Swiss Franc The Euro has risen by 0.02% to 1.0515 EUR/CHF and USD/CHF, May 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly...

Read More »SNB COVID-19 refinancing facility expanded to include cantonal loan guarantees as well as joint and several loan guarantees for startups

The Swiss National Bank announced the establishment of the SNB COVID-19 refinancing facility (CRF) on 25 March 2020. This facility allows banks to obtain liquidity from the SNB by assigning credit claims from corporate loans as collateral. In so doing, the SNB enables banks to expand their lending rapidly and on a large scale. To date, the SNB has accepted as collateral for the CRF only credit claims in respect of loans guaranteed by the federal government under the...

Read More »The Way of the Tao Is Reversal

As Jackson Browne put it: Don’t think it won’t happen just because it hasn’t happened yet. We can summarize all that will unfold in the next few years in one line: The way of the Tao is reversal. This is the opening line of Chapter 40 of Lao Tzu’s 5,000-character commentary on the Tao, The Tao Te Ching. There are many translations of this slim volume, and for a variety of reasons I favor the 1975 translation by my old professor at the University of Hawaii, Chang...

Read More »Most think Switzerland is reopening fast or too fast, according to survey

© Hdesislava | Dreamstime.com A survey published on 7 May 2020, suggests only 36% of Swiss support the government’s calendar for reopening the country after the Covid-19 shutdown. 23% think the plan to reopen is too slow, while 42% think it is fast or too fast. However, 60% said they had confidence in the government. The most controversial aspects of the plan were reopening schools and reopening restaurants, bars and nightclubs. 37% thought restaurants were opening...

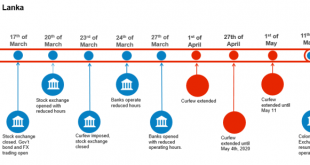

Read More »Restricted Market Trading Comments

Restricted Market Trading Comments By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations today following an extended period of closure. Foreign exchange trading is...

Read More »Three Reasons Why the Eurozone Recovery Will Be Poor

The eurozone economy is expected to collapse in 2020. In countries such as Spain and Italy, the decline, more than 9 percent, will likely be much larger than in emerging market economies. However, the key is to understand how and when the eurozone economies will recover. There are three reasons why we should be concerned: The eurozone was already in a severe slowdown in 2019. Despite massive fiscal and monetary stimulus, negative rates, and the European Central...

Read More »FX Daily, May 11: Quiet Start to New Week

Swiss Franc The Euro has fallen by 0.08% to 1.0514 EUR/CHF and USD/CHF, May 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week begins slowly in the capital markets. Many markets in the Asia Pacific region, including Japan, Hong Kong, and Australia, gained over 1%, but European and US shares are heavier. Benchmarks off all three regions rallied by 3.4%-3.5% over the past two weeks. Bond markets are...

Read More »Economic cost of pandemic will be enormous: SNB chief

Jordan insists the central bank can continue to defend the Swiss franc. (Keystone / Marcel Bieri) Coronavirus is costing between CHF11 billion and CHF17 billion a month, putting such a strain on the Swiss economy that it will take years to recover. Swiss National Bank (SNB) chairman Thomas Jordan has predicted the worst depression since the 1930s. In two newspaper interviews on Sunday, Jordan warned of significant job losses and an erosion of prosperity in the wake...

Read More »Swiss customs uncover blackmarket animal drugs scam

Among the drugs seized were hormones that increased milk production in cows. (© Keystone / Gaetan Bally) More than 200 farmers, many in Switzerland, are suspected of buying illegal medicaments for their livestock from a French blackmarket dealer. Swiss customs uncovered the scam when the veterinarian was stopped at the border with his car full of animal drugs. Swissmedicexternal link, the body that authorises medicaments in Switzerland, has issued 51 penalty notices...

Read More »Swiss tourism industry struggling for survival

Many hotel beds have been empty in the last few weeks. (© Keystone / Gaetan Bally) The Swiss tourism industry will take five years to recover from the coronavirus pandemic with around a quarter of companies in the sector fearing for their future. However, Martin Nydegger, head of Switzerland Tourism, believes something can still be salvaged for the industry this year. In an interview with the Schweiz am Wochenende newspaperexternal link, Nydegger referred to a survey...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org