Implications for precious metals investors As the long-awaited “second wave” of the corona pandemic sweeps through Europe, another round of severe restrictions, travel bans and rules that prevent the proper function of international business and trade threatens to once again disrupt all kinds of sectors, including the gold industry. Lockdown 2.0 Until only a couple of months ago, multiple heads of state, government officials and all kinds of experts were openly...

Read More »Yes, Virginia, There Is An Alternative, 11 November

On Monday the dollar had a ferocious rally, moving up from 15.87mg gold to 16.77mg and from 1.21g silver to 1.32g. In mainstream terms, the price of gold dropped about a hundred bucks, and the price of silver crashed $2.20. One notion we’re hearing a lot now is, “there is no alternative to stocks.” Certainly, stocks have been rallying. They were up in Sunday evening (as we reckon it here in Arizona) trading. Then Pfizer announced good news for its COVID vaccine, and...

Read More »Swiss multinationals: global heavyweights in high-risk sectors

Switzerland is home to the headquarters of several world leaders in raw materials, such as Glencore, based in the canton of Zug. Keystone / Alessandro Della Bella Home to big players in the raw materials, food and chemicals industries, Switzerland boasts one of the world’s highest concentrations of multinational headquarters. Multinationals play an important role in the Swiss economy, providing both jobs and tax revenues. In 2018, the Federal Statistical Office found...

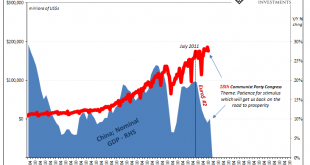

Read More »The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago. If the global economy isn’t going to recover, and there’s absolutely no sign that it will, then the one seemingly logical (though far-fetched) way forward would be if the...

Read More »Everything You Don’t Want to Know About Covid Vaccines (Because You Can’t Be Bullish Anymore)

In such a highly polarized, politicized environment, is such a scrupulously objective study even possible? Now that we’ve had the happy-talk about Pfizer’s messenger-RNA (mRNA) vaccine (and noted that Pfizer’s CEO sold the majority of his shares in the company immediately after the happy-talk), let’s dig into messenger-RNA (mRNA) vaccines which are fast approaching regulatory approval. Some people have concluded vaccines are not safe, regardless of their source or...

Read More »FX Daily, November 11: Reduced Risk of Negative Policy Rates Lifts Sterling and the Kiwi

Swiss Franc The Euro has fallen by 0.18% to 1.0793 EUR/CHF and USD/CHF, November 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally...

Read More »Raiffeisen pulls out of Swiss Bankers Association

The Swiss Bankers Association said it regretted Raiffeisen’s decision Keystone Raiffeisen, Switzerland’s third-largest banking group, says it will leave the Swiss Bankers Association (SBA) at the end of March 2021. It intends to represent its interests independently. “The banking sector and the interests of the various players in the Swiss financial centre have changed considerably in recent years,” Raiffeisen said in a statement on Tuesday. “As part of its group...

Read More »Dollar Consolidates, Weakness to Resume

Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today UK House of Lords altered the Internal Market Bill; UK employment numbers were slightly better than expected;...

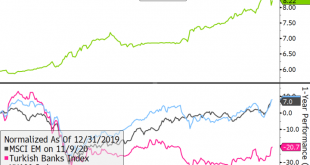

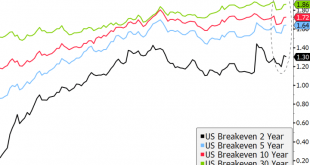

Read More »Vaccine and Split Government

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around. While the policy-driven (fiscal and monetary) reflation theme from earlier in the year helped backstop the worst of the economic fallout, its reflationary impact was skewed towards asset price inflation....

Read More »Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Money – sound and unsound - Click to enlarge Interview with Rafi Farber: Part II of II Rafi Farber, pen name Austrolib, is the publisher of The End Game Investor, a daily market commentary written from an Austrian economics perspective focusing on precious metals, the Comex, and monetary analysis. His work is followed by leaders in the precious metals industry including Eric Sprott. He also writes a weekly column on the gaming industry at CalvinAyre. Contact him...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org