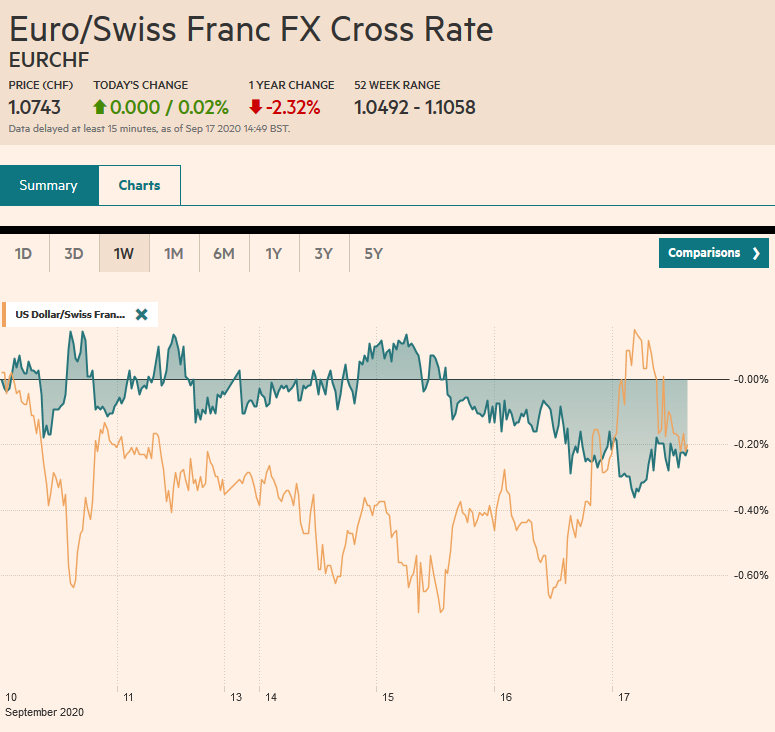

Swiss Franc The Euro has risen by 0.02% to 1.0743 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors’ confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears to be the essence of the switch to an average inflation target. The MSCI Asia Pacific Index snapped a five-day advance, with several markets (Australia, Hong Kong, South Korea, and Malaysia off over 1%). The Dow Jones Stoxx 600 in Europe is ending a four-day rally and has halved this week’s gains with

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, Bank of Japan, Brazil, Brexit, Featured, Federal Reserve, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.02% to 1.0743 |

EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors’ confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears to be the essence of the switch to an average inflation target. The MSCI Asia Pacific Index snapped a five-day advance, with several markets (Australia, Hong Kong, South Korea, and Malaysia off over 1%). The Dow Jones Stoxx 600 in Europe is ending a four-day rally and has halved this week’s gains with about an 0.6% loss through late morning turnover. Financials and materials have been sold off the hardest. US shares are weaker, and the S&P 500 and NASDAQ are poised to gap lower at the opening. European bond yields are 1-2 bp higher, while the 10-year US Treasury yield is little softer at 0.68%. The dollar is mostly higher, with the yen and sterling the only majors resisting the greenback’s pull. Its initially stronger gains have been pared, and only the Scandis and the Canadian dollar are off by more than 0.2%. Emerging markets currencies are also under pressure, with Turkey, Mexico, and South African (which is expected to announce a 25 bp rate cut shortly) the weakest. Gold has been set back but recorded am marginal new low for the week ($1937) October WTI rallied almost 5% yesterday, the most since June, bolstered by shrinking US inventories, which are the lowest since April. It is consolidaitng today and straddling the $40 a barrel level. |

FX Performance, September 17 |

Asia Pacific

As widely expected, the BOJ did not alter its stance or its bond-buying operations. It did upgrade its economic assessment for the first time since the pandemic struck. The market recognizes a recovery is underway after three consecutive quarterly contractions. Assistance to the corporate sector remains a critical concern. However, Governor Kuroda does not appear poised to initiate new measures. The dollar was near JPY105 when Kuroda’s press conference began and eased to the session low near JPY104.70 during the talk. It remained pinned near there during the European morning. August CPI will be reported tomorrow, and the core rate, which excludes fresh food, is expected to fall to -0.4% from flat in July. It would be the lowest since 2016.

