While demand for public transport collapsed during Switzerland’s partial lockdown, bicycle usage soared across the country. But greater acceptance of cycling nationwide will depend on further political decisions and transport planning. Ernst Leuthold, the owner of a bike shop in Bern, can’t believe his eyes. “It’s amazing to see all these people who haven’t been on a bike for years and then suddenly feel the need to do so,” he declared. Daniel Schärer, director of...

Read More »Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further. POLITICAL OUTLOOK Legislation was introduced last week that allows Beijing to directly impose a national security law on Hong Kong. Local legislative approval would be circumvented but Chief Executive Lam said Hong Kong authorities would fully...

Read More »An Economy That Cannot Allow Stocks to Decline Is Too Fragile To Survive

The fragile ice shelf of speculative bets and debt clinging to the mountainside is making strange creaking sounds– will you listen or will you ignore it because ‘the Fed has our back’? Feast your eyes on the chart below of the Nasdaq 100 stock market Index, which is dominated by the six FAAMNG (rhymes with “famine”) stocks: Facebook, Apple, Amazon, Microsoft, Netflix and Google which now account for over 20% of the entire U.S. stock market’s capitalization. Notice...

Read More »Restricted Market Trading Comments

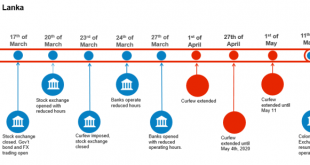

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More »How We Might Respond to a Panedemic Were Society Not So Dominated by the State

“There are no libertarians in an epidemic” crowed Atlantic reporter Peter Nicholas back on March 10, as he listed the numerous economic interventions the Trump administration was undertaking in the wake of the mounting COVID-19 crisis. This intervention, Nicholas declared, just goes to show you that whatever antigovernment talk one might talk, government intervention in the economy is “nothing new and, as may well prove the case this time around, it’s often...

Read More »FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Swiss Franc The Euro has risen by 0.63% to 1.0667 EUR/CHF and USD/CHF, May 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today’s activity has been minor. The...

Read More »Re-Opening the Economy Won’t Fix What’s Broken

Re-opening a fragile, brittle, bankrupt, hopelessly perverse and corrupt “normal” won’t fix what’s broken. The stock market is in a frenzy of euphoria at the re-opening of the economy. Too bad the re-opening won’t fix what’s broken. As I’ve been noting recently, the real problem is the systemic fragility of the U.S. economy, which has lurched from one new extreme to the next to maintain a thin, brittle veneer of normalcy. Fragile economies cannot survive any impact...

Read More »Swisscom network experiencing problems

© Rostislav Ageev | Dreamstime.com Since 11:50 am on 26 May 2020, Swisscom’s mobile and landline networks have been experiencing problems. Landline and mobile network calls are currently impaired for business and private customers, according to Swisscom. The company said its specialists are working on rectifying a fault that started at 11:50am on 26 May 2020. According the Swiss government website alert.swiss the network disturbance is affecting 14 cantons. Update:...

Read More »Tourism industry told to adapt to new travel habits

The future of tourism? A couple of hikers by the Seealpsee in northeastern Switzerland on May 17 (Keystone) Going on holiday in one’s own country and in the countryside, in smaller groups and sometimes with restrictions – this is the new reality to which the tourism industry must adapt, according to a study by the University of St Gallen. Mobility and socialising: both are undesirable in times of Covid-19. The tourism industry was therefore the first to be affected...

Read More »So Much Dollar Bull

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered. In second place (now third) for the dollar’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org