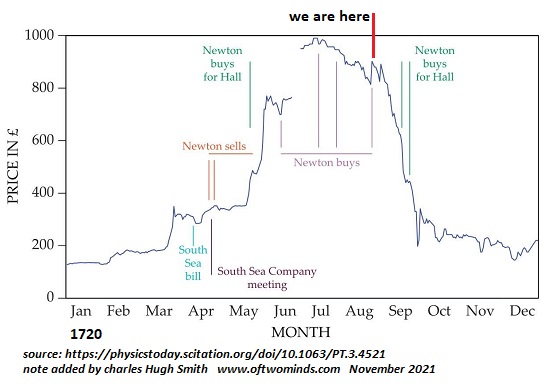

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You’ve heard the expression “cash is king.” Very true. But it’s equally true that “crash is king:” when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic. Everything that the mainstream uses to predict “value,” market action and “the future” is tossed out the window. Price-earnings, “growth,” “innovation,” cash flow, yields, the bat-guano-quatloo carry trade, etc., etc., etc.-none of it stops the crash or makes sense of the crash, which happens for systemic reasons beyond conventional explanations. In the context of conventional concepts of “value” and central bank power, crashes

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You’ve heard the expression “cash is king.” Very true. But it’s equally true that “crash is king:” when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic.

Everything that the mainstream uses to predict “value,” market action and “the future” is tossed out the window. Price-earnings, “growth,” “innovation,” cash flow, yields, the bat-guano-quatloo carry trade, etc., etc., etc.-none of it stops the crash or makes sense of the crash, which happens for systemic reasons beyond conventional explanations.

In the context of conventional concepts of “value” and central bank power, crashes are impossible. According to conventional explanations, the central banks control the markets and so crashes are brief and shallow because the banks will quickly change course and flood the financial markets with free money.

In the conventional view, markets are rational and liquid: there will always be a a buyer for every seller (i.e. liquidity) because there will always be a rational reason and cash/credit available to buy an asset at the current price.

Crashes reveal this as false: there is no buyer for every seller in crashes because it’s not rational to buy assets which have been grossly overvalued and are resetting at new valuations in a chaotic freefall. Indeed, the entire concept of “value” is in doubt, and as we all know, markets hate uncertainty.

Secondly, there may not be cash or credit available to purchase assets, as credit dries up as fast as liquidity: the last thing lenders want is for reckless gamblers to borrow their money and then lose it all trying to catch the falling knife.

| This is why crash is king: when liquidity dries up, the entire structure of “there’s always a buyer” collapses. When there are only sellers and few buyers, markets crash. When the underlying value of the asset can no longer be known with any certainty, it’s not rational to gamble that the first or second leg down is “the bottom.”

When future supply and demand are up in the air, tumbling chaotically, there is no way to pin down the value of anything. Money and credit are no different than any other commodity: the cost and value of money is dictated by demand for that particular flavor of “money” and credit. When “money” loses purchasing power and credit is no longer available, the demand for assets collapses right as assets are dumped to limit losses and raise cash. It may be time to revisit core and periphery. Like many others, I find the model insightful and useful: The Core-Periphery Model (June 11, 2013). The E.U., Neofeudalism and the Neocolonial-Financialization Model (May 24, 2012). Crashes reveal what’s core and what’s periphery because the core controls the destiny of the periphery. In systems terminology, the initial conditions set the parameters of potential options and the limits of the efficacy of various choices. The core’s initial conditions are considerably more constructive than the initial conditions of the periphery. In network terms, every connection between nodes runs through the core. This is not the case for the nodes. The dependency chains are asymmetric: each node looks stable and independent until push comes to shove. Everyone is dependent but some are less dependent than others. The vast majority of the grandiose claims of what’s truly core will be revealed as false in a crash. The crash in core assets is less severe and the bounce back is quicker, as the underlying value of the core resets more readily. Crashes in the periphery are one-way slides. These assets never recover their speculative-excess valuations because the eventual reset of underlying value strips out all the artificial / phantom value. |

|

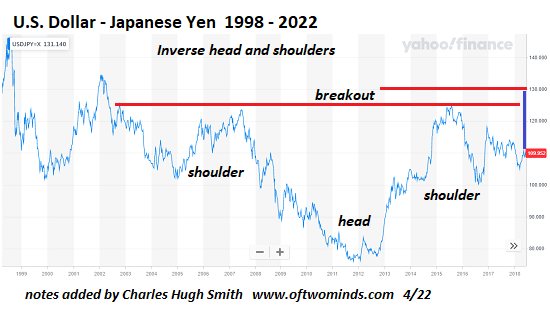

| It’s instructive to look at these charts of the Japanese yen (USDJPY). Something is happening, and the punditry is rushing to stake claims of understanding it all. I am circumspect about this tsunami of explanations. There are a lot of major revaluations underway and these act as feedback for each other in complex ways. This suggests to me that any one explanation will very likely be wrong / misleading.

It may be nothing more than a zephyr, but I find it interesting that the long-term chart of the USD-Yen appears to be a multi-decade inverse head and shoulders which if it plays out would suggest a massive revaluation of the yen is underway in the direction of devaluing the purchasing power of the yen. This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. Cash may be king but when crash is king you have to choose the right kind of cash to avoid the general decimation of “wealth.” Every node claims to be core, but that’s not how it works. There may only be one core. While the crash will garner everyone’s attention, it’s the aftermath of the crash that will inform us what’s core and what’s periphery. |

Tags: Featured,newsletter