In 2012, the American Taxpayer Relief Act (ATRA) established, for the first time, a permanent estate tax and gift tax exemption. The exemption is the amount an individual can pass on at death without paying estate taxes. The legislation set the exemption at $5 million per person, indexed for inflation.

Five years later, Congress decided the exemption was not large enough and passed the Tax Cuts and Jobs Act of 2017 (TCJA), which increased the lifetime exemption amount to $11,180,000 per person. As with the previous legislation, the new exemption was indexed for inflation.

Coming up in 2023, the new exemption amount will take a substantial jump to $12,920,000 per person or $25,840,000 per couple, up from the $12,060,000 and $24,120,000 respectively that were

Articles by Bob Williams

2023 Retirement Plan Contribution Limits

November 15, 2022Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023.

The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500. For individuals 50 and older, the catch-up contribution limit goes to $7,500, up from $6,500. So, if you qualify for catch-up contributions you can contribute up to $30,000 next year.

IRA contributions move up to $6500 from $6,000. The catch-up contribution limit remains at $1,000.

Contributions to SIMPLE retirement accounts go to $15,500, up from $14,000. The catch-up contribution limit for SIMPLE plans increases to $3,500, up from

Market Currents: Fed Confusion

October 20, 2022The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it.

[embedded content]

[embedded content]

Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »It’s Time to Tackle the Year-End Financial Checklist

October 12, 2022Here we are again in the final quarter of the year when thoughts turn to Thanksgiving and Christmas and… reviewing your financial house. Oh, that’s not on your list? Well, let’s put it there because financial issues cannot be on automatic pilot. Things change and you need to keep current. Here are 16 items you need to review before the end of the year.

Tax Loss Harvesting

No one wants to pay more taxes than necessary (at least no one I know) and harvesting capital losses to offset any capital gains is one way to do that. Even if you can’t use all the losses this year, excess losses are carried forward to be used in future years.

You might be reluctant to sell an investment you really like. But keep in mind the Wash Sale Rule from IRS Code section 1092. It allows

Market Currents: Don’t Listen to Buy and Hold Investing Advice

October 7, 2022For decades a Buy and Hold strategy was a staple of financial advice. But should it be? Alhambra CEO separates myth and reality.

[embedded content]

[embedded content]

Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Markets,newsletter,Real Estate,stocks

Read More »Medicare Part B Premiums Will Go Down in 2023

September 30, 2022In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90.

That’s good news in light of the 14.5% increase in Part B premiums in 2022, the largest dollar increase in the history of Medicare. CMS said the increase was necessary to pay for Aduhelm, an expensive new Alzheimer’s drug. But, the manufacturer of Aduhelm lowered the price, CMS approved the drug on a limited basis, and Medicare is expecting lower spending on other Part B services. That’s why Part B premiums are going

Be Sure to Read the Medicare Fine Print

September 9, 2022Medicare. The government defines it as “The federal health insurance program for people 65 and older.” That seems simple enough. But there’s more to it than meets the eye because Medicare, like so many other things, has fine print that could end up costing you a lot of money if you don’t know about it.

Since Medicare began in 1965, a myth has developed that Medicare pays for all your healthcare costs. Absolutely not true! The Medicare website says, “Original Medicare covers most, but not all of the costs for approved health care services and supplies. If you get a service that Medicare doesn’t cover, you pay the full cost. There’s no limit on what you’ll pay out-of-pocket in a year unless you have other coverage.”

Medicare pays 80% of approved expenses,

How Working Longer Affects Your Social Security Benefits

August 31, 2022Since 1935, Social Security has been synonymous with retirement. It was always intended to supplement retirement income, never be a person’s total retirement income. Unfortunately, according to the Center on Budget and Policy Priorities, about half of older Americans rely on Social Security for at least 50% of their income, and 25% of retirees rely on it for 90% of their income. That’s why more Americans are choosing to work longer.

For decades, labor force participation at older ages has been declining. But today, Americans aged 62-65 are participating at the highest rate since the government began collecting labor force data almost 60 years ago. Those over 65 are twice as likely to be working today as 65-year-olds in 1985.

