We expect oil prices broadly to stabilise in 2017—but prices will continue to be affected by geopolitical shocks in the region, which will also create tremors on financial markets.Oil currently seems to have reached its fair value at around USD50 per barrel for Brent crude. We expect prices to average around USD55/b in 2017, while supply continues to adapt to sluggish demand. The agreement between OPEC members on 30 November and with non-OPEC producers a week later should reinforce the trend...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but… growth, and inflation, and supply cuts, and growth again… Well that de-escalated quickly… As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th. WTI CrudeWTI Crude - Click to enlarge “The OPEC cuts are going to prevent some of the mega-glut,” said Olivier Jakob, managing director at Petromatrix GmbH in Zug,...

Read More »FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

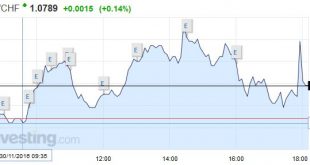

Swiss Franc The EUR/CHF improved today. The OPEC-non-OPEC agreement was the reason. Always when oil gets more expensive, the euro, gold, CHF and the whole “Asian bloc” rises against dollar and yen. Still it was astonishing that the euro improved more against USD than the inflation hedge CHF. Reason might be that investors now consider the ECB the most dovish central bank. Higher oil prices, however, may lead to more...

Read More »FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

Swiss Franc The EUR/CHF improved today. The OPEC-non-OPEC agreement was the reason. Always when oil gets more expensive, the euro, gold, CHF and the whole “Asian bloc” rises against dollar and yen. Still it was astonishing that the euro improved more against USD than the inflation hedge CHF. Reason might be that investors now consider the ECB the most dovish central bank. Higher oil prices, however, may lead to more...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked...

Read More »FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org