Australia offered a pleasant surprise. Rather than lose 35k jobs as economists forecast in the Bloomberg poll (median), it gained 111k jobs. The unemployment rate slipped from 7.5% to 6.8%. Economists had expected it to have ticked up to 7.7%. The participation rate ticked up (64.8%) rather than slip. Full-time positions grew by 36.2k, roughly the same pace as in July. Given the central bank’s somber assessment and the outbreak in Victoria, one cannot help but wonder if the proverbial other shoe is yet to drop.

The dollar is lower against the yen for the fourth session. It broke below JPY105 yesterday for the first time since the end of July and found support, as we suggested, at JPY104.80. It made a marginal new low today. Although a new low can be recorded in North America today, the intraday momentum indicators are stretched, suggest limited immediate downside. On the other hand, $2.3 bln in expiring options are struck between JPY105 and JPY105.10. It is interesting, but not particularly impactful to know there are $3.4 bln in options in the JPY105.40-JPY105.55 area that will roll-off today. The Australian dollar was initially sold to new lows for the week (~$0.7255) but has rebounded to straddle $0.7300 in the European morning. The $0.7320-$0.7340 band offers the nearby cap. The dollar rose by about 0.25% against the Chinese yuan, its first increase of the week. The PBOC set the dollar’s reference rate at CNY6.7675, which was a little firmer than expected. Recall the dollar finished around CNY6.8345 last week. The dollar has risen in only one week since the end of June. Our operating assumption is that the demand for yuan from foreign investors and as a result of its current account surplus is not overwhelming officials and that the persistence of the yuan’s gains can only come if Beijing thought it was in its interests.

EuropeIn order to win over Conservative rebels, Prime Minister Johnson was forced to offer an amendment that gives Parliament a veto over implementing the most odious part of the Internal Market bill. At the same time, he will offer another amendment designed to limit a potential challenge from the judiciary. Sterling rallied in response, and the unwinding of the euro-sterling cross weighed on the euro prior to the broader dollar bounce after the FOMC. Yet, the stronger the hand Johnson as domestically, the greater the conflict with Europe. This has been the case since 2016, like scissors, closing the gap on one side opens it on the other. The UK has yet to disclose how it will check and enforce animal product inspections and trade. There are other issues relating to transport and energy that the UK. There is a month before the EU Summit at which an agreement is necessary to allow time for the ratification process. |

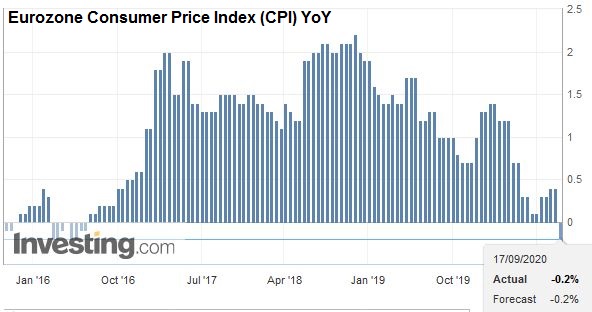

Eurozone Consumer Price Index (CPI) YoY, August 2020(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The outcome of the Bank of England’s MPC meeting is expected shortly. Few expect fresh actions now, but the consensus is for additional stimulus as its next meeting in early November. The BOE has not shut the door on negative rates, but that does not seem to be the most likely next step. Instead, increasing its Gilt purchases and bringing the base rate from 10 bp to zero would likely be delivered first. A dissent in favor of immediate easing would not surprise. If Lagarde and Powell have emphasized the high levels of uncertainty, BOE Governor Bailey has it two-fold with the pandemic and what more and more people recognize as a likely disorderly exit from the standstill agreement. |