The length of time you work definitely

Tips for Buying a Medicare Supplement Policy

August 14, 2022The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage.

There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

There is Original Medicare, which comes packaged as Part A, which provides hospital insurance, and Part B, which covers doctor visits and outpatient services. There is no coverage for vision, dental, hearing or prescription drugs. Original Medicare pays 80% of approved expenses. The remainder comes out of your pocket. That’s why people often pair a Medicare Supplement plan, also known as a

Another Historic Social Security Cost of Living Increase is on the Way

August 3, 2022It’s almost time for the Social Security Administration to break out pencil and calculator to find out how much more it costs to live this year than it did last, and then decide how much of a raise Social Security beneficiaries will get in 2023. For 2022, the Social Security Cost of Living Adjustment (COLA) was 5.9%, the largest increase since 1982. Well, hang on to your hat boys and girls because, in the words of Bachman Turner Overdrive, “you ain’t see nuthin’ yet.”

The annual Social Security COLA is based on the change in prices of a market basket of goods, in other words, the Consumer Price Index (CPI), in regular terms inflation. On July 13, 2022, the Bureau of Labor Statistics said inflation in June 2022 was running at an annual rate of 9.1%, a much higher

Ask Bob: Is Maxing Out Your 401k A Good Investment Decision?

July 20, 2022Since the beginning of 401(k) plans in 1978, people have considered it to be the quintessential retirement plan—you get to save money before taxes and in most cases, the company puts money into your account, too. What could be better than that? But now, 44 years later, it’s time to take a broader look at 401(k)s that considers taxes on 401(k) distributions.

401(k)s certainly have a place in your investment plan. Most employers offer some kind of match up to a certain level. It just makes sense to contribute enough of your money to receive everything the company is willing to contribute on your behalf. It’s free money. To quote an age-old axiom, don’t leave money on the table.

But once you’ve contributed enough to get the entire company match, does it make sense

4 Social Security Changes to Expect in 2023

July 15, 2022Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Cost of Living Increase

In 2022, Social Security recipients received a 5.9% cost-of-living adjustment (COLA). It was the biggest increase in 40 years. Inflation continued to pick up speed and the 2023 COLA will almost certainly be higher.

Social Security sets the annual cost-of-living-adjustment every October using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). According to the Bureau of Labor Statistics, the CPI-W through May was running at 9.3%. Others look at the Consumer Price Index for All Urban Consumers (CPI-U) which is

Wasting Money on Medicare

July 7, 2022How would you like to waste a lot of the money you spend on Medicare coverage and miss a bunch of the benefits Medicare provides? Crazy question. But that’s exactly what’s happening to millions of Medicare beneficiaries.

In October 2021, the insurance website MedicareAdvantage.com published the results of its most recent survey of Medicare beneficiaries. What it found was disturbing.

Three out of four Medicare beneficiaries describe the program as “confusing and difficult to understand.”

More than half of beneficiaries don’t know when the Annual Enrollment Period (AEP) begins.

Roughly three out of four beneficiaries incorrectly believe that Original Medicare has an annual out-of-pocket-spending limit to protect against high medical costs.

Four out of five

Letting Retirees Save for Healthcare Tax-Free

June 29, 2022Health Savings Accounts (HSA) for retired folks. Isn’t that a novel idea? But it’s being considered in Congress—The Health Savings for Seniors Act, H.R. 3796.

As it stands right now, the only people eligible for an HSA are those aged 65 years and younger who have a high-deductible health insurance plan meaning you have to pay $1,400 out-of-pocket for an individual or $2,800 for a family before the insurance plan pays anything. You get to deduct your contributions to an HSA up to an annual maximum. The money grows tax-free. Then, as long as you use the money for qualified healthcare expenses, you don’t pay taxes on the money you withdraw from the account. It’s truly tax-free.

Under current law, seniors with Medicare can use their existing HSA funds to pay for

Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

June 8, 2022In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger.

Social Security calculates cost-of-living increases based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from September to September each year. According to the Bureau of Labor Statistics, the CPI-W has increased 9.4% from March 2021 to March 2022. So, unless inflation comes down, its projected that the next Social Security COLA could be 9% or higher.

