They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed. Therefore, “they” now salivate (reported to be...

Read More »US election: Red flags for investors

Part II of II Outlook and wider impact As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease. From “covid checks” to rent relief, and everything in between, all their proposed “fixes” are only providing some temporary breathing room to those millions of citizens affected by the economic...

Read More »Swiss consumers want repair label on electronic appliances

Just over half of respondents to a survey said a repair label would play a decisive role in the purchase of an electronic product. © Keystone / Adrian Reusser No less than 98% of people polled by a consumer protection alliance are in favour of a labelling system that evaluates the repairability of electronic and household appliances. Most of them were also prepared to pay more for a product that offered specific repair guarantees. A vast majority of survey...

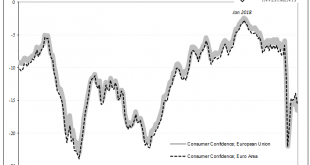

Read More »Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom. To interrupt now what has already proved to be a seriously impaired rebound should get people thinking more realistically about 2021. Once...

Read More »How Decades of Media and Faculty Bias Have Pushed America to the Left

It’s been clear for decades that national news organizations such as CNN and the New York Times tend to be biased in favor of social democracy (i.e., “progressivism”) and what we would generally call a “left-wing” ideology. Journalists, for instance, identify as Democrats in far higher numbers than any other partisan group. And political donations by members of the media overwhelmingly go to Democratic candidates. This is why even as far back as the...

Read More »FX Daily, October 23: Disappointing PMIs may Sharpen ECB’s Dovishness but the Euro Remains Firm

Swiss Franc The Euro has fallen by 0.06% to 1.071 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is finishing the week on a soft note, falling against all the major currencies. On the week, it is off by at least one percent against most of them, with the Australian and Canadian dollars and Japanese yen, laggards, rising 0.5%-0.75%. Emerging market currencies are...

Read More »World Data Forum: strong international cooperation for quality data

22.10.2020 – The United Nations World Data Forum took place from 19 to 21 October 2020 in digital format due to COVID-19. The event brought together several thousand experts to find innovative solutions in order to meet the need for better quality data to implement the 2030 Agenda and to control the pandemic. Every two years, the United Nations World Data Forum (UNWDF) brings together participants from various regions, countries and data communities, covering the...

Read More »Coronavirus: false positives rare, according to Swiss experts

© Anyaivanova | Dreamstime.com There is an idea circulating that many of the positive PCR tests results for the SARS-CoV-2 virus in Switzerland are false, results which are known as false positives. However, according to experts interviewed by RTS, PCR test false positives are rare. A number of political figures, including some Swiss parliamentarians, have been referring to large numbers of false positive SARS-CoV-2 PCR test results. While some infected with the...

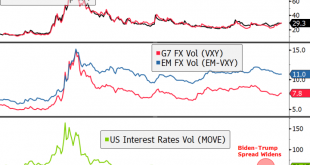

Read More »Dollar Catches Modest Bid but Weakness to Resume

Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome Measures of cross-asset volatility suggest a far too generous interpretation of the odds for a clean Democratic sweep; KC Fed...

Read More »Is the US Election the “Cork in the Bottle” for Gold and Silver?

Today we are taking our weekly look at the charts for gold and silver. Republicans and Democrats continue to play the “will they, won’t they?” game over another stimulus package in a Covid19 ravaged US economy. An agreement on a package will ultimately be seen as positive for the markets but, with the US Election just weeks away this may prove to prolong negotiations or postpone decisions until the results of the election are clear and accepted by all. Will Gold Now...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org