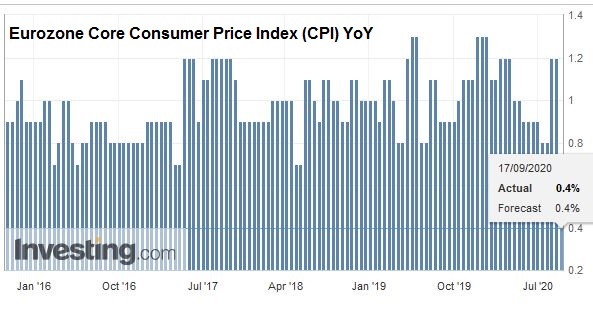

Eurozone Core Consumer Price Index (CPI) YoY, August 2020(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro, as we have argued, is in a range, and it has not been trending higher for several weeks. It was sold a little below $1.1740 in Asia, its lowest level since August 12. It recovered to almost $1.1820 in Europe before meeting new sellers. Assuming the nearby expiring options (~880 mln euros at $1.18 and 530 mln euros at $1.1775) have been neutralized, note that there is a little more than a 500 mln euro option at $1.17 and a 1.2 bln euro option at $1.1850 that will be cut today. Sterling poked above $1.30 briefly yesterday but held below the $1.3040 (38.2%) retracement target of its drop from the start of the month. It was sold down to almost $1.29 before snapping back to around $1.2975. Sterling is continuing to recover against the euro, and that appears to be adding pressure to the single currency. The euro approached GBP0.9080, which represents the (50%) retracement of the rally in the first half of the month. A break would target the GBP0.9030 as the next retracement objective.

America

The Federal Reserve did not surprise the investors. It delivered a dovish message without taking any new initiatives. Only one FOMC member saw a hike as likely in 2022. Two did in June. Projections were made for 2023 for the first time, and 13 of the 17 officials expect that it will still be appropriate to keep rates at the 0-25 bp. There were two dissents. The first was by Minneapolis’ Kashkari, who wanted core inflation to be made explicit. This confuses many observers and economists, but the Fed targets the headline PCE deflator but talks a great deal about core inflation. Core inflation is emphasized but ironically not targeted because, over time, it appears that the headline inflation converges to core inflation, not the other way around. Dallas Fed President Kaplan also dissented. He wanted the Fed to have greater policy flexibility, which seems to be a pushback from a less dovish stance.

Chair Powell repeatedly claimed that forward guidance is sufficient and powerful. He cited that as a reason to believe that the current asset purchases (~$80 bln in Treasuries and ~$40 bln in mortgage-backed securities) were sufficient. Although it seemed like a classic “buy the rumor sell the fact” type of activity, some observers suggested that without new tools to achieve its new inflation regime, the idea that the Fed would tolerate inflation above 2% when it could not reach 2% itself loses its potential sting. The 10-year bond yield rose 1.5 bp to almost 0.70%. The two-year note yield was unchanged (~0.14%). The implied yield of the December 2023 Eurodollar futures contract rose by a single basis point to 39.5 bp.

| The US economic diary is busy. Weekly initial jobless claims are still front, and center as investors and businesses try to gauge the condition of the labor market. A small decline in both new and continuing claims is expected, but at 850k and 13 mln respectively, one can see the pressure to do more. The housing market has bounced back in a big way, and Powell recognized this yesterday. Still, after a 22.6% rise in housing starts in July, a small pullback is expected. |

U.S. Initial Jobless Claims, September 17, 2020(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

| Permits, a leading indicator, are expected to rose a couple percent after a nearly 18% gain in July. Lastly, the Philadelphia Fed’s September manufacturing survey will be released. Recall that it peaked in June at 27.5 and stood at 17.2 in August. The median forecast in the Bloomberg survey calls for additional slippage to 15 in September. The Empire State survey, which was also disappointed in August, rose more than expected (to 17.0 from 3.7 and amid forecasts for a 6.9 reading). |

U.S. Housing Starts, August 2020(see more posts on U.S. Housing Starts, ) Source: investing.com - Click to enlarge |

Canada and Mexico have a light economic calendar today. Canada reports July retail sales tomorrow. A modest gain (1%) is expected after June’s 23.7% jump. Mexico’s calendar is fairly light until the central bank meets a week from now, but is widely expected to sit pat with its overnight rate at 4.5%. The US dollar is near the best levels of the month against the Canadian dollar. It rose to almost CAD1.3250 earlier today, which likely means that that option for $335 mln at CAD1.3225 has been neutralized. The US dollar’s eight-week slide against the Loonie ended last week. It was virtually flat coming into today’s session for the week. A move above CAD1.3250 could spur greenback gains toward CAD1.3300-CAD1.3320. The US dollar fell to a new six-month low yesterday against the Mexican peso near MXN20.9230. It has recovered the MXN21-handle but needs to overcome resistance in the MXN21.16 area to signal a further recovery into the MXN21.30-MXN21.50 area. The greenback settled last week near MNXN21.76, its fifth consecutive weekly decline. Lastly, as expected, Brazil’s central bank kept the Selic rate at a record low of 2%. The dollar looks comfortable in a BRL5.0-BRL5.5 range, which it has been for three months, but for a brief probe higher in late August.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of England,Bank of Japan,Brazil,Brexit,Featured,federal-reserve,newsletter