Becoming Swiss can cost up to CHF4,000 in some cantons (Keystone) Naturalisation fees vary among Switzerland’s 26 cantons. This has caught the eye of the federal price watchdog, who doubts that the fees fall within the legal framework. The law on Swiss citizenshipexternal link stipulates that “the fees may not amount to more than is required to cover costs”. But for price watchdog Stefan Meierhans this is “more than questionable”, as he writes in his...

Read More »SWISS publishes flight timetable for June

Part of the Acropolis in Athens, one of the destinations where SWISS plans to expand its services (Keystone) After grounding most of its fleet because of Covid-19, Swiss International Air Lines will partially restart its flight operations in June and plans to operate up to 190 flights from Zurich and Geneva to 41 European destinations. The return to the skies would follow in stages, and the range of flights available will gradually be increased over the coming weeks,...

Read More »Dollar Firm as Risk-off Sentiment Intensifies

Risk-off sentiment has intensified; as a result, the dollar is getting some more traction Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%There have been growing discussions about negative rates in the UK; weak UK data, rising Brexit risks, and a more dovish BOE have taken a toll...

Read More »Ludwig von Mises & “Circulation Credit” Theory of the Trade Cycle

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] Starting with Carl Menger’s undisputed role in the “marginal revolution,” which ushered in subjective value theory, the Austrian school has made important contributions that have been absorbed into standard economic theory. However, the Austrian theory of the business cycle is still something unique to the school, differing not...

Read More »“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens. That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and...

Read More »FX Daily, May 14: Risk Appetites Wane

Swiss Franc The Euro has fallen by 0.08% to 1.0504 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have been gradually waning this week. US equity losses mounted yesterday after Tuesday’s late sell-off. Asia Pacific equities were off, with many seeing at least 1.5% drops. Europe’s Dow Jones Stoxx 600 is off a little more to double this week’s decline and leaves it in a...

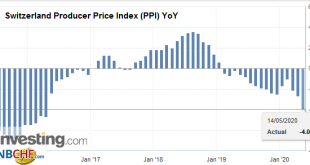

Read More »Swiss Producer and Import Price Index in April 2020: -4.0 percent YoY, -1.3 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Top Swiss firms pay respects to ‘formative’ business leader Fritz Gerber

Fritz Gerber worked for the Basel-based pharma giant for more than two decades, shaping Roche’s development into a global healthcare firm. (Keystone / Markus Stuecklin) Pharmaceutical giant Roche and Zurich Insurance have paid their respects to business executive Fritz Gerber, who passed away on Sunday at the age of 91. “Fritz Gerber was one of the most influential business leaders in Switzerland during a period of formative development for the country’s modern, open...

Read More »Coronavirus: the dangers of singing

© JaCrispy | Dreamstime.com As Switzerland reopens, the details around how SARS-CoV-2 spreads becomes more relevant to everyday life. Matthias Egger, the head of Switzerland’s Covid-19 task force, stresses the importance of continuing to follow social distancing and hygiene rules. However, the Swiss government’s recommended rule of staying two metres away from the next person might not be enough if the next person is singing. Infection requires a minimum amount of...

Read More »Miracles Aren’t Shovel-Ready

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.” They did it – and it didn’t take. Lagarde’s outreach was simply an act of admitting reality. Having forecast an undercurrent of worldwide inflationary breakout (how...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org