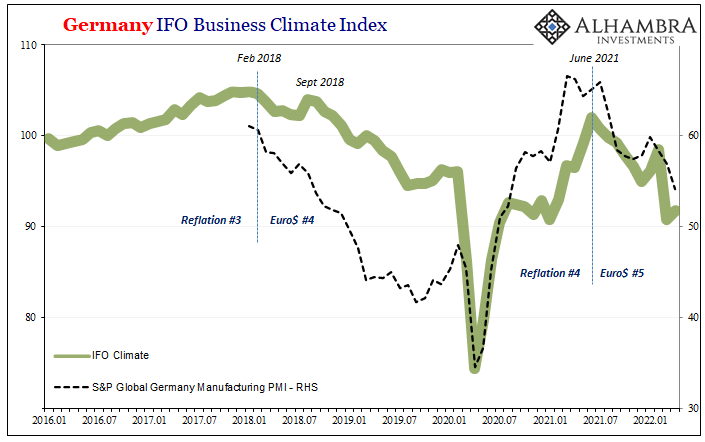

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one? The S&P Global Flash Germany Manufacturing PMI fell to 54.1 in April of 2022 from 56.9 in March, below forecasts of 54.1, and pointing to the slowest growth in factory activity since August of 2020 amid reports of severe supply disruption and a drop in demand for goods. emphasis added Since I’ve belated decided to date Euro$ #5 to around May 2021 using various financial

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Brazil, currencies, economy, Featured, Federal Reserve/Monetary Policy, industrial production, Japan, Markets, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand.

Wait, what was that last one?

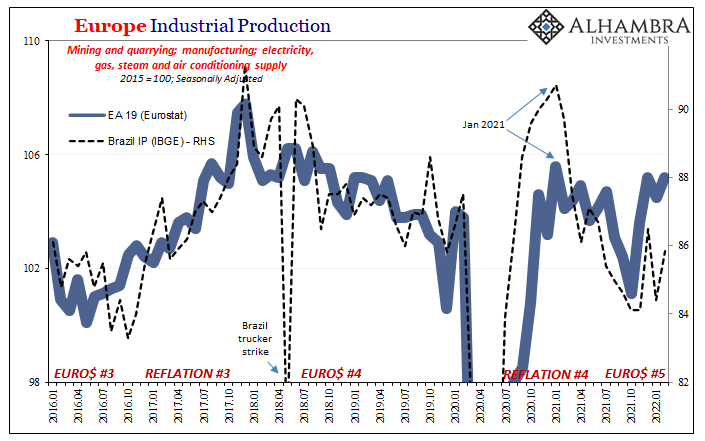

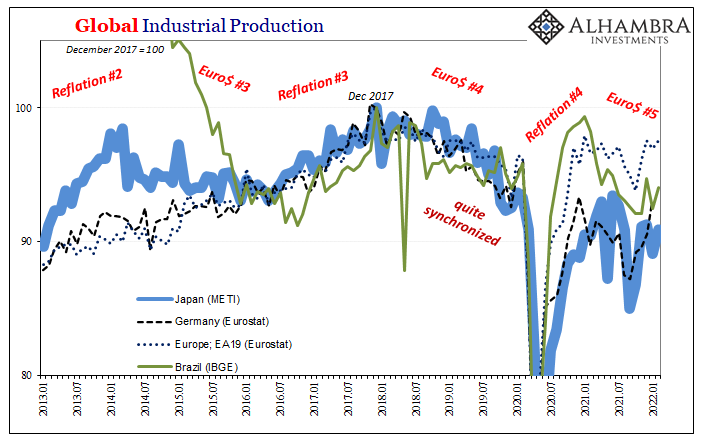

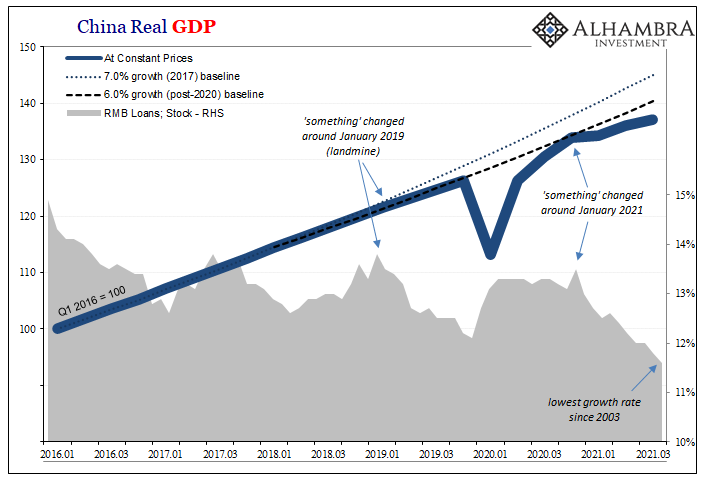

emphasis added Since I’ve belated decided to date Euro$ #5 to around May 2021 using various financial markets, including the euro’s value against the dollar, what about the global economy and its various constituent parts? Quite a lot in it also points to around mid-year last year, particularly in the goods and industrial economy which is more important for #5 than it had been for #4 and the previous others. |

|

| This is simply because, hopped up on government interference, the goods economy was far and away the biggest contributor to what had been Reflation #4. US consumers, in particular, went crazy online shopping much if not most of which was made then shipped from overseas.

