“Will I outlive my money?” That’s one of the biggest concerns for most retirees. There’s the high cost of medical care, which gets more expensive all the time. There’s inflation, which raises the cost of goods and services, eating into your retirement budget. And then, there’s taxes, which are as certain as death, and the politicians who want to raise them. So, if taxes are an issue where you live, and you’re thinking about moving to a place that’s more economically...

Read More »Clay Miller: An Entrepreneurial Journey to New Lands, New Organizational Designs, and New Value

Key Takeaways The entrepreneurial instinct can be sparked in K-12 and around the family dinner table. An entrepreneurial culture is highly beneficial to society at the global, national, and local levels. We should examine how well we nurture the entrepreneurial instinct in K-12 schooling and in the discussions we have with our kids at home. Clay Miller got a Commodore 64 (you can look it up!) when he was 11 years old, and his interest in computing, software and...

Read More »The Saving Problem in America: Alternatives and Reforms

Since before covid-19 and the lockdown, I have written articles that touch on the purpose and importance of personal savings, and more importantly, why the lack of personal savings was going to make an economic crisis in the year 2020 potentially tragic for most Americans. As a result, I have been interviewed a couple of times specifically on the topic of personal savings. These interactions have indicated to me that people do not understand the importance of savings...

Read More »FX Daily, September 17: Powell Lets Steam Out of Equities and Spurs Dollar Short-Covering

Swiss Franc The Euro has risen by 0.02% to 1.0743 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors’ confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears...

Read More »Referendum: Swiss to vote on ending EU agreement

© Miriam Doerr | Dreamstime.com On 27 September 2020, Swiss voters have many decisions to make. This time the list of votes includes decisions on fighter jets, hunting, tax deductions for child care and paternity leave. Probably the most important among them is a decision on whether to accept a proposal to end the EU agreement on the free movement of people between Switzerland and the bloc, known as the Limitation Initiative. The agreement between Switzerland and the...

Read More »Medical Reimbursement Accounts

[embedded content] You Might Also Like 5 Tax Strategies to Help you Hold on to Your Money in Retirement What is retirement, really? We think we know. So, we do our best to prepare for both current circumstances and as many surprises as we can conjure up. After all, with people living longer than ever before your money has to last longer than ever before. Gratuitously Impatient (For a)...

Read More »The Evidence Keeps Piling up: Lockdowns Don’t Work

Extraordinary measures require extraordinary evidence. Have the advocates for lockdowns made their case? The data suggests they have not. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. Original Article: “The Evidence Keeps Piling up: Lockdowns Don’t Work“. You Might Also Like The Disastrous Legacy of Woodrow Wilson [unable to retrieve full-text...

Read More »Crypto Nation Switzerland evades Covid’s clutches (for now)

The blockchain sector started in Zug’s Crypto Valley (represented here with a chart of companies), but has spread to other areas of Switzerland. © Keystone / Urs Flueeler The Swiss blockchain industry appears to be in rude health despite the economic fallout of the coronavirus pandemic. The number of new companies and jobs produced by the sector increased in the first six months of the year. Is this trend set to last? The number of Crypto Nation (including...

Read More »FX Daily, September 16: Dollar Eases Ahead of the FOMC

Swiss Franc The Euro has fallen by 0.04% to 1.0751 EUR/CHF and USD/CHF, September 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has been sold against nearly all the world’s currencies ahead of what is expected to be a dovish Federal Reserve, even if no fresh action is taken. The Scandis and Antipodean currencies are leading the majors. The South African rand and Mexican peso are leading the...

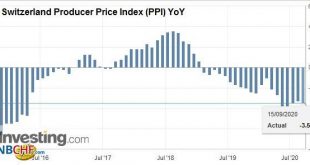

Read More »Swiss Producer and Import Price Index in August 2020: -3.5 percent YoY, -0.4 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org