Without the annual COLA, many retirees would not be able to survive in an inflationary environment, especially those on fixed incomes. Additionally, low-interest rates have worked against retirees who depend

Baby Boomer Retirement at Risk

March 20, 2022The seven deadliest words in the English language—We’ve never done it this way before. And that certainly applies to Baby Boomers whose prospects for retirement are different than any preceding generation.

Many Boomers, those born between 1946 and 1964, have made their retirement plans based on their parent’s generation. The World War II crowd retired with income from Social Security and, in most cases, a generous pension, providing non-stop income that lasted the remainder of their lifetimes. With that income, mom and dad didn’t need to tap their financial assets as often in order to cover their spending, therefore, the money lasted longer.

But Boomers seldom have access to pensions these days, and a new study from the Center for Retirement Research at Boston

How the IRS Taxes Your Retirement Income

March 13, 2022Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.” You’ve been saving and planning and getting things in place. But have you planned for the taxes you have to pay on retirement income? Many retirees don’t take that into consideration and are surprised when they end up with less money to fund their retirement lifestyle.

Uncle Sam doesn’t give you a break just because you’re retired. There are federal taxes on Social Security as well as distributions from 401(k) plans and IRAs. And unless you live in Alaska, Florida, Nevada,

Read More »Medicare Eats Up Most of the 2022 Social Security Raise

December 1, 2021There was dancing in the streets when Social Security announced that 2022 checks will go up by 5.9%, the biggest Cost of Living Adjustment (COLA) in 40 years. But now, the streets are empty and the cheering is gone. Most of that Social Security COLA will be eaten up by increases in Medicare.

Medicare Part B, which covers doctor services and outpatient care, will go up by 14.5% which is the largest Medicare increase ever. This year the monthly premium for Medicare Part B is $148.50. Next year that jumps to $170.10, more than double what Medicare Trustees estimated back in the summer. In addition, the Part B deductible is going up, from $203 this year to $233 in 2022, an increase of 14.8%. But that’s not all. The Medicare Part A deductible goes up $72, from $1484 to

Don’t Be the Victim of These 20 IRA Mistakes

April 6, 2021Hey! It’s just an IRA. What is there to know? You put money in and it’s a tax deduction, you get to take it out after 59 ½ without paying a penalty, and at 72 the IRS makes you take some out. What else could there be?

In reality, there’s a lot more. Besides being able to contribute $6,000 every year, or $7,000 if you’re over 50, IRAs make up one of the major sources of retirement savings in the United States. The Investment Company Institute says there was more than $11 trillion in IRAs in 2020. And when you look at the rules governing IRAs, there are lots of potential mistakes that will leave you with substantially less money, putting a serious dent in your retirement income. Morningstar has come up with a list of IRA land mines and ways to avoid them.

Waiting

4 Social Security Planning Steps BEFORE You’re Ready to Retire

March 10, 2021Social Security is an important part of almost every retirement plan, whether you’ve saved enough or not. That’s why it’s important to know as much about your Social Security situation as possible. And you don’t want to wait until you’re about to retire to gather the facts and take appropriate steps. Social Security planning needs to start 5 years before your target retirement date.

Check your estimated benefit amount

The easiest way to check Social Security’s estimate of how much you’ll receive is to check online. Go to ssa.gov and create a My Social Security account. This is where you can find:

Estimates of how much you’ll receive if you claim benefits early, at your Full Retirement Age (FRA) or at age 70.

Your most recent Social Security statement

Your

The Insatiable Appetite to Tax Social Security Benefits

February 9, 2021First, it was 10%, then 20%, and today more than 50% of U.S. retirees pay taxes on their Social Security benefits, and the number is expected to go even higher. The cause seems to be that one government hand doesn’t know, or care, what the other government hand is doing.

The rub comes because income tax brackets are adjusted for inflation each year. But income thresholds determine if you pay taxes on Social Security, and how much, haven’t been adjusted for inflation since 1984 when benefits first became taxable. That’s why, over almost four decades, the number of retirees forced to pay taxes on their Social Security has gone from 10% to almost 56%.

