Days after Netflix reported bad earnings and an “unexpected” hit to their subscriber base, CNN announced that it had pulled the plug on its own brand-new streaming service, CNN+. Despite arguments to the contrary from the parent company, the CNN+ adventure turned out to be a costly mistake that attracted few subscribers and a paltry number of regular viewers. The project had already invested $300 million plus actor contracts they must reassign. They had plans to...

Read More »Euro$ #5 in Goods

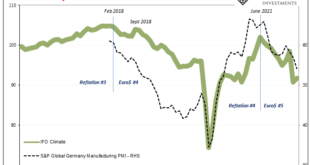

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one? The S&P Global Flash Germany Manufacturing PMI fell to 54.1...

Read More »Elon Musk kauft Twitter und Crypto Twitter ist in aller Munde

Eigentlich galt Elon Musks Angebot an Twitter als primär politisch motiviert. Musk positionierte sich als Free Speech Aktivist, der Twitter übernehmen wolle, um den freien Austausch von Ideen wieder möglich zu machen. Kurz nachdem die Übernahme offiziell wurde, reagierte auch die Crypto Community euphorisch. Crypto News: Elon Musk kauft Twitter und Crypto Twitter ist in aller MundeUnter dem Begriff „Crypto Twitter (kurz: CT)“ zirkuliert gerade der Glaube an eine...

Read More »Geldcast update: calls for a more transparent Swiss National Bank

The Swiss National Bank (SNB) is very opaque by international standards. That has to change, says Yvan Lengwiler, professor of economics at the University of Basel. He explains his proposals in the latest Geldcast update. “There is no right to secrecy,” says Yvan Lengwiler – not even at the Swiss National Bank. He has joined forces with Stefan Gerlach of the EFG Bank and Charles Wyplosz, a professor at the Graduate Institute in Geneva, to form the “SNB...

Read More »Warum man „Inflation“ nicht messen kann

Über „die Inflation” wird viel Irreführendes geredet. Von Politikern, Zeitkommentatoren und selbst von manchen Ökonomen. Schon die am meisten verbreitete Definition ist falsch. So heißt es, „Inflation” sei ein anhaltender Anstieg der Preise. Weiterhin wird behauptet, dieser Anstieg ließe sich messen und demnach ergebe sich das „Preisniveau” und die „Inflationsrate”. Preise Der Grundirrtum des Ansatzes zur Messung der Preisinflation besteht darin, zu glauben,...

Read More »Crash Is King

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You’ve heard the expression “cash is king.” Very true. But it’s equally true that “crash is king:” when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic. Everything that the mainstream uses to predict “value,” market action and “the future” is tossed out the window. Price-earnings,...

Read More »War in Ukraine – Week 8

Day 56 April 20 4-year old Alisa is begging to be evacuated from under siege Mariupol. So are thousands of others after about 50 days underground. But russia won’t allow it. They are holding these people hostage, watching them die slowly and painfully one by one. Source: Nataliya Melnyk on Facebook ********************************************************* Day 55 A big thank you from my little shelter van Goghs to everyone who helps us keep them distracted...

Read More »China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar. Commodity prices are broadly lower amid concerns over demand. China’s CSI 300 fell 5% today and Hong Kong’s Hang Seng was off more than 3.5%. Most of the major markets in Asia Pacific were off more than 1%. Europe’s Stoxx 600...

Read More »Vietnam Should Have Been the End of US Foreign Intervention. It Wasn’t, and the World Is Worse Off

In 1975, after nearly a decade of outright conflict, the United States government abandoned its doomed escapade in Vietnam. It left a devastated country and over a million corpses in its wake. The corrupt South Vietnamese regime, already teetering on utter collapse, completely dissolved without American support. And the Communist forces of North Vietnam eagerly descended on Saigon, impatient to implement their antimarket and antiproperty policies. What followed was a...

Read More »CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss. Instead, CNY is doing the plummeting and at a speed reminiscent of August 2015. That month did not, obviously, lead to a vast rearrangement...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org