A pedestrian walks along an empty street in Haro, northern Spain, on March 9, 2020 (Copyright 2019 The Associated Press. All Rights Reserved) Swiss pharma giant Roche said on Tuesday it would send all of its 1,200 Spanish employees home starting from Wednesday to work remotely amid the coronavirus outbreak. “The company will maintain its normal activity and will guarantee, as until now, the supply of medicines to hospitals,” Roche said in a statement. The company...

Read More »If China Is the Problem, Can’t We At Least Have Free Trade with Everyone Else?

It remains unclear how much the stock market implosion of recent days will affect the larger economy. As David Stockman has noted often, the Wall Street economy is not synonymous with the Main Street economy, contrary to what the advocates of rampant bank bailouts and financialization would have us believe. Nevertheless, fear of a general crisis has driven Donald Trump to hint that tax cuts should be on the table. That’s good news, and the first place Trump should...

Read More »ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week. POLICY OUTLOOK It’s worth noting that even with the complicated voting rights system, a formal vote is not always needed to act. For instance, at the September 2019...

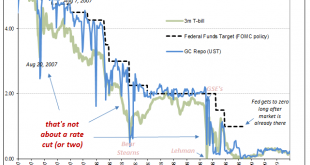

Read More »Low Rates As Chaos, Not ‘Stimulus’

Basic recession economics says that when you end up with too much of some commodity, too much inventory that you can’t otherwise sell, you have to cut the price in order to move it. Discounting is a feature of those times. What about a monetary panic? This might sound weird, but same thing. In other words, if you have too much cash (stay with me) and not enough takers, then the price you’ll accept to lend that cash must fall to accommodate the lack of demand. How...

Read More »Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn. The case of recession does seem to be one of those open...

Read More »Coronavirus hits Swiss train passenger numbers

Waiting for departure in Olten, northwestern Switzerland. (© Keystone / Peter Klaunzer) The number of people taking trains in Switzerland has fallen since the outbreak of the coronavirus, resulting in a huge financial hit, Swiss Federal Railways reported on Tuesday. The number of passengers across Switzerland has fallen by 10-20%, while the number of people travelling to Italy has dropped by 90% and those going to France has fallen by 60% compared to before the virus...

Read More »Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs Italy announced that it is extending travel curbs beyond just the north to the entire nation; further fiscal measures there will be seen Japan reported February...

Read More »FX Daily, March 10: Markets Stabilize after Body Blow

Swiss Franc The Euro has risen by 0.09% to 1.0597 EUR/CHF and USD/CHF, March 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump’s press conference today is expected to spell out in greater detail relief for households and businesses....

Read More »Swiss hotels poised for big losses after record 2019

Fewer tourists than usual on the Kappellbrücke, Lucerne. (Keystone / Alexandra Wey) The Swiss hotel industry could lose out on up to half a billion francs in 2020 due to the impact of Covid-19, the boss of the country’s tourism body has said. Martin Nydegger of Switzerland Tourism said on Monday that he expects the virus to account for some 2.1 million fewer overnight stays in Swiss hotels this year compared with 2019, amounting to financial losses of CHF532 million...

Read More »Why Sweden’s Negative Interest Rate Experiment Is a Failure

According to the Financial Times’s February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success. Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015. The reason given by central bank policymakers for the introduction of the negative interest was to counter deflation. Note that for the period November...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org