Here are the rules that determine if you have to pay taxes on your Social Security benefit?

If you’re single and

Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

December 7, 2020May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it.

Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness. Strauss Attorneys PLLC has come up with a list of estate planning insights, cautions, and opportunities for you to consider.

• Falling Values: some assets, be they business, real estate, or stock, have decreased in value over the past year. It may be a good time to transfer those depreciated assets to a younger generation and let the assets regain their value in their hands, and

How Much Taxes Will Retirees Owe on Their Retirement Income

November 10, 2020Planning for retirement. We spend most of our working career preparing for it, saving for it, covering every contingency. When you finally wave goodbye to the company, you’re ready for all that planning to take over. But does your planning take into account the taxes you’ll have to pay on your retirement income? It’s one of the biggest retirement planning mistakes people make.

Anqui Chen and Alicia H. Munnell at the Center for Retirement Research at Boston College analyzed data from the most recent federal Health and Retirement Study. They published their findings in a preliminary paper, How Much Taxes Will Retirees Owe on Their Retirement Income. Chen and Munnell say that retiree households will pay approximately 6 percent of their retirement income in federal

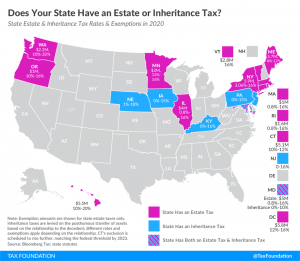

17 States that Charge Estate or Inheritance Taxes

November 3, 2020Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise.

On the federal level, the estate tax issue is not as big a deal as it was back in the day. Today individuals can pass on more than $11 million and couples can pass on more than $23 million before Washington comes after your money.

17 states, on the other hand, have not moderated their position on estate and inheritance taxes. According to the Tax Foundation, Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, Washington and the District of Columbia all charge an estate tax, which is levied on the value of the deceased’s assets

Charitable Remainder Trusts

October 27, 2020[embedded content]

Alhambra’s’ Bob Williams describes Charitable Remainder Trusts and how they can be used as a planning tool to create a win-win for you and charities.

You Might Also Like

What The PMIs Aren’t Really Saying, In China As Elsewhere

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance.

Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not

5 Estate Planning Myths That Can Derail Your Estate Plan

October 18, 2020You spend a lifetime earning, saving, acquiring. But the old adage is true—you can’t take it with you. So, what do you do with your assets when you’re gone? How do you want them distributed? That’s where a good estate plan comes in. However, some estate plans are based on ideas that just aren’t true. Plans are made based on emotion rather than logic, and that’s where the best-laid estate plans can go wrong.

Christopher D. Wright, JD is a CPA at Marks Paneth LLP. In more than 30 years of helping clients develop estate plans, he’s discovered 5 common misconceptions that should be avoided.

Myth #1: An estate plan should be based solely on tax mitigation

No one likes to pay taxes and when you’re gone you want to leave as much to your heirs as possible, but escaping

Monthly Macro Monitor – September (VIDEO)

October 3, 2020[embedded content]

Alhambra CEO Joe Calhoun and Alhambra’s Bob Williams look at data from the past month and discuss what it means for the economy.

You Might Also Like

Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime.

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to

12 States That Keep Retirement Dollars in Your Pocket

September 18, 2020“Will I outlive my money?” That’s one of the biggest concerns for most retirees. There’s the high cost of medical care, which gets more expensive all the time. There’s inflation, which raises the cost of goods and services, eating into your retirement budget. And then, there’s taxes, which are as certain as death, and the politicians who want to raise them.

So, if taxes are an issue where you live, and you’re thinking about moving to a place that’s more economically friendly to your retirement savings—where do you go?

There are nine states that have no state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

With no state income tax, you don’t have to worry about paying taxes on distributions from

Medical Reimbursement Accounts

September 17, 2020[embedded content]

You Might Also Like

5 Tax Strategies to Help you Hold on to Your Money in Retirement

What is retirement, really? We think we know. So, we do our best to prepare for both current circumstances and as many surprises as we can conjure up. After all, with people living longer than ever before your money has to last longer than ever before.

Gratuitously Impatient (For a) Rebound

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in