According to the Financial Times’s February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success. Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015. The reason given by central bank policymakers for the introduction of the negative interest was to counter deflation. Note that for the period November 2012 to December 2014 the average yearly growth rate of the consumer price index stood at –0.1 percent. According to the Financial Times analysts, it is still too early to judge whether negative rates have worked or have caused lasting damage to the economy and finance sector. From the perspective of

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| According to the Financial Times’s February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success.

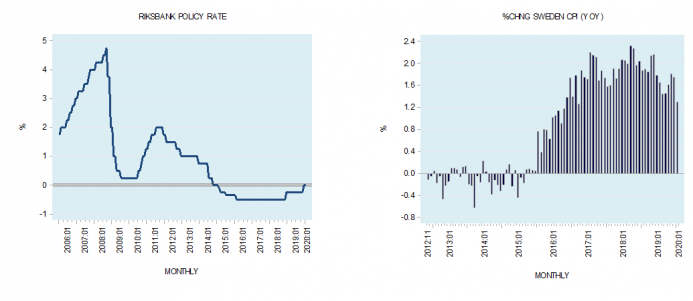

Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015. The reason given by central bank policymakers for the introduction of the negative interest was to counter deflation. Note that for the period November 2012 to December 2014 the average yearly growth rate of the consumer price index stood at –0.1 percent. According to the Financial Times analysts, it is still too early to judge whether negative rates have worked or have caused lasting damage to the economy and finance sector. From the perspective of countering price deflation as indicated by the yearly growth rate of the consumer price index (CPI), one could suggest that the policy was a success since the annual growth rate of the CPI after 2015 has visibly strengthened (see chart). |

|

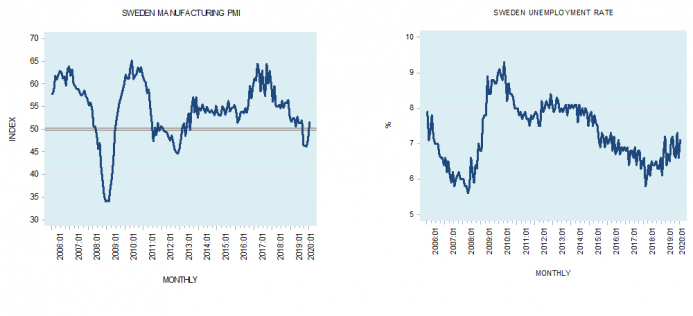

| From the economic activity perspective, results appear to be mixed. The manufacturing purchasing managers index (PMI) stood at 51.5 in January against 47.7 in the previous month (see chart). The unemployment rate, however, has jumped to 7.1 percent in January from 6.6 percent in the month before and 6.1 percent in January 2019 (see chart).

Even if the data were to continue showing that the risk of price deflation has diminished while the pace of economic activity in terms of various macroeconomic indicators has strengthened, this itself should not be used as confirmation that the negative interest rate experiment of Sweden’s central bank was a success. It is quite possible that the negative interest rate experiment has inflicted damages such as the misallocation of resources that cannot be detected by inspecting the data. In order to comprehend the possibility of such damages what is required is to establish the essence of what interest is all about. People Assign Higher Valuation to Present Goods versus Future GoodsAs a rule, people assign higher valuation to present goods versus future goods. This means that present goods are valued at a premium relative to future goods. Here is why. An individual who has just enough resources to keep himself alive is unlikely to lend or invest his paltry means. To this individual the cost of lending or investing is likely to be very high—it might even cost him his life if he were to consider lending part of his means. Therefore, under this condition he is unlikely to lend or invest even if offered a very high interest rate. We can also say that his time preference, i.e., his preference for the present over the future, is going to be extremely high. Once, however, his wealth starts to expand, the cost of lending, or investing, starts to diminish. Allocating some of his wealth toward lending or investment is now going to undermine to a lesser extent our individual’s life and well-being. Consequently, it is quite likely that his time preference for the present versus the future will not be as high as before. From this we can infer, all other things being equal, that anything that leads to an expansion in the real wealth of individuals gives rise to a decline in the interest rate, i.e., the lowering of the premium of present goods versus future goods—the lowering of the rate of time preference. Conversely, factors that undermine real wealth expansion lead to a higher interest rate (i.e., to the increase in time preference). |

|

According to Carl Menger:

Likewise according to Mises,

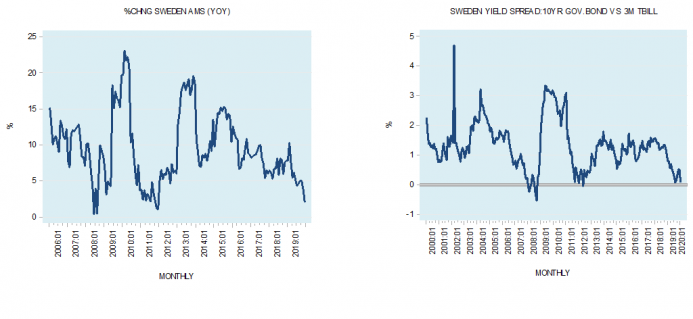

Note again that increases in real wealth tend to lower individuals’ time preferences whereas decreases in real wealth tend to raise time preferences. The link, however, between changes in real wealth and changes in time preferences is not automatic. Every individual decides how to allocate his wealth in accordance with his priorities. Changes In Time Preferences Mirrored Through Supply and Demand for MoneyThe lowering of time preferences (i.e., the lowering of the premium of present goods versus future goods) is likely to become manifest in a greater eagerness to invest real wealth. With the expansion in real wealth, people are likely to increase their demand for various assets—financial and nonfinancial—and lower their demand for money. This will raise asset prices and lower their yields, all other things being equal. Observe that while the increase in the pool of real wealth is likely to be associated with a lowering of the interest rate, the opposite is likely to take place with a fall in the pool of real wealth. People are likely to be less eager to increase their demand for various assets, thus raising their demand for money relative to the previous situation. With all other things being equal, this will manifest in the lowering of the demand for assets, lowering their prices and raising their yields. What Will Happen to Interest Rates If the Money Supply Increases?An increase in the supply of money, all other things being equal, means that those individuals whose money stock has increased are now much wealthier. Hence, this will likely set in motion a greater willingness by these individuals to purchase various assets. This leads to the lowering of the demand for money by these individuals, which in turn bids the prices of assets higher and lowers their yields. At the same time, the increase in the money supply also sets in motion an exchange of nothing for something, which amounts to the diversion of real wealth from wealth generators to non–wealth generators. The consequent weakening in the real wealth formation process sets in motion a tendency for interest rates to rise. Taking into account the damage inflicted on the wealth generating process, the increase in the growth rate of money supply, all other things being equal, sets in motion only a temporary fall in interest rates. (The decline in the interest rate cannot be sustainable because of the damage to the process of real wealth generation.) Conversely, a decline in the growth rate of money supply, all other things being equal, sets in motion a temporary increase in interest rates. Given that a fall in the money supply diverts now less real wealth from wealth generators to non–wealth generators, this strengthens the real wealth generation process, likely setting in motion a general fall in interest rates over the longer term. We can thus see that the key for the determination of interest rates is individuals’ time preferences, which are manifested in the interaction of supply and demand for money. Note that the central bank has nothing to do with the underlying interest rate determination in this framework. The policies of the central bank only distort interest rates, thereby making it much harder for businesses to ascertain what is really going on. Negative Interest Rates Create Economic ImpoverishmentWhen the central bank forces interest rates into negative territory, it forces wealth producers to exchange more for less. This leads to economic impoverishment of wealth generators and undermines the real wealth generation process. In addition, forcing interest rates into negative territory in opposition to consumers’ time preferences leads to the misallocation of real savings and to the menace of boom-bust cycles. Note that to reach this conclusion we do not require statistical support. This conclusion is derived from the axiom that individuals’ time preferences are positive. This means that in a free unhampered market interest rates cannot be negative. Hence, we do not require waiting for the statistical information to establish whether the negative interest rate scheme of the Swedish central bank was a success, for it cannot be so. Again, we know that individuals’ time preferences are positive, and this knowledge is sufficient to establish that whenever we observe negative interest rates they imply distortions in the markets. Given that Sweden’s central bank has kept interest rates negative for five years, this has likely inflicted severe damage to the process of real wealth formation. From this perspective, Sweden’s central bank’s experiment could be pronounced a failure. An Increase to 0 Percent from –0.25 Percent In the Policy Rate Has Laid the Foundation for a BustThe reversal of the negative interest rate policy since November of last year is likely to undermine various activities that have emerged on the back of the past negative interest rates. (The Swedish central bank raised the policy interest rate to 0 percent in December 2019 from –0.25 percent in the previous month. This comes after the interest rates were in negative territory for five years.) Consequently, a bust in these activities will likely result. A visible decline in the annual growth rate of Sweden’s money supply (specifically the AMS) raises the likelihood of a bust ahead (see chart). (Note that the yearly growth rate of the AMS fell to 2.1 percent in December from 3.9 percent in November and 7.8 percent in December 2018). The narrowing in the spread between the yield on the ten-year government bond and the three-month Treasury bill rate also seems to support this conclusion (see chart). |

- 1. Carl Menger, Principles of Economics (New York: New York University Press), p. 153–54.

- 2. Ludwig von Mises, Human Action, 3d rev. ed., p. 483–84.

Tags: Featured,newsletter