mom vs. +0.1% expected; -0.5% previous) and manufacturing production (-1.2% mom vs. +0.2% expected; +0.1% previous) numbers out of France, with both indicating an unexpected decline in June. Over in the US we saw the June JOLTS survey that saw job openings tick up marginally and clock in just shy of expectations (5.624mn vs. 5.675mn expected; 5.514mn previous). The hiring rate and quits rates were essentially the same as in May, clocking in at 3.6% (3.5% previous) and 2.0% (2.0% previous) respectively. We'd be impressed if Yellen can decipher too much from one of her favourite indicators.

Moving onto what looks like another fairly quiet day today now. Firstly in Europe we have the final July CPI numbers for France (-0.4% mom expected; -0.4% previous) and Italy (-0.1% YoY expected; -0.1% previous), both of which are expected to remain in deflationary territory. Over in the US we will see the initial jobless claims numbers (265k expected; 269k previous) for the first week of August and the import price data for July (-0.4% mom expected; +0.2% previous). Our Chief US Economist Joe LaVorgna notes that claims have hovered around multi-decade lows for the past four months, thus indicating that the labor market has likely reached full employment. Given the present stage of the business cycle, he advises keeping a close watch for any potential spike in claims given the existing pressure on corporate profit margins.

In another reminder that Brexit may not be contained, a gauge of U.K. home sales pointed to the fastest decline in transactions since the global financial crisis in 2008, Royal Institution of Chartered Surveyors data showed on Thursday. As a result, sterling snapped lower and cable dropped below 1.3000, trading at 1.296 at last check. Singapore cut the top end of its 2016 growth forecast after the economy expanded less than previously estimated in the second quarter.

Asia started off on the wrong goot, with the MSCI Asia Pacific excluding Japan Index falling 0.2 percent, down from a one-year high. Australia’s S&P/ASX 200 Index dropped 0.6 percent as benchmarks lost ground in Shanghai and Taiwan. Hong Kong’s Hang Seng Index climbed 0.4%, led by financial companies, after the head of the city’s bourse operator told CNBC an exchange trading link with the Chinese city of Shenzhen will soon be announced. Hong Kong Exchanges & Clearing Ltd. jumped 2.9 percent, its biggest increase since May. The MSCI Emerging Markets Index slipped 0.1 percent after advancing five days to the highest close since July 2015. Gulf stocks declined on Thursday, with the Bloomberg GCC 200 Index losing 0.4 percent, trimming this week’s gain to 1.3 percent.

The rebound in the commodity complex translated into strength for European equities, as the Stoxx 600 rebounded from a decline of as much as 0.2%, as miners and oil companies came off session lows. Volume remains lethargic, and the number of shares changing hands was about a third less than the 30-day average according to Bloomberg. Zurich Insurance Group AG added 4.2 percent after saying earnings fell less than projected. KBC Group NV advanced 5.5 percent after posting better-than-expected profit and revenue and cutting its forecast for 2016 loan-loss provisions in Ireland. K+S AG, Europe’s biggest potash producer, plunged 9.2% after saying it expects lower earnings in 2016. Thyssenkrupp AG lost 0.7 percent after Germany’s biggest steelmaker reported a decline in quarterly profit.

S&P 500 futures rose 0.2% after the underlying equity benchmark declined 0.3 percent on Wednesday, retreating from a near-record high.

The yield on 10Y U.S. Treasuries rose two bps to 1.51%. It fell on Wednesday as 10-year notes were auctioned at the lowest yield in four years amid near-record demand from a group of buyers that includes foreign central banks and mutual funds. The U.S. is scheduled to sell $15 billion of 30-year bonds Thursday. U.K. 10-year bonds were little changed, after a three-day rally in the securities pushed yields to a record low on Wednesday. Gilts have been boosted this week on signs the Bank of England may need to pay higher prices to purchase enough to meet the target for its expanded quantitative-easing program.

Investors will look Thursday to earnings from retailers including Macy’s Inc. for indications of the health of the American consumer, as well as the latest weekly jobless claims report, where 265k Americans are expected to have filed unemployment benefits.

* * *

Markets Snapshot

In another reminder that Brexit may not be contained, a gauge of U.K. home sales pointed to the fastest decline in transactions since the global financial crisis in 2008, Royal Institution of Chartered Surveyors data showed on Thursday. As a result, sterling snapped lower and cable dropped below 1.3000, trading at 1.296 at last check. Singapore cut the top end of its 2016 growth forecast after the economy expanded less than previously estimated in the second quarter.

Asia started off on the wrong goot, with the MSCI Asia Pacific excluding Japan Index falling 0.2 percent, down from a one-year high. Australia’s S&P/ASX 200 Index dropped 0.6 percent as benchmarks lost ground in Shanghai and Taiwan. Hong Kong’s Hang Seng Index climbed 0.4%, led by financial companies, after the head of the city’s bourse operator told CNBC an exchange trading link with the Chinese city of Shenzhen will soon be announced. Hong Kong Exchanges & Clearing Ltd. jumped 2.9 percent, its biggest increase since May. The MSCI Emerging Markets Index slipped 0.1 percent after advancing five days to the highest close since July 2015. Gulf stocks declined on Thursday, with the Bloomberg GCC 200 Index losing 0.4 percent, trimming this week’s gain to 1.3 percent.

The rebound in the commodity complex translated into strength for European equities, as the Stoxx 600 rebounded from a decline of as much as 0.2%, as miners and oil companies came off session lows. Volume remains lethargic, and the number of shares changing hands was about a third less than the 30-day average according to Bloomberg. Zurich Insurance Group AG added 4.2 percent after saying earnings fell less than projected. KBC Group NV advanced 5.5 percent after posting better-than-expected profit and revenue and cutting its forecast for 2016 loan-loss provisions in Ireland. K+S AG, Europe’s biggest potash producer, plunged 9.2% after saying it expects lower earnings in 2016. Thyssenkrupp AG lost 0.7 percent after Germany’s biggest steelmaker reported a decline in quarterly profit.

S&P 500 futures rose 0.2% after the underlying equity benchmark declined 0.3 percent on Wednesday, retreating from a near-record high.

The yield on 10Y U.S. Treasuries rose two bps to 1.51%. It fell on Wednesday as 10-year notes were auctioned at the lowest yield in four years amid near-record demand from a group of buyers that includes foreign central banks and mutual funds. The U.S. is scheduled to sell $15 billion of 30-year bonds Thursday. U.K. 10-year bonds were little changed, after a three-day rally in the securities pushed yields to a record low on Wednesday. Gilts have been boosted this week on signs the Bank of England may need to pay higher prices to purchase enough to meet the target for its expanded quantitative-easing program.

Investors will look Thursday to earnings from retailers including Macy’s Inc. for indications of the health of the American consumer, as well as the latest weekly jobless claims report, where 265k Americans are expected to have filed unemployment benefits.

* * *

Markets Snapshot