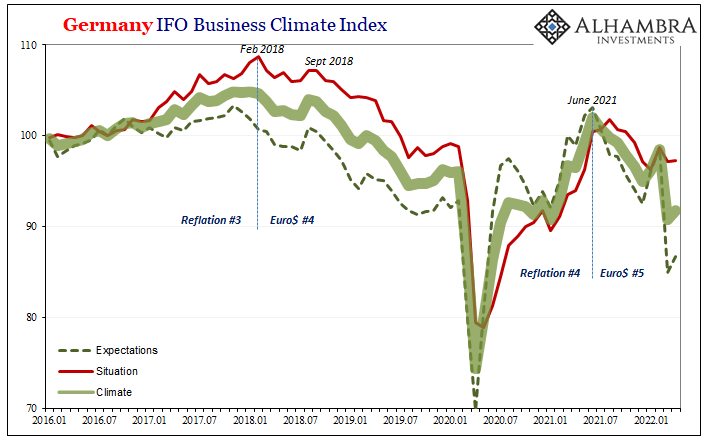

And even then, the price illusion created by transportation inelasticity made it all seem far greater than it ever was. This was also true in the important goods connection between Germany and China. Beginning with Germany, from sentiment to industrial output, the peak registered back around April to June across data and surveys. |

|

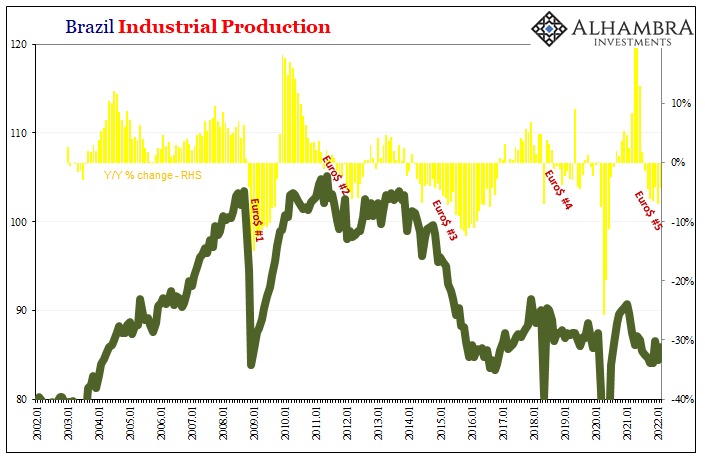

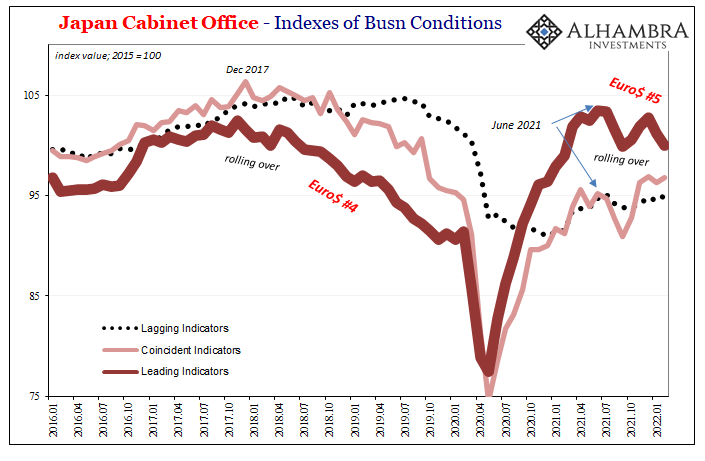

| It’s basically the same story one place to the next with a few exceptions here or there. Very little actual recovery and what was recovered started being lost close to the time market conditions and prices flipped to Euro$ #5.

Below is a sample from Germany and Japan as leading indicators, with Brazil thrown in because of the price illusion generating an even larger mistaken impression about its health and contributions to the global economy. Far more bad than good(s), much more consistent with Germany and Japan than not, a Euro$ #5 in the global goods economy which had emerged right when markets said it would. |

|

Tags: Bonds,Brazil,currencies,economy,Featured,Federal Reserve/Monetary Policy,industrial production,Japan,Markets,newsletter