To read or watch the news in today’s world is to be confronted with a wide array of stories about financial organization and financial institutions. News about central banks, interest rates, and debt appear to be everywhere. But it was not always the case that the financial sector and financial institutions were considered so important. Public policy in general was not always designed with a focus toward propping up banks, keeping interest rates low, and ensuring an...

Read More »Enough food for months, government assures

No need of hoarding and panic shopping, the Swiss government has reiterated. (© Keystone/Goran Basic) The Swiss authorities say there are food stocks available to consumers for more than four months to cope with the current coronavirus epidemic. “There is no reason to panic over food,” the government’s delegate for national economic supply,external link Werner Meier, said in an interview published on Wednesday in various newspapers belonging to the CH Media group....

Read More »FX Daily, March 18: Bonds Join Equities in the Carnage

Swiss Franc The Euro has fallen by 0.27% to 1.0537 EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again....

Read More »USD/CHF Price Analysis: Pullback from 50-day EMA shifts focus to weekly support trendline

USD/CHF slips from a two-week high. 61.8% Fibonacci retracement, 200-day EMA add to the resistances. While extending its U-turn from 50-day EMA, USD/CHF drops 0.30% to 0.9583 ahead of the European session on Wednesday. The pair currently declines towards 38.2% Fibonacci retracement of its fall from November 2019, at 0.9500. However, an upward sloping trend line since March 09, near 0.9470 now, could restrict further downside. In a case where the bears dominate...

Read More »SNB-Zinssenkung trotz Virus-Krise wohl kein Thema

Die SNB dürfte nach überwiegender Einschätzung von Experten bei ihrer Sitzung am Donnerstag ihren Zinssatz unverändert lassen – trotz des weltweiten Trends zu Zinssenkungen. Mit zwei Ausnahmen erwarten die 29 von Reuters befragten Finanzmarktteilnehmer und Analysten, dass die Währungshüter der Schweizerischen Nationalbank (SNB) den Leitzins auf dem seit mehr fünf Jahren geltenden Rekordtief von minus 0,75 Prozent belassen. Auch die Sichteinlagen von Banken bei...

Read More »Jim Bianco: “This Is One Of The Biggest Moments Of Truth In Financial Market History”

Authored by Christoph Gisiger via TheMarket.ch, To contain the economic and financial ramifications of the coronavirus pandemic, Central Banks are going all in. Jim Bianco, founder and chief strategist of Bianco Research, warns that this time, monetary policy might be unable to stop financial markets from collapsing. The Federal Reserve brings out the bazooka: It cuts the federal funds rate down to zero and will buy $700 billion in Treasuries and mortgage-backed...

Read More »Is GFC2 Over?

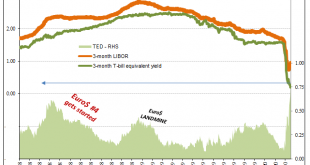

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either. Stocks rebounded because of “major helicopter stimulus” or because that’s just what stocks do during times like these. Some of the biggest up days have followed, and are often found in between, the greatest...

Read More »Money Supply Growth Climbs to 37-Month High

The money supply growth rate rose again in February, climbing to a 37-month high. The last time the growth rate was higher was during February of 2017, when the growth rate was 7.9 percent. During February 2020, year-over-year (YOY) growth in the money supply was at 7.49 percent. That’s up from January’s rate of 6.32 percent, and up from February 2019’s rate of 3.20 percent. The increase in money supply growth in February represents a sizable reversal of the trend...

Read More »Don’t Panic – Prepare

“Let’s Deal With The Facts Now” – Watch Interview Here ◆ Markets have collapsed around the world as we predicted as the ‘Giant Ponzi Everything Bubble’ meets the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and bond markets and banks may be next … “bank holidays”, bail-ins and currency resets are likely ◆ The virus is a final “snow flurry” which is unleashing the financial and economic avalanche. ◆...

Read More »FX Daily, March 17: Even Turn Around Tuesday is Flat

Swiss Franc The Euro has fallen by 0.21% to 1.0565 EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: While the markets are not as disorderly as they have been, the tone is fragile, and the animal spirits have been crushed. Australian stocks fell more than 10% last week and dropped another 9.7% yesterday before rebounding by almost 6% today to be one of the few Asia Pacific equity...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org