Argentinians are known for for slinging clever insults. Spaniards, for example, love Argentine “puteadas” so much that they created a website called “Curse like an Argentinian.” Now in the world of bad words, one stands out that, when received, mortally wounds the rival in the argument. It’s hard to recover after such an attack. Curiously, this insult can be written without violating the rules of decorum. It is the adjective “neoliberal.” This is how the local and...

Read More »USD/CHF technical analysis: Bulls struggle to extend the recovery beyond 0.9900 handle

Renewed US-China trade optimism helped regain some traction. The uptick lacked bullish conviction and warrants some caution. The USD/CHF pair stalled its recent pullback from levels beyond 200-day SMA and regained some traction on the last trading day of the week. Renewed trade optimism weighed on the Swiss franc’s safe-haven status and led to a modest recovery, though bulls struggled to extend the momentum beyond the 0.9900 handle. On the daily chart, the pair has...

Read More »FX Daily, November 15: Market Runs with US Line that US-China Deal is Close

Swiss Franc The Euro has risen by 0.39% to 1.0929 EUR/CHF and USD/CHF, November 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments by US presidential adviser Kudlow playing up the prospects of a trade agreement between the US and China, with other reports suggesting a key call be held today, is helping to underpin sentiment into the weekend. The MSCI Asia Pacific Index pared this week’s loss today, with...

Read More »Andréa Maechler – SNB: Klimarisiken für die Stabilität der Wirtschaft sind «mässig»

Andréa Maechler, Mitglied des Direktoriums der Schweizerischen Nationalbank. Bild: ZVG Aufgabe der Nationalbank sei die Gewährleistung der Preisstabilität, sagte SNB-Direktorin Andréa Maechler. Es sei nicht wünschenswert, dass die SNB “spezifische struktur- oder gesellschaftspolitische Ziele anstrebe”. Das Bestimmen der Ziele und der Lösungsansätze für den Übergang in eine kohlenstoffarme Wirtschaft müsse “im Rahmen eines Dialogs und aufgrund politischer...

Read More »Additional funds set aside for transalpine rail transport

An initiative, approved by voters 25 years ago, wants heavy-goods vehicles to be in put on rail in a bid to reduce transalpine traffic (Archive picture). (Keystone/Martin Ruetschi) The Swiss government has decided to earmark CHF180 million ($182 million) as part of a package to promote the transfer of heavy-goods transport from road to rail. In its bill to parliament, the government foresees an extension of payments to transport companies using freight trains until...

Read More »Time limit to exchange old banknotes eliminated

The decision applies to bills starting in the sixth series issued in 1976, which includes the 100-franc note with a portrait of architect Francesco Borromini. Banknotes as old as 1976 can soon be traded in at the national bank following a decision by the federal government to eliminate the 20-year time limit. The Swiss National Bank (SNB) issues a new series of banknotes every 15 to 20 years and removes the old notes from circulation. Six months later, the old notes...

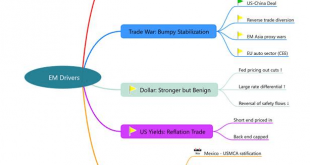

Read More »Emerging Market Risk Map

With year-end upon us, we review some of the key risks to EM assets and how we think they progress from here. In short, the two most significant downside risks would be a decisive improvement in Elizabeth Warren’s polling figures and an upset in the US-China trade negotiations. We expect a stronger dollar and higher yields in the near-term but with the upside for both capped, leaving us with a modestly favourable risk-taking environment. In terms of risk...

Read More »Why Friedman Is Wrong on the Business Cycle

According to an article in Bloomberg on November 5, 2019, Milton Friedman’s business cycle theory seems to be vindicated. According to Milton Friedman, strong recoveries are just natural after particularly deep recessions. Like a guitar string, the harder the string is plucked down, the faster it should come back up. Bigger recessions should lead to faster growth rates during the recoveries, to get the economy back to the pre-recession level of activity. In...

Read More »Congressman Prods Attorney General on Gold, Silver Trading Questions Ignored by CFTC

A U.S. representative who has been pressing the Treasury Department, Federal Reserve, and Commodity Futures Trading Commission (CFTC) with questions about the gold and silver markets has asked Attorney General William P. Barr to try intervene and get answers from the commission. In a letter dated November 1 and made public today, the U.S. representative, Alex W. Mooney, Republican of West Virginia, commends Barr for the Justice Department’s recent criminal...

Read More »Monetary Metals Leases Platinum to Money Metals Exchange

Scottsdale, Ariz, October 25, 2019—Monetary Metals® announced today that it has leased platinum to Money Metals Exchange® to support its U.S.-based business of selling precious metals at retail and wholesale. Investors earn 3% on their platinum, which is held in Money Metals’ inventory vault in the form of platinum coins, bars, and rounds. The lease fee is paid in gold. Monetary Metals has a disruptive model, leasing gold and silver—and now platinum—from investors...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637094243479377368-310